Banks are eager for business as loan markets improve and more M&A dialogue takes place.

Debt and loan markets are still in repair mode as they were back in April, so it’s time for corporates to talk to their relationship banks about their credit needs, particularly as it relates to revolving credit. That’s according to Jeff Stuart, EVP and head of capital markets at U.S. Bank.

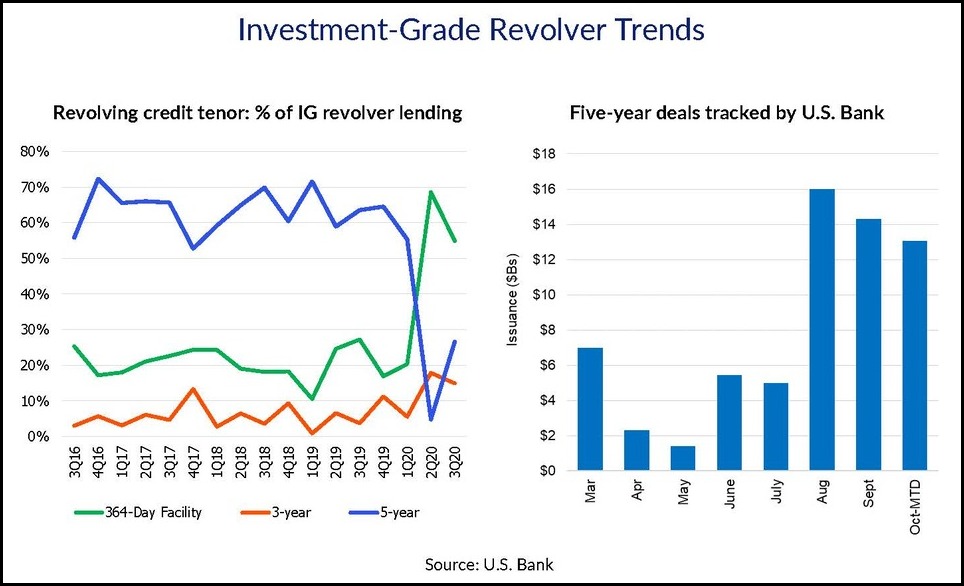

Revolver trends. Mr. Stuart, presenting his view of revolvers and more at NeuGroup’s Assistant Treasurers’ Leadership Group second-half meeting, said companies had paid down most of their “Covid crisis drawdowns” of revolving credit lines over the course of the pandemic. Nonetheless, they were keeping those lines of liquidity open just in case.

- Borrowers are paying down revolver draws and refinancing incremental loans with longer-dated bond issuances, which is a positive trend, Mr. Stewart noted in his presentation.

- As for keeping the lines open, Mr. Stuart told members that it’s “not time to cancel your liquidity yet,” particularly as another growing wave of Covid-19 infections sweeps across the world.

- Mr. Stuart also noted that for higher-rated issuers, pricing has returned to pre-pandemic levels. “Five-year tenors are coming back; that’s a good sign.”

Don’t wait. If company revolvers are to be extended, right after the election might be a good time to do it, Mr. Stuart said. He added that even if your current revolver doesn’t need attention until next year, most banks have fresh budgets in January and are looking to book new loans in the first quarter. “Don’t wait until your revolver matures,” he said.

- He also encouraged companies to use the revolver as they see fit, because banks and rating agencies aren’t giving drawdowns the negative weight they used to. “The stigma of drawing down your revolver is over,” he said.

Deal debt. Following a big decline in M&A loan issuance, there more recently has been “a lot of dialogue about M&A in the last few months” between banks and corporates, Mr. Stuart said.

- The deal market is building, he added, “so much so that the election might not matter.”

- Despite the M&A dialogue, many companies “haven’t pulled the trigger” yet, awaiting clarity around Covid, Mr. Stuart said.