Risk managers at life sciences companies hear analysis, share pain, discuss options.

Virtually no company is immune to the ongoing pain meted out by rising insurance premiums in the wake of the pandemic. But one way to soften the blow, when possible, is differentiating yourself from the pack.

- That takeaway and others emerged this week at a NeuGroup meeting for life sciences treasurers featuring an update on property insurance and directors and officers (D&O) coverage by Brad Zechman, an account executive at Aon who also addressed the group in June. “I wish I was coming back under better circumstances,” he said.

- Members across the NeuGroup Network have been sharing details of the increases they’re paying for renewals this year and offering advice on coping with markets that show no signs of softening anytime soon.

- The unfavorable conditions are motivating some corporates to consider options including the potential use of captives. They also underscore the need for alternative risk transfer solutions. As NeuGroup founder Joseph Neu wrote recently, “Traditional insurance is overripe for transformation and it’s a matter of when, not if.”

Shop early. One valuable lesson learned: Start the renewal process as soon as you can. “You can never start early enough,” one member said, adding that getting rate quotes has been taking longer under current market conditions. Another treasurer said, “You need to be engaged throughout the process; you can’t wait for the total tower to be built.”

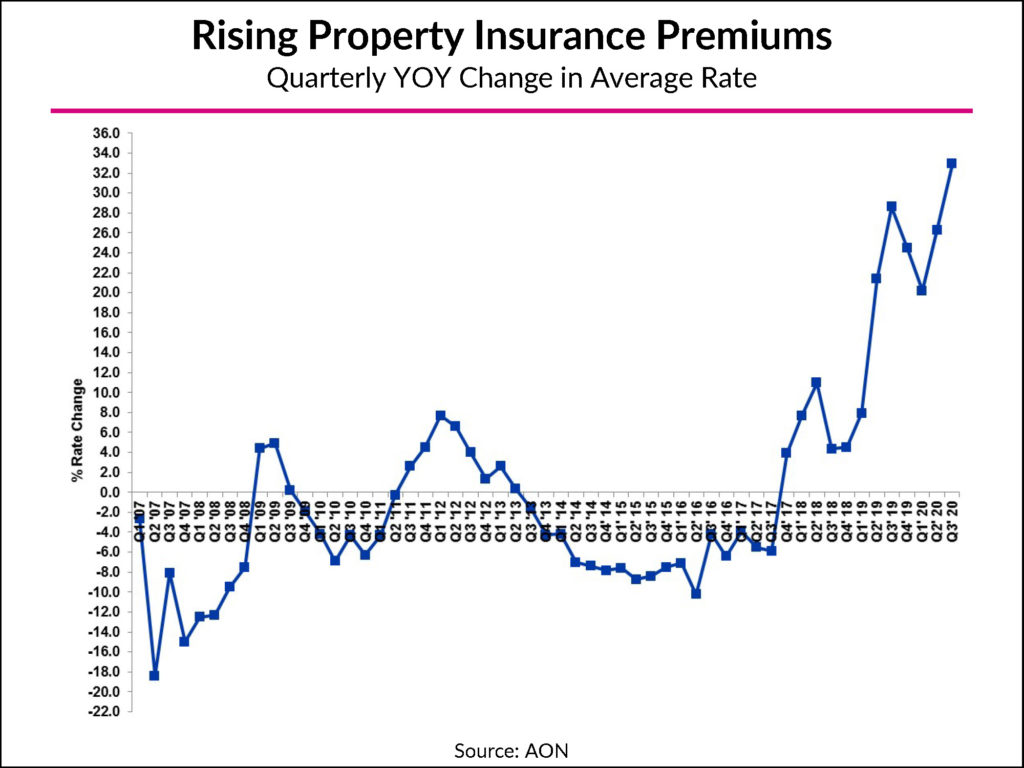

Explaining the pain. As the chart above shows, companies faced average increases for property coverage of about 33% in the third quarter. “Many insurers are continuing to push rates higher toward what they believe are sustainable levels to address increased risk and natural catastrophe losses,” Aon’s presentation stated. Increases are higher for companies with quota-share programs as opposed to single carrier program structures.

