Some take advantage of opportunities to pick up yield; others play it safer and stick to government money funds.

The Covid crisis has illuminated where corporate cash investors sit on the risk tolerance spectrum—a point underscored in a Virtual Interactive Session sponsored by ICD this week that gave some NeuGroup members a clearer picture of where they stand relative to their peers.

Career risk vs. opportunity for yield. Hearing what some peers have done “reinforces how conservative we really are,” said one member whose company “took a hit” in an ultra-short duration fund as the pandemic unfolded and “was not used to seeing a dip” in its portfolio.

- The company’s resulting risk aversion, “with everyone gun-shy,” has made taking any chances to “get a few more bips” an unacceptable “career risk kind of thing,” he said. The company is now sticking with government money market funds.

- On the other end of the risk spectrum sat a multinational that, like others, raised lots of cash and liquidity in the early days of the pandemic. A member from this company took the stance that “we have to look for opportunities to invest that cash,” this member said.

- “Although we didn’t know the exact timing or size of our cash needs, we were able to assume that the majority of this balance would be around for at least a number of months, so in that situation prime funds worked out.”

How to decide it’s time for prime. This member, whose company had never invested in prime money market funds, said the funds “eventually turned into opportunities” to “generate some yield.”

- The company made the move after computing “the minimum number of days (how long) we need to stay invested in a prime fund to offset a small drop in NAV of that fund,” he said.

- It calculates the number by taking “the additional yield that prime funds offer over the next best alternative investment. Using this, we back into the number of days the principal needs to be invested for, so that this incremental return is equal to the loss caused by a drop in NAV.

- “For us, this just sets a baseline for what we deem to be the shortest possible duration, and we evaluate from there if we wish to proceed. If we do, we continually monitor the investment and any movements in the NAV.”

- Another member said his company “didn’t do a good enough job of measuring the risk; we should have moved back sooner to prime, more proactively.”

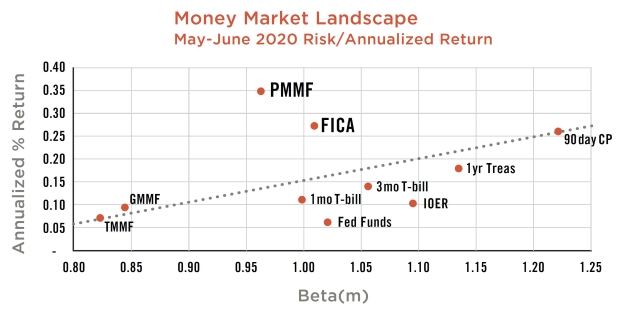

Identifying opportunities with the efficient frontier. ICD described a model it developed, based on modern portfolio theory, to help clients assess the relative risk-weighted investment opportunities in money markets by using efficient frontier analysis.

- As the chart shows, prime money market funds (PMMF) and Federally Insured Cash Accounts (FICA) appeared above the beta line of one-month Treasury bills from May to June of 2020.

- That indicates those investments provided more return than the risk associated with them, according to the model. One member said she wants to get more info on FICAs.

Beyond prime: deposits. Several members said they are making use of time deposits and short-term deposits with approved counterparties, suggesting that technology that helps assess and monitor counterparty risks is timely.

- “We do time deposits and we’ve got approved counterparties that we will trade with. And we are able to pick up a good return, well into 25 to 35 basis points range on a one-month time deposit. That’s what we are doing to pick up additional yield and optimize,” one member said.

- “30-day, that seems to be the [point] where you start to see rates a little bit better,” another member said. “And we stagger them so they’re every couple of weeks, so that way every few weeks we have our vision point to be able to collect cash back in and let it mature, or let it roll over. We’ve done a couple longer tenor, but nothing more than three months.”

Beyond the credit facility banks? One member said his company had “maxed out” on depositing cash in interest-bearing accounts using banks in its credit facility. He turned to highly-rated banks outside the group that had approached the company offering attractive rates.

- Another member, in the process of moving cash out of government MMFs and into demand deposit accounts, said he “hadn’t thought of going outside the credit facility.”

- But, reflecting the range of risk appetite among companies, another member said he was staying away from bank deposits to avoid counterparty risk.