Willis Towers Watson advocates an approach that makes use of modern portfolio theory to assess the true value of insurance.

For more than a year, buying and renewing insurance policies has been a severe pain point for many finance teams, all suffering through a hard market of rising premiums, higher retentions and lower capacity. And the pandemic.

- That makes now a good time to consider a modernized approach to insurance and risk finance strategy that takes what Willis Towers Watson (WTW) calls a portfolio view of risk, making use of technology and data analytics to arrive at an efficient frontier of cost and risk.

- Sean Rider, head of client development in North America for WTW, explained the firm’s solution to NeuGroup members attending a recent presentation titled “The Modernization of Risk and Financial Strategies.”

- At the outset of his remarks, Mr. Rider said, “Insurance is a problem to solve,” a sentiment shared by many of the roughly 60 members in the virtual room.

Taking a page from insurance carriers. A key goal of WTW’s more strategic, less tactical and transactional approach to solving that problem is to bridge the gap between how corporates buy insurance and how insurers price risk, a gap that gives the carriers an information advantage, the firm said.

- That advantage arises in part because corporates often manage insurance in silos, assessing coverage lines individually and placing insurance outside the many other risks finance and treasury teams manage.

- Insurers, meanwhile, underwrite risk in the context of a portfolio, holistically, employing technology for modelling and other functions.

- In the past two years, WTW developed a dynamic analytic platform called Connected Risk Intelligence for its consulting clients that provides data visualization and access to the same statistical framework and stochastic analysis available to insurance companies that use software sold by WTW.

The payoff. Armed with better information and the ability to “map and model and test all the potential transactions” available to them, Mr. Rider said, corporates can optimize their risk financing strategy and move to the efficient frontier, making data-driven decisions that he called courageous and “rooted around your priorities.”

- This approach, WTW’s presentation said, allows corporates to “exploit arbitrage opportunities among mitigation, transfer and retention levers.”

- This may result in buying less of some coverage and more of others as a company maximizes efficiency by analyzing its financial risk weighed against other risks and the cost for mitigating them to various degrees.

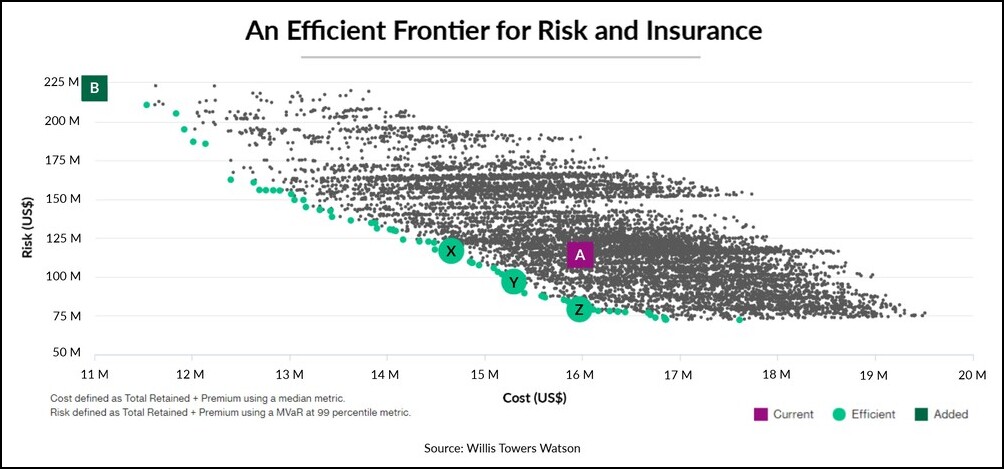

A portfolio review. In the graphic above, shown at the NeuGroup presentation, each point in the “cloud” represents one of tens of thousands of combinations of insurance options, such as buying D&O, workers compensation and liability coverage at various costs and levels of coverage.

- The x-axis represents the average cost of those strategies and the y-axis shows the corresponding amount of risk the corporate will retain net of insurance in a severely adverse year.

- “B” represents the example company’s exposure if it is entirely uninsured: $225 million in the adverse scenario, $11 million in a typical year. With its actual strategy, marked “A,” the company has reduced its exposure or residual risk to $120 million for the incremental cost of $5 million.

- The green points represent the efficient frontier, where the corporate can no longer reduce risk without taking on more cost; and can no longer reduce cost without taking more risk.

- That means the vast majority of combinations of insurance coverage decisions shown are inefficiently priced, including the company’s current strategy.

- “X” shows that the company could achieve the same risk mitigation for less cost: about $14.75 million vs. $16 million.

- “Z” shows the company could reduce its residual risk to $80 million (vs. $120 million) for the same $16 million. And “Y” falls between X and Z on the efficient frontier.

- “In the example, let’s say the organization’s tolerance for insurable risk is $80 million at the one in 100-year probability level,” Mr. Rider said.

- “Then the current approach (and any combination above Z) is not just inefficient, it fails the fundamental purpose of insurance: protecting against loss that imperils financial resilience.”

The difference. The discussion this portfolio review makes possible is “what’s not happening in how insurance decision making happens today,” Mr. Rider said.

- Now, though, the conversation is shifting to meet the needs of corporates facing new challenges. “We are talking about risk, we are talking about value, we’re talking about efficiency. We’re recognizing the complexity of these decisions. And this approach is something that we’re not going to unlearn.”