Editor’s note: NeuGroup’s online communities provide members a forum to pose questions and give answers. Talking Shop shares valuable insights from these exchanges, anonymously. Send us your responses: [email protected].

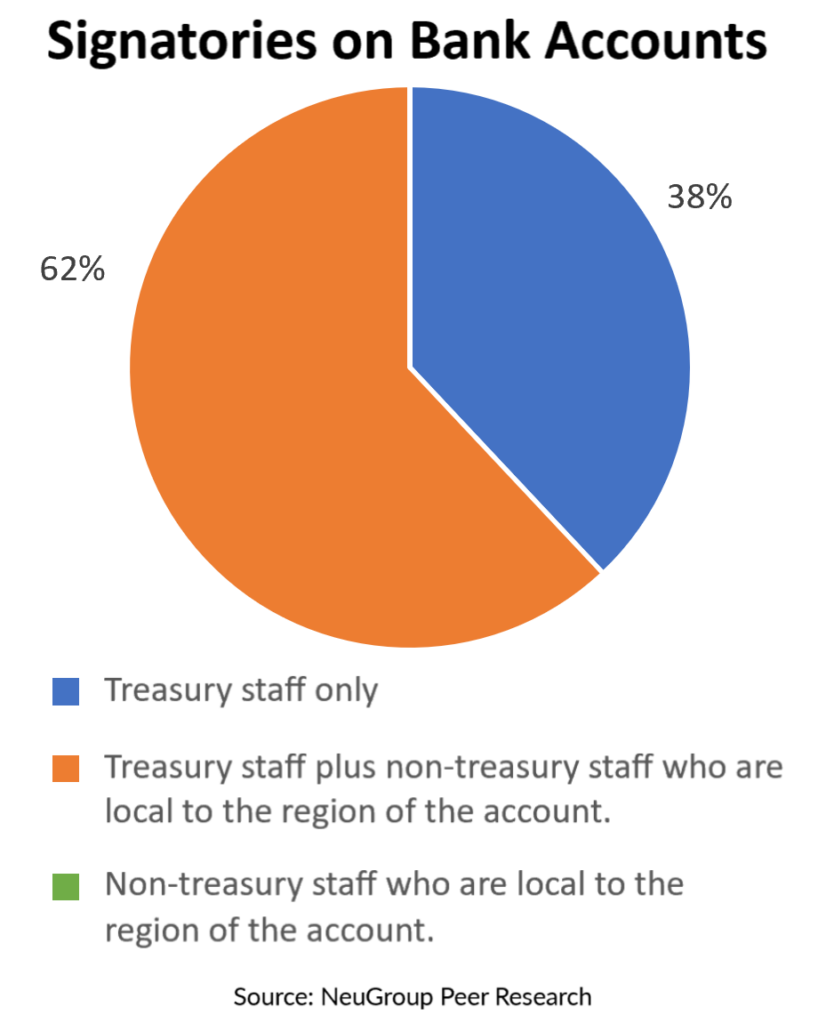

Member question: “The signatories on your global bank accounts are most accurately reflected by which of the following choices?”

- Treasury staff only.

- Treasury staff plus non-treasury staff in the region of the account.

- Non-treasury staff who are in the region of the account.

Peer responses:

Peer answer 1: “We have split the global treasury team into US and non-US. US staff are signatories on US accounts. The non-US treasury team is not a signatory in the US but is for the rest of the world.”

Peer answer 2: “Unless prohibited by local laws and regulations, signatories who are authorized to open, close and modify accounts are limited to a small number of corporate treasury directors and above.

- “If local check signers are required, we differentiate with the bank to allow certain local personnel to authorize checks—however, they cannot take other actions with the accounts.”

Peer answer 3: “Generally, for opening, closing and modifying accounts and services, we prefer to have corporate signers which includes the treasurer and four other finance leadership (VP-level) team members.

- “However, as some countries have different requirements, we do make adjustments; and typically in these cases, we utilize a treasury team member or local finance director. Globally, we require two authorized signers for all such activity (whether required by the bank or not).”