Treasury investment managers trying to get a better handle on FASB’s new methodology for estimating credit losses got some help this month at two NeuGroup virtual meetings. No surprise, the issue of how exactly to estimate those losses generated plenty of interest.

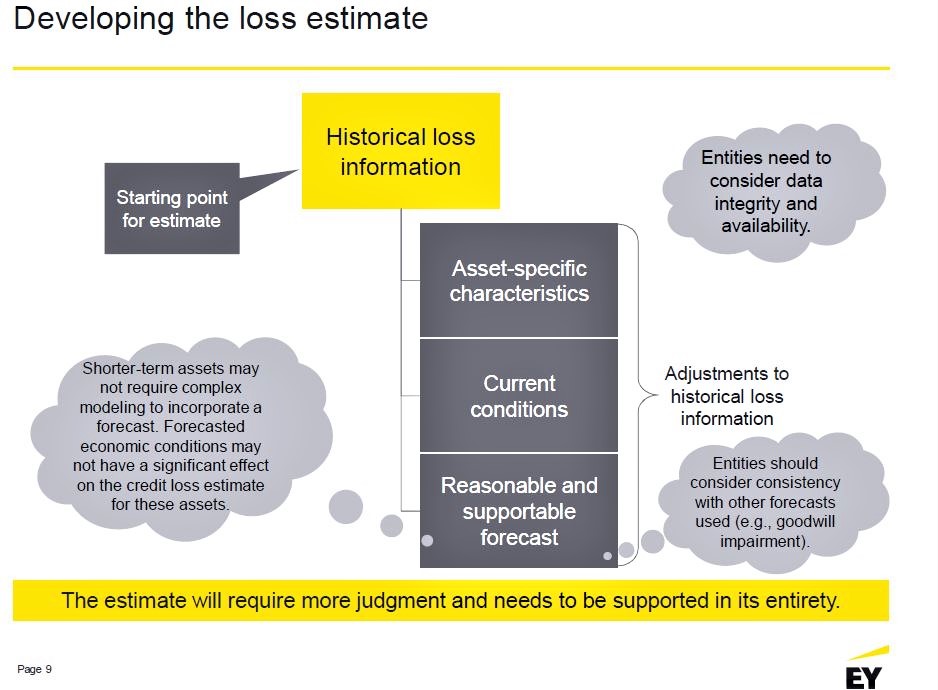

- One of the meetings featured a presentation from EY that included the slide below. It lays out three criteria used to adjust historical loss information to develop a loss estimate. EY’s presenter said that coming up with a “reasonable and supportable forecast” is the tricky part, especially given the uncertainty created by the pandemic.

- One member commented that while the slide is simple, “the definition of a credit loss is where I have an issue.” Like other members, he underscored the difficulty of determining what portion of an unrealized loss is related to credit as opposed to other factors, including liquidity. “I have a problem actually calculating that,” he said.

- EY’s presentation made the point that CECL requires “the use of more judgment and is expected to increase earnings volatility.”

Models. One EY presenter said the length of time the CECL process takes depends in part on what model corporates use to estimate losses. At another meeting, presenters from Aladdin—which offers risk management software tools and is owned by BlackRock—described three sources for coming up with “CECL numbers.” They are:

- Asset Managers. Aladdin advises asking if money managers are able to provide CECL- compliant numbers and to consider whether differences in loss modeling approaches between managers are acceptable. One member got silence after asking peers at the meeting if they had had any luck getting CECL information from external asset managers. Another member reported no luck after asking Clearwater.

- Internal Processes. Determine whether you have internal models that you can use as-is or if you need to make adjustments. And do you have in-house expertise for all asset classes? Are all the right teams involved?

- Vendor Solutions. Aladdin, which offers CECL modelling services to corporates, recommends assessing the quality of a firm’s asset coverage, asking whether it supports end-to-end workflow, including integration with accounting platforms, and asking whether the corporate can selectively override the vendor’s model settings if treasury has a different view.