Corporates report success using DocuSign with many banks, but Latin America presents challenges.

“Has anyone successfully used DocuSign with banks?” one NeuGroup member asked at a recent virtual meeting. “Yes” was the resounding answer from peers—more evidence that the pandemic has accelerated automation and digitization in finance. And one goal for many treasury teams is to make “wet” signatures a thing of the past.

- The member who posed the question wants to use DocuSign’s electronic signature solution internally and externally—for intercompany loans, signatory changes and to open, close or change bank accounts.

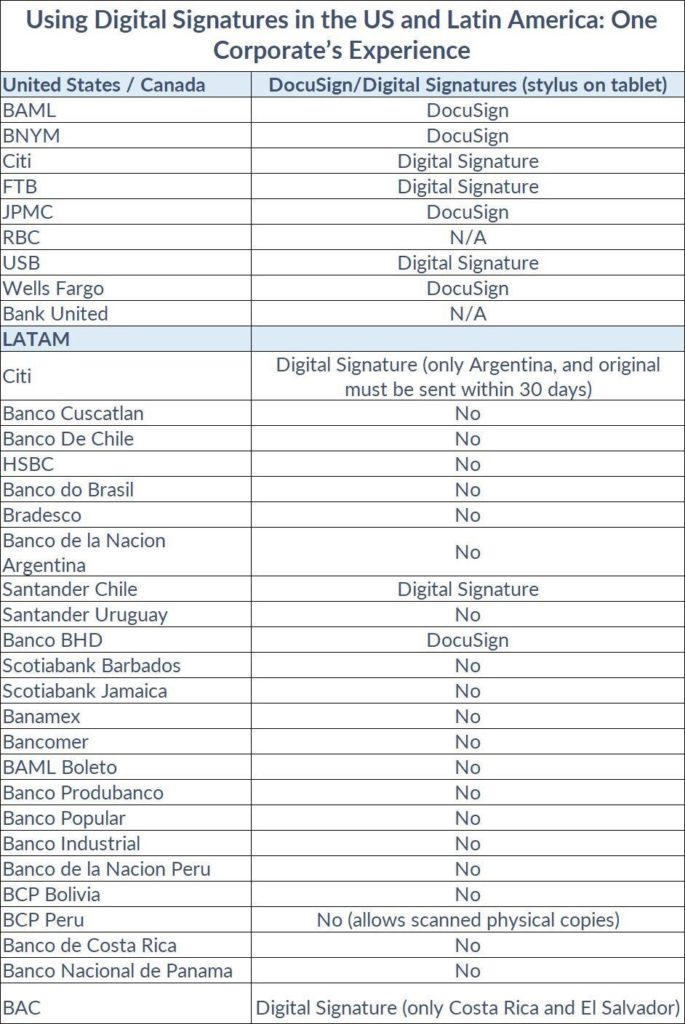

- One pain point that several members brought up: difficulties using DocuSign in Latin America. See the table below.

- The takeaway is that corporates should keep applying pressure to financial institutions and regulators to allow broad use of digital signatures across the globe.

The good news. Members reported success in using DocuSign with banks including Bank of America, JPMorgan Chase, Citi, Wells Fargo and Societe Generale.

- “We have used it in lots of places,” said one member.

- “The banks will do it if they want your business,” another said, recommending that others push institutions to accept digital signatures. “Unless they can produce a regulatory reason, use DocuSign.”

The problem. Regulatory issues and how banks interpret different rules and laws in dozens of countries are one reason using digital signatures can prove challenging for corporates.

- Many companies at the meeting use Citi to bank in Latin America and most of them reported having difficulties using DocuSign in the region.

- “They’re requiring originals for everything,” one member said.

- “We’re hearing it’s more the regulatory environment,” said another, adding that it may also may reflect a more conservative approach by Citi.

- Another said, “My assumption is that it is banks’ interpretation of country-specific regulatory rules that drive the compliance/non-compliance with digital signatures. But I don’t have clarity from the banks on why they will or will not accept DocuSign.” This member’s company also uses a stylus to sign documents on an iPad.

Citi and DocuSign. Driss Temsamani, Citi’s head of digital channels and data for Latin America, told NeuGroup Insights that DocuSign is embedded in the CitiDirect BE Digital Onboarding platform, adding that onboarding is the key priority in the bank’s digital transformation strategy. In Latin America, the platform was introduced in Brazil in 2019.

- The platform is now in use in 12 Latin American countries and Citi clients can use digital signatures in all but four of them. The exceptions include Mexico and Uruguay, where regulatory approval is pending.

- El Salvador and Panama do not have laws covering digital signatures and the DocuSign feature on Citi’s platform is disabled in those countries.

- Asked how he would respond to corporates expressing frustration with using e-signatures in Latin America, Mr. Temsamani said he would need each client to tell him more about its specific issue so he could better understand and address their feedback. “Whenever a client tells me something, it’s always valid and a top priority,” he added.

Editor’s Note: The table below was provided by a NeuGroup member company and is the treasury team’s documentation of its experience with various banks.

The table is not based on any information provided to NeuGroup by the banks listed and does not claim to represent the banks’ policies or the experience of any other company.

“Digital Signature” refers to the member company signing a document using a stylus on a tablet; DocuSign is its preferred method.