Treasury’s role is critical as ratings agencies translate financial soundness into ESG readiness.

Credit rating agencies face daunting challenges, not only with old-fashioned credit ratings, but also their efforts to gauge corporates’ environmental, social and governmental (ESG) status. In fact, corporate treasury’s approach to the former can significantly impact the agencies’ views on the latter, according to Karl Pettersen, managing director and chief sustainability officer and the head of ratings advisory at Societe Generale.

- ESG rating and scoring firms, some of which the credit rating agencies have recently acquired, all use very different data and methodologies, leaving companies uncertain about their standings.

- “The language for ESG is changing fast, because of evolving taxonomies, market developments such as carbon pricing, and because social questions are becoming more pressing,” Mr. Pettersen said.

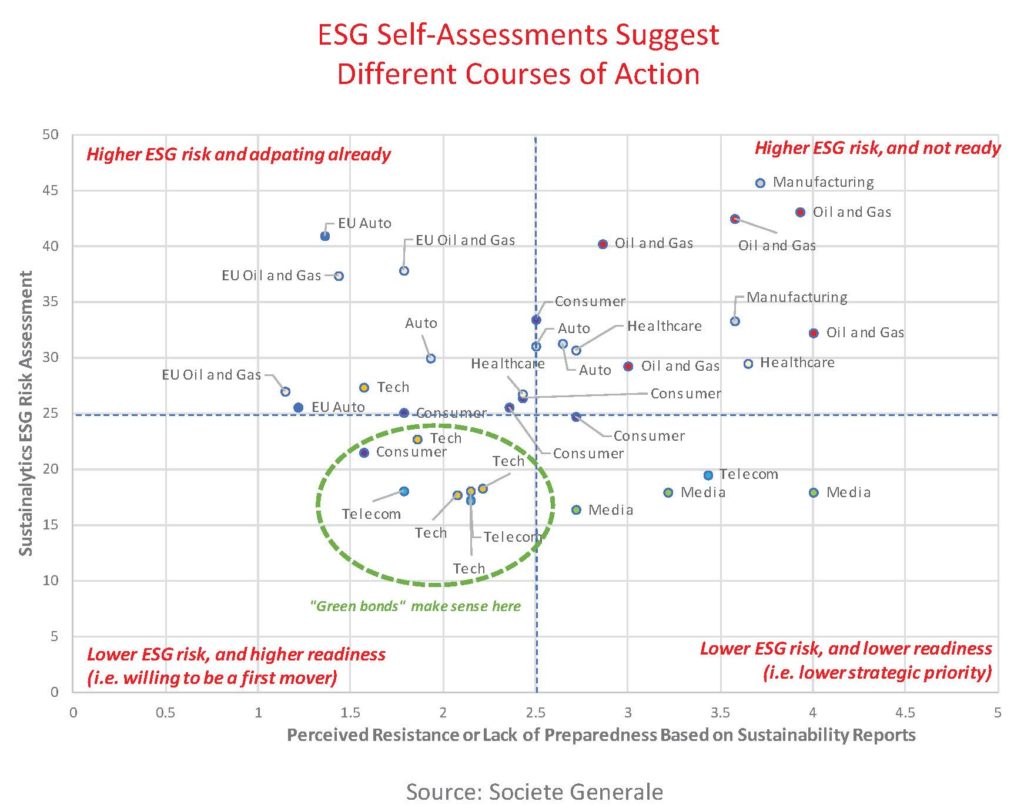

Find a starting point. Mr. Pettersen presented a graphic with quadrants representing higher and lower levels of ESG risk and readiness and different starting points for companies to approach an ESG strategy

- Those in the bottom left have lower ESG risk and a higher willingness to be a first mover (i.e. higher ESG readiness), so issuing a public green or social bond makes sense.

- Those with a low risk/low readiness profile may be best served in engaging proactively in the social conversation, first through internal policy changes, and then through external relationships with diversity partners.

- “When you’ve figured out your starting point, because ESG is a response to societal needs, it needs to be public and it should also be permanent,” Mr. Pettersen said. “Something that becomes part and parcel with what the company does and is consequential to its business.”

Treasury’s role. Given that ESG standards are still forming, traditional financial tools remain the most reliable, Mr. Pettersen said, noting SocGen’s research imbedding ESG into equity recommendations.

- The “trust factor” has become increasingly important for credit ratings as the agencies navigate challenges to their traditional credit methodologies, and that trust carries over to ESG.

- The more aggressively the rating agencies view a company’s financial policies, he said, the less likely they are to view it as less ESG ready—a “clear correlation.”

- “And if they like your financial-policy track record, they’re more likely to trust you on ESG,” he said.

Unfair controversy. A treasurer noted skeptically that ESG rating firms disproportionally rely on independent sources reporting controversies, and Mr. Pettersen acknowledged such controversies may be unfounded but nevertheless affect a company’s ESG score.

- As a former credit rating analyst, Mr. Pettersen said he advised companies to take control of the narrative. Noting an earlier NeuGroup poll indicating corporate America expresses sustainability as building a better world, he said companies should focus on what they can do to improve.

- “That allows you to take control of the narrative a bit and define better what your actual starting point is,” he said. “And because not a lot of companies are doing this now, it may give you a first mover advantage.”

Evolving ESG conversation. A few years ago, the market wanted companies to show they were thinking about ESG and doing something about it, Mr. Pettersen said. “Now, it’s turning into, ‘Show me that when you’re taking risk, you’re doing it in a responsible and balanced fashion across your stakeholders.’”