Progress on connectivity with APIs starts with payments and administrative efficiency, GCBG members learned at a recent meeting.

Members of NeuGroup for Global Cash and Banking got a realistic assessment of the state of bank connectivity with open APIs at a recent meeting sponsored by ION Treasury, a top provider of treasury management systems.

- ION’s perspective, an example from a member company and comments from a global bank considered ahead of the curve with APIs provided a view of the current landscape of API connectivity and the technology’s potential.

State of play. APIs have been heavily hyped as transforming treasury, but the reality is that these are still the early days of API transformation. An in-session poll revealed that just 26% of members were using APIs, but 47% indicated that they expect to soon.

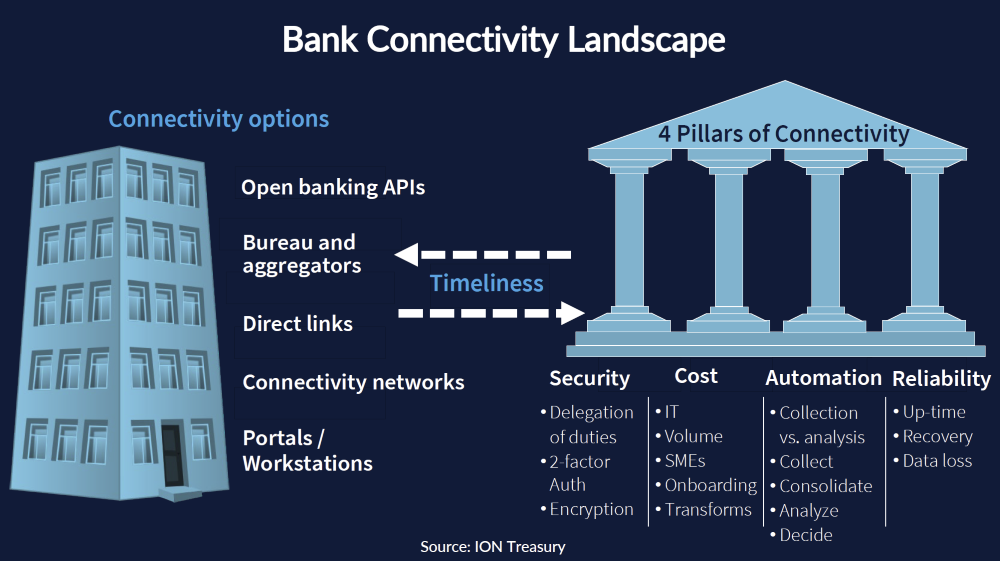

- As ION noted, the bank connectivity part of APIs is all about timeliness and improving the security, cost, automation and reliability of connections (the four pillars of connectivity—see chart) between banks and corporate treasuries.

- The improvement is relative to existing connectivity via service bureaus and other aggregators, connectivity networks (including SWIFT), host-to-host direct links and e-banking portals and workstation connections.

- Of course, each of these means of connectivity will also likely deploy API connections. However, they may not do so in an open way that allows new ways for fintechs and other third parties to create new business opportunities on top of banks and banking infrastructure.

SWIFT payments: a current focal point. The SWIFT Global Payment Innovation (gpi) initiative can help implement broader API adoption in bank payments globally. However, in its current state it is mainly about imposing standards on banks to increase transparency on payment fees, along with providing end-to-end payment tracking and confirmation closer to real time.

- Case in point. The member example backs this up. Like many large corporates, this multinational deployed a variety of means and systems to connect to banks to make and reconcile payments. This created a complex web of payment file transfers.

- Payment file streamlining. To streamline that web, the company brought in a service bureau to connect it to all of its global banks via SWIFT, replacing a separate TMS-to-bank connection in the US and a bilateral transfer between its major global transaction banks and foreign operations.

APIs where they make sense. According to the member implementing the payment file streamlining project, APIs will be deployed where they make sense. As priorities, he listed:

- Interfaces between treasury systems and bank administrative systems (though these depend on internal IT approval).

- Interfaces between treasury systems and other corporate systems (to streamline workflows for investment, FX and delegation of authority to act on the behalf of affiliates).

- Intraday balance reporting from financial institutions (a step toward real-time or statement-less reconciliation and liquidity management).

- Bank portal user entitlements (to eliminate tokens and manage user access to include automated removal of users when they leave).

- Bank account validation services (to help ensure compliance with controls on accounts from opening to signatories and closing).