Low fixed interest rates may make it harder—but not impossible—to convince management to swap to floating.

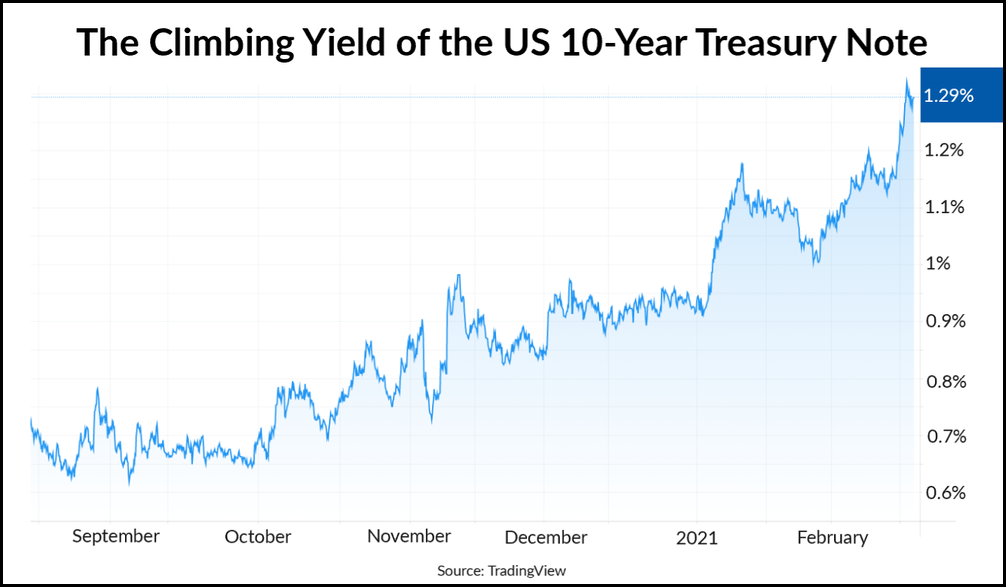

Interest rates may be ticking up, but their historically low level is one reason some treasury teams may face difficulty convincing senior management to swap more of their company’s debt stack to floating rates from fixed.

- “It’s a hard time to argue to do it given where long-term rates are,” one NeuGroup member said at a recent meeting.

- “When the fixed-rate environment is this attractive, it’s hard to convince a CFO to ignore locking in a < 3% coupon for 30 years so we can swap into a floating-rate instrument to save another few %, but because it’s floating, it’s not guaranteed,” he added in a follow-up interview.

Glass half full. Another member took the view that a “swap may not look ridiculous right now” because of “positive carry across the curve—there is generally enough positive carry, so it may not look like a bad time to start legging in some swaps.”

- He suggested that it may make sense for companies to set a “bogey” whereby they would swap to floating if they had a “certain amount of positive carry.”

Earnings optics. This member said “optics” and “EPS sensitivity” can be obstacles to getting a swap approved, especially for companies like his that “don’t have a long history of having meaningful interest expense on our P&L.”

- “There is always hesitancy to add volatility to earnings that floating-rate exposure layers on,” he said, referring specifically to “situations where the swap may have negative carry,” as was the case in Q4 2019.

- “So not only is a newly issued bond EPS dilutive because of the added interest expense, but then the swap makes it even further dilutive because of the negative carry.”

- However, this member said, “Once we spent time with management on the benefits of [asset liability management], we have had very constructive conversations.”

Taking time; avoid timing. One member said that to counter the reality that “it’s never going to seem easy to enter into swaps,” companies need to have an “institutional goal” about the mix of fixed- to floating-rate debt that allows them to enter swaps over time—and not look at them on a standalone basis.

- That message resonated with another member who observed, “They are more focused on absolute rates vs. initial carry; you have to have a long-term, fixed-float execution plan, meaning you continuously swap into floating at some %/target per year vs. trying to time the market.”

Eye-opening savings. Another member said treasury succeeded in convincing management at his company to swap a portion of every debt issue to floating to achieve a mix of 75% fixed and 25% floating. The key to adopting this systematic approach was showing management the “triple-digit millions” the company would have saved historically under that approach—what he called an “eye-opener.”

- That has allowed the company to “be agnostic about the entry point” to a swap because, “over time, floating rate wins.”