Wells Fargo explains credit and capital charges for corporate counterparties on derivative transactions.

Corporates that are using or considering using long-dated hedges such as five-year FX forwards or swaps can benefit from understanding the way banks price derivatives using a combination of credit and capital charges. That idea surfaced during a recent meeting sponsored by Wells Fargo for NeuGroup members who manage foreign exchange risk.

- Credit and capital costs can impact unwinds and restructurings as well as new transactions, Wells Fargo said. The extent to which hedges are in or out of the money, and the remaining tenor of the hedges, drives these calculations.

- The presentation included explanations of the relevant acronyms CVA (credit value adjustment), DVA (debit value adjustment) and FVA (funding valuation adjustment) used to calculate the charges.

- Wells Fargo also addressed how companies may deal with these adjustments from an accounting perspective.

Why this is relevant now. The presentation made the case that credit and capital charges are relevant now by citing the results of a 2020 FX Risk Management Survey the bank conducted.

- Almost half of public companies report hedging long-dated FX exposures. “Widening FX carry in recent years has been a driver in some cases,” Wells Fargo reported.

- Also, “Changes in the accounting rules (see ASU 2017-12) and decreased cost of funding in foreign currency vs. USD has increased usage of net investment hedges.”

Understanding the acronyms. CVA is priced off of what is called “positive exposure”—the risk that the bank’s counterparty, the corporate, defaults. The higher the corporate’s credit default swaps (CDS) level is, the higher the CVA cost, the presentation explained. And the larger the potential exposure, the higher the CVA cost.

- The CVA fee is embedded in the FX or interest rate quoted by the bank to the corporate for the derivative trade.

- DVA is priced off of “negative exposure” and takes into account the credit risk of the bank, its likelihood of default. The credit fee would in part represent a netting of CVA and DVA.

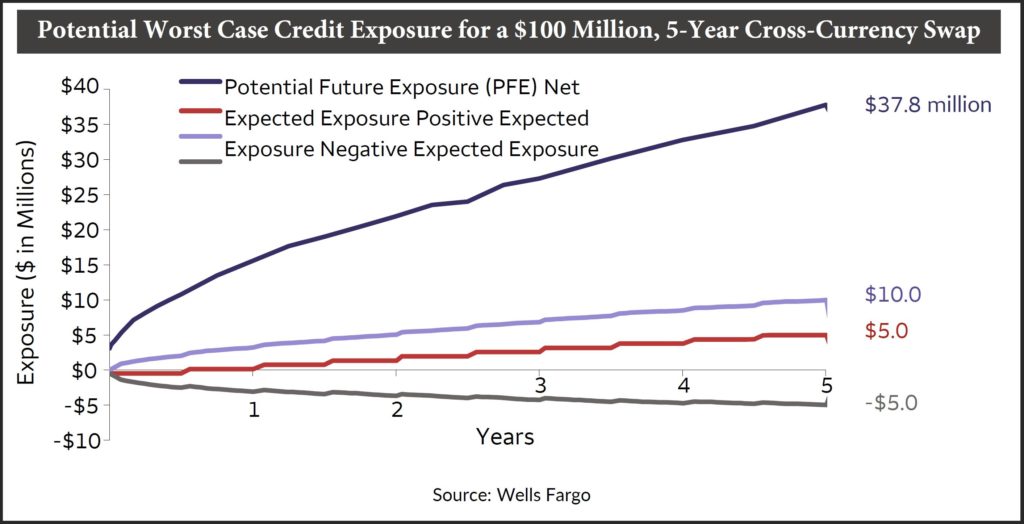

- The presentation noted that the “worst case” exposure from a $100 million, five-year cross-currency swap, where the company pays EUR fixed rates and receives USD fixed, could be “quite large”: $37.8 million (see below).

- FVA is priced off of both positive and negative exposure and takes into account the bank’s funding cost.

- Most banks, the presentation said, have made a policy decision to consistently use either DVA or FVA.

The capital factor. Banks are bound by regulators to hold equity capital for derivative transactions, one reason banks also charge corporates a capital charge.

- The presentation included a graphic explaining three common methods of calculating derivative capital requirements, plus the standardized approach for counterparty credit risk (SA-CCR), the capital requirement framework under Basel III.

- Credit and capital costs can vary from bank to bank, a Wells presenter explained. Most of this variation reflects differences in capital costs as banks have different return on equity (ROE) targets and different capital constraints given the makeup of their balance sheets.

What about credit support annexes? A Wells Fargo presenter explained that while corporate clients could avoid credit and capital charges by constructing a “perfect CSA,” one downside is the company must be confident it can come up with the necessary cash collateral at any time.

- So corporates should consider the benefits of not having to post collateral when structuring hedging programs and when considering whether to unwind or restructure derivatives, he added.

- Corporates that do have CSAs tend be companies on either end of the credit spectrum: the highest quality credits or those with the weakest credit profiles, the presenter said.

- The presenter also noted that bank capital rules don’t provide for as much pricing benefit for most CSAs, other than “perfect” ones. And those have daily margining, low minimum transfer amounts and only allow for USD cash as collateral.”

Accounting. Wells Fargo made the point that for credit and capital charges, “We believe the accounting guidance indicates to include these charges in effectiveness tests, but as a matter of practice, many clients do not, or only include these charges for longer dated hedges where they’re material.”

- The presentation noted that because market participants consider counterparty credit risk in pricing a derivative contract, a company’s valuation methodology should incorporate counterparty risk in its determination of fair value.

- It noted that derivatives are unique “in the fact that they can potentially be in both an asset and liability position.”