Wells Fargo’s risk-adjusted liquidity ratio offers insights on how corporates view liquidity during recessions.

Setting a target for a company’s ideal liquidity level is never easy. Corporates use a variety of metrics and liquidity ratios to get it right. But what happens when events like the global financial crisis or the pandemic push the economy into recession and force corporates to go into crisis mode?

- In theory, given that most companies revenues and expenses drop somewhat during a recession, they should be carrying less liquidity.

- But in the 2008 financial crisis, every business sector increased liquidity despite reductions in all aspects of their businesses, including revenues, expenses, investments and working capital.

- That’s according to an analysis from Wells Fargo, sponsor of the spring meeting of NeuGroup for Capital Markets (NGCM).

The old playbook doesn’t work. “That tells me those liquidity ratios are really only useful during quiet, normal times, and it’s not the right amount of liquidity when times get tough, in a recession,” said Hans Tallis, head of quantitative corporate finance at Wells Fargo and an adjunct professor of finance at Columbia Business School.

- The bank’s presentation concluded that “managers don’t size liquidity to static income or balance sheet values. Instead, a robust measure of liquidity should include risk.”

- Mr. Tallis described a tool his team developed to provide the best explanation for how companies think about liquidity and when it can be adjusted.

A simple solution. After exploring numerous options, the team arrived at what Mr. Tallis described as the “very simple” risk-adjusted liquidity (RAL) ratio. It is the median liquidity—cash plus undrawn revolving credit—divided by “EBIT risk,” which is the difference between a company’s high and low earnings before interest and taxes (EBIT) over a short look-back period.

- “We looked back two years at a given company’s top and bottom levels of EBIT, and tracked its EBIT range over that period,” Mr. Tallis explained.

- Applying RAL to different industry sectors during the Great Recession more than a decade ago produced a more stable liquidity target for sectors, excluding healthcare and information technology, which held significant cash offshore that skewed the findings.

- “I can’t say this is how every management team thinks about the right amount of liquidity, but it certainly seems a lot closer,” Mr. Tallis said.

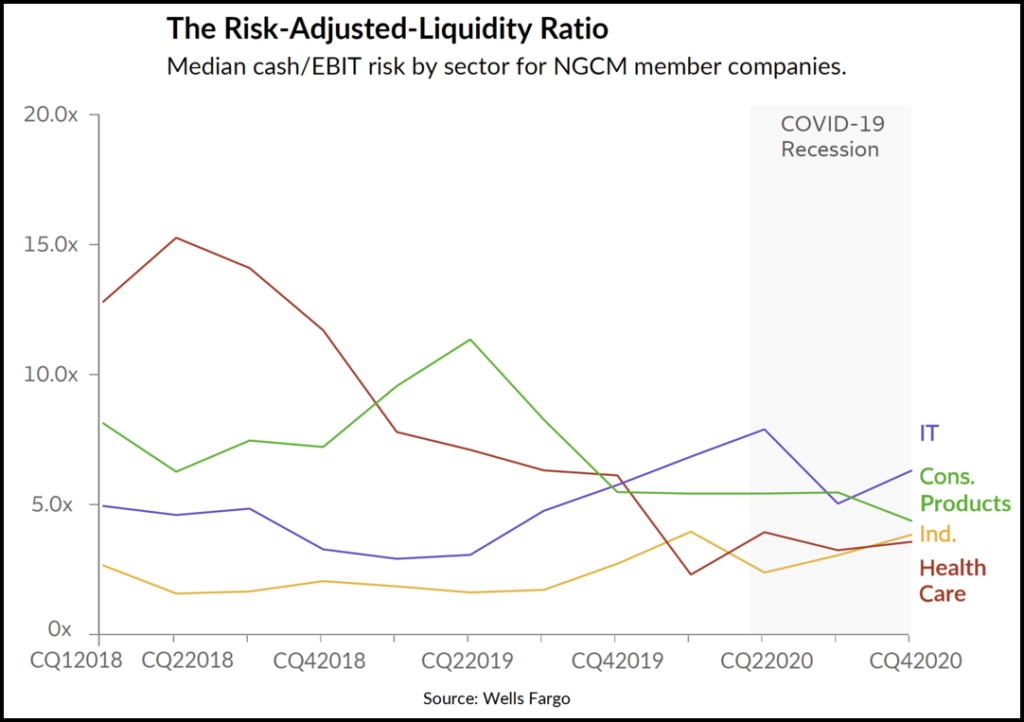

The Covid recession. Splitting NGCM members’ companies by sector, Wells Fargo found the companies adjusted their liquidity throughout 2020’s pandemic-prompted recession in different ways.

- Most companies built up cash, tapping revolving lines of credit and issuing debt, while EBIT risk was increasing. That resulted in a fairly stable RAL ratio, Mr. Tallis said. See the chart below for details.

Member takeaway. The RAL ratio did a “reasonably good job” of characterizing the liquidity profiles of NGCM members throughout both recessions, Mr. Tallis said, and so it may be a useful guidepost to think about a company’s appropriate amount of liquidity.

- “Once your earnings trajectory stabilizes and you’re confident that EBIT is stable or perhaps will inflect upwards, that may be the right time to think about reducing the amount of liquidity that the company is carrying on the balance sheet,” he said.