Lessons learned and changes made after a plunge in JPY reveals cracks in communication and processes.

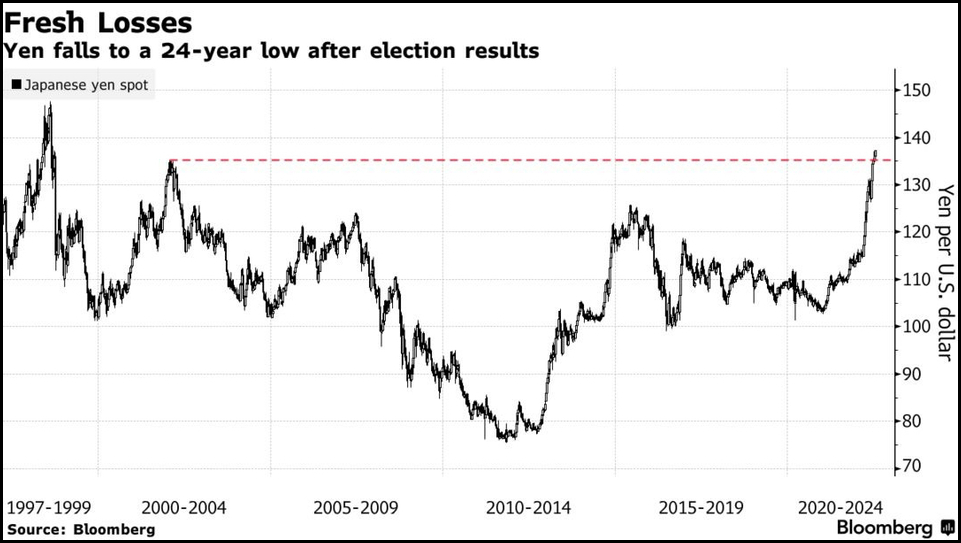

The plunge of the Japanese yen (JPY) this year to its lowest level against the US dollar in more than two decades (see chart) revealed communication problems at one NeuGroup member company between FX risk managers in treasury and the sales team in Japan—problems that could have resulted in a painful financial outcome. Instead, the company’s treasurer came away with valuable lessons for any corporate with exposure to currency swings.

Storms and fire drills. In addition to the yen’s steep drop, several other factors combined to create the challenge facing the company’s treasurer. “We had the perfect storm and it caused a big fire drill because it was going to be a big hit to revenue,” he told NeuGroup Insights in a recent interview. Among the causes of the storm:

- Supply chain problems made forecasting shipments and revenue in Japan more difficult.

- The difficulty of forecasting made treasury very cautious on placing hedges (forwards) because it didn’t want to risk over-hedging and the possible loss of hedge accounting.

- Revenue from Japan jumped by tenfold in one quarter, ballooning the company’s exposure to JPY.

- The resignation of the company’s FX manager required an assistant treasurer to address the problem.

- The business team had changed the process by which it locked in an exchange rate with a major customer.

Deeper, more frequent communication. As a result of the change in the rate lock process, the yen price of the customer’s order had been fixed a year earlier, before the yen’s decline. But the revenue would be converted at the current exchange rate, when the shipment was accepted, meaning the company would receive far less revenue in dollars than forecast.

- Treasury learned about the rate lock process change late in the game, necessitating the fire drill. “We realized that our visibility to their processes and our underlying exposures was not as good as it should have been,” the treasurer said.

- The good news is the customer agreed to change the price based on a more current exchange rate, helping the treasurer’s company avoid the revenue shortfall. In addition, the company placed forwards to hedge against further declines in JPY.

- To help avoid future pitfalls, treasury now checks with the sales team in Japan at least three times a quarter to get updates on the revenue forecast, up from two so-called checkpoints previously.

- To get more context than is provided by internal revenue forecasting tools, the checkpoint discussions with the sales team are much more detailed than before, and the teams are communicating between the checkpoints.

- “We have righted the ship,” the treasurer said. “Everyone is aligned and understands the problem, so as soon as things change or when issues come up, we’re being notified, which wasn’t happening. Everyone was kind of waiting for these formal checkpoints before.”

Find the micro impact in the macro. The storm also underscored for the treasurer the need for more analysis of possible impacts of rapid changes in global economics and monetary policy and how, for example, Japan’s decision not to raise interest rates as the Fed hiked rates would affect the company’s exposure given forecasting issues and hedging policies.

- Treasury is now having more proactive, internal conversations to review market intelligence, including close tracking of exchange rates.

- “We need to ask the right questions and make sure we aren’t missing anything,” the treasurer said.

Lessons learned. After weathering the storm in Japan, the NeuGroup member identified these key takeaways a that can be broadly applied to how FX risk management teams work internally and collaborate with the business.

- Adopt a more seamless and flexible approach to FX hedging. The company used to layer in hedges twice a quarter; now it’s “doing it more seamlessly across the quarter as we get better information,” the treasurer said.

- Actively involve business partners in finding solutions. Team efforts that incorporate the views of all key stakeholders to address challenges produce better results than relying primarily on treasury knowledge.

- Don’t get complacent. Continuously question processes that may seem to be working fine, finding cracks as you ask how new market information may impact those processes and determine what needs to be done differently. “When something like this happens, it highlights all the places you have cracks in your processes,” the treasurer said.