Differentiation. One key to lower premium hikes, Mr. Zechman said, is “how you differentiate yourself from everybody else,” citing the higher rates paid for programs with higher levels of catastrophic exposure and reduced scrutiny for companies with lower CAT exposure or “low claim activity.”

- Business and contingent business interruption exposure for companies with complex or outsourced supply chains is another differentiator because underwriters are scrutinizing those exposures.

- That scrutiny means transparency is key and companies are advised to provide as much information on their vendors as possible. “Take it as far as you can,” Mr. Zechman said. “All the detail helps.”

- One treasurer pushed back when an insurance company justified a rate increase based on a false assumption. “They try to grab onto anything to raise prices,” he said.

- Another emphasized the need to educate insurers that not all life sciences companies present the same level of risk. “Make sure they are very clear on differentiation and that safety is not being compromised,” he said.

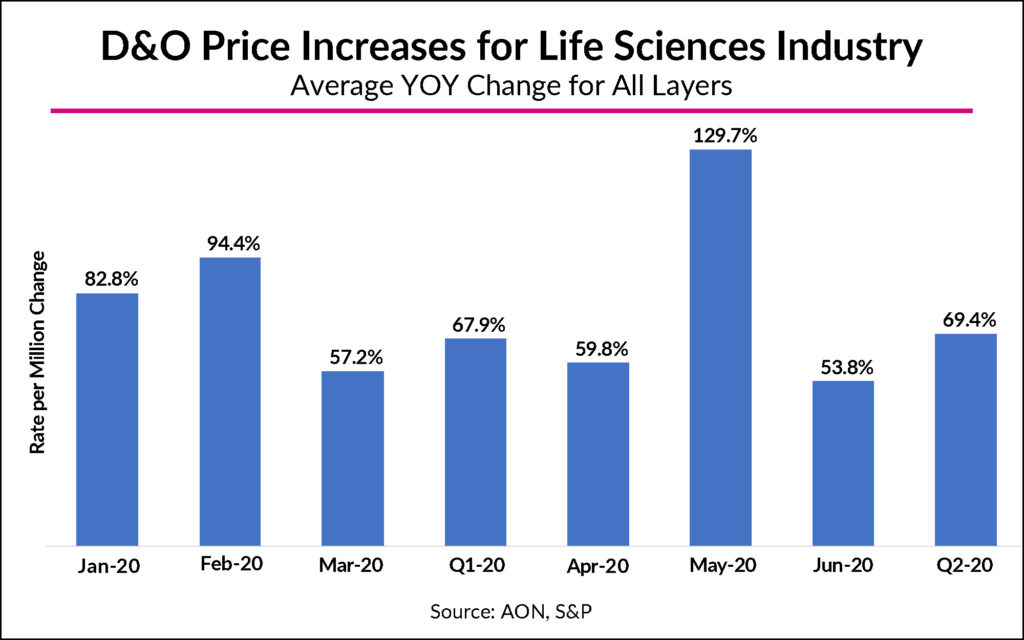

Covid exclusions. Insurers are mandating Covid-19 exclusions to “clarify their intent to not cover losses from it and other pandemics,” according to Aon’s presentation. The “Covid environment has put additional pressure on premiums” for both property and D&O coverage, Aon notes, adding that 17 Covid-related securities class action lawsuits were filed through October 2020.

The D&O landscape. In addition to detailing D&O rate increases for life sciences companies (see above), Aon made these observations about the market, which it says “continues to firm” amid rising claim costs and frequency.

- The London insurance market still faces capacity challenges. Some companies are being denied B&C coverage and going with side A only. Others, in the US and elsewhere, are going with side A only to cut costs.

- Going with side A only, Mr. Zechman said, is a more straightforward and “easier conversation” because it’s taking exposure off the table.

- But companies converting B&C coverage to A only are not seeing the bang for the buck they have in the past, he said. The discounts for side A only are not as significant as they once were in the US and are virtually nonexistent in London. Retentions are rising for most companies, particularly in high-risk industries.

- The good optics for corporates engaged in developing vaccines and antibodies are not, by and large, helping to lower D&O costs. Life sciences companies “are still one of the most challenging industries for D&O insurance,” Mr. Zechman said.