Editor’s note: NeuGroup’s online communities provide members a forum to pose questions and give answers. Talking Shop shares valuable insights from these exchanges, anonymously. Send us your responses: [email protected].

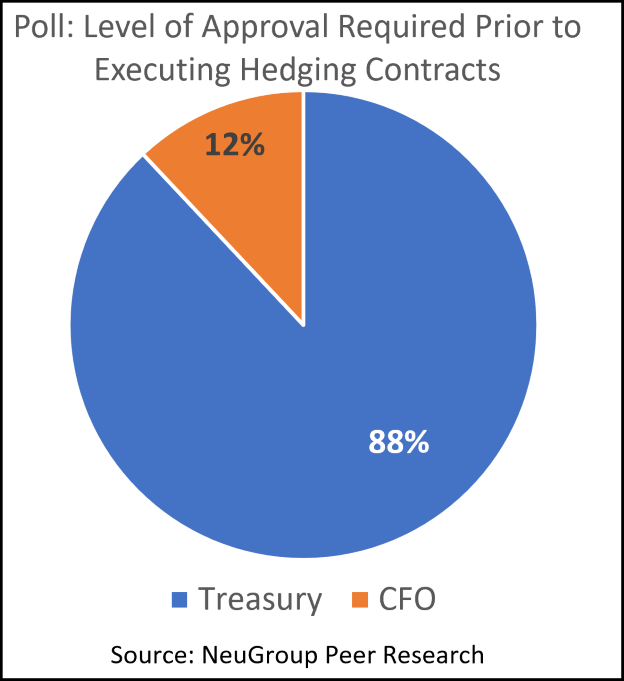

Member question: “I know we talked about this at some point this year, but I wanted to see if you all would help me benchmark. What level of approval/review/sign-off is required prior to executing your hedging contracts?”

Peer answer 1: “Our treasurer signs off on each monthly tranche of cash flow hedges we execute, as per our policy. We don’t require a monthly sign-off on balance sheet hedges.”

Peer answer 2: “For balance sheet hedges and cash flow hedges, the treasurer approves the trades. The assistant treasurer, or a delegate, approves true-ups.

- “If we were to make substantial changes to the hedge programs, then we would inform and seek the approval of the CFO prior to making those changes.”

Peer answer 3: “Two authorized FX traders are required to review and approve any FX trades. Options require treasurer or assistant treasurer approval.”

Peer answer 4: “Our CFO approves the cash flow hedge strategy monthly, or more frequently if market movements warrant a different strategy.

- “Balance sheet hedges are governed by our policy and don’t require separate CFO approval.

- “I review every executed trade at the end of the month to ensure they are aligned with approvals (CF hedges, balance sheet hedges, spot deals, etc.).”