Members of NeuGroup’s corporate enterprise risk management group hear how they can divine unseen, emerging risks.

The ancient stoics often practiced premeditatio malorum or the premeditation of evils, which was basically the art of expecting the worst. In a sense, this is how enterprise risk managers must go about their jobs today, particularly when the timeline of 100-year disruptive occurrences has been compressed to every four to five years.

- Social, geopolitical and environmental risks combined with the everyday risks of competition and markets have prompted ERM practitioners to look farther and wider for risks seemingly popping up everywhere.

Keys to success. Doing a good job discerning those risks (and opportunities) will mean success for the company, according to Paul Walker, the James J. Schiro/Zurich Chair in Enterprise Risk Management and Executive Director of St. John’s University’s Center for Excellence in ERM.

- Dr. Walker, who presented at a NeuGroup for Enterprise Risk Management meeting in April, said a recent survey he conducted showed that 94% of respondents agreed that “how well an organization anticipates, interprets and reacts to emerging risks, market changes, trends and disruption is the key to future success,” according to a white paper by Dr. Walker.

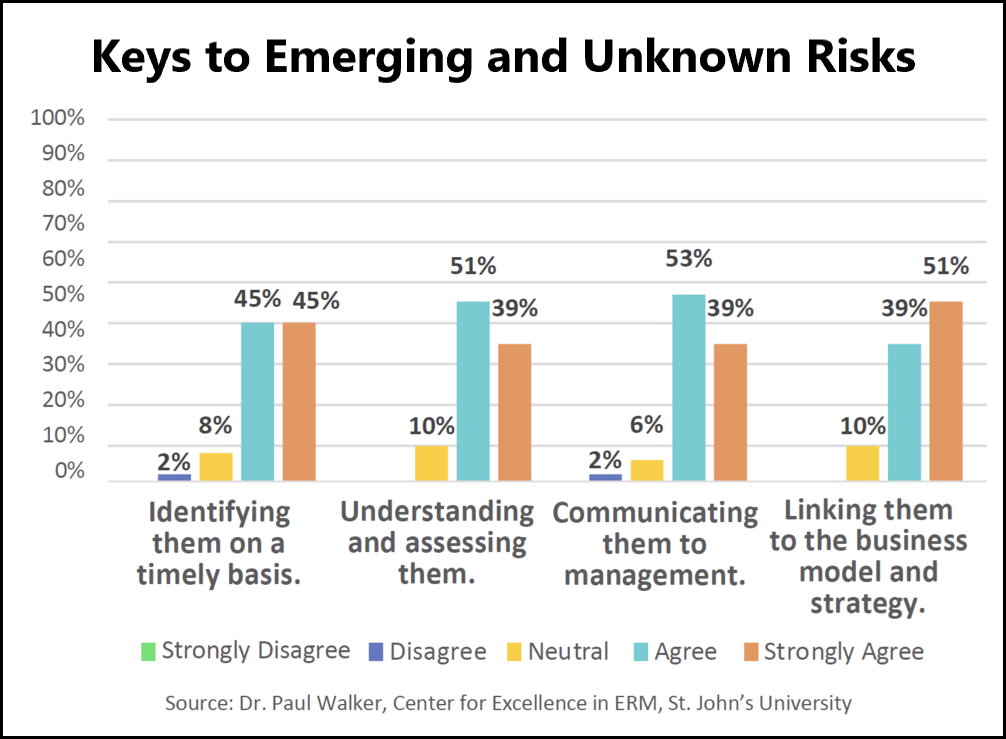

- The way companies can do that is to “spend time to understand” and to locate emerging risks and then “tie them back to business the model,” Dr. Walker said (see chart). And whatever the decision is to meet that risk, it must include a plan of action. “Gotta be actionable,” he said. When practitioners “are standing in front of the CFO” they need to have a plan.

- One member responded that being able to know “what’s around all corners” is crucial, but described being able to see what’s coming as one of the biggest challenges in his career as an ERM professional.

- “If something happens, the board always turns around and says, ‘Why didn’t you see this coming?’” he said. “The way I prepare for this is by sharing all the things that could ever happen that we have consolidated over the many years, from internal sources all the way to an alien invasion.”

Prioritize thorough plans. Plans need to be thorough, Dr. Walker said. He said one way to get that thoroughness is working with parts of the company already doing the analysis. “Some of you may have within your org … someone already doing” analysis of risk related to their specific function—say for financial planning or marketing—”get to know them,” Dr. Walker advised.

- He cited one company he works with that “breaks down business impacts into social, tech, economic, environmental, political” categories and then gives them a score on dimensions of business impact.

- An ERM member said his team looks at various trends and breaks them down into what impact those trends may have on the company. “What can they signal? And what would happen if you did nothing? How confident are you in the path?” Are actions required? And should they do a strategic deep dive?

- “It comes back to, what do we change?” Dr. Walker said of the impact of trends. Is it the business model? The strategy? Or is it just making the company more resilient? “I think executives want to know [from risk managers], ‘what do we do?’”

The danger of irrelevance. Dr. Walker also said emerging risks aren’t all bad and some “are opportunities.” Quoting a senior strategy executive he’d worked with, he said “the greatest risk to any organization is irrelevance.” Therefore, organizations “must learn to see change and trends” and risk leaders cannot afford to miss “strategic pivot points” and end up losing the company massive value and risk going bankrupt.

- Missing the boat has been a topic of other NeuGroup ERM meetings, with one member discussing how his company had the opportunity to acquire a budding rival and decided against it. Today, the company it didn’t acquire is larger than his company. His company has since acquired another company, paying top dollar for it in the process. This has prompted other worries, the member said, the main one being whether the previous missed opportunity caused them to overpay for the new acquisition.