Treasurers seeking clarity on bank fees and product profitability get insights from Chatham Financial and NeuGroup.

At a recent meeting of NeuGroup for Large-Cap Treasurers, members compared notes on revolving credit facilities, bank groups and share of wallet issues, including which products produce the greatest return for banks.

- A survey taken before the meeting revealed that despite market volatility last year that could have convinced corporates to replace some banks, most members did not see the size or composition of their bank group change much.

- However, some companies, at the margin, are shrinking the number of banks to minimize the amount of time needed for all the coverage and to rightsize the group relative to their wallet.

Wallets and returns. The survey sparked a discussion of share of wallet where some members expressed interest in how others keep track of the fees they pay banks. All treasurers said they keep close track of their wallet, but several noted that some products are difficult to measure as they do not have a stated fee.

- For example, one treasurer said he knows exactly what he paid on a bond transaction but is less certain on what a bank makes on an interest rate swap.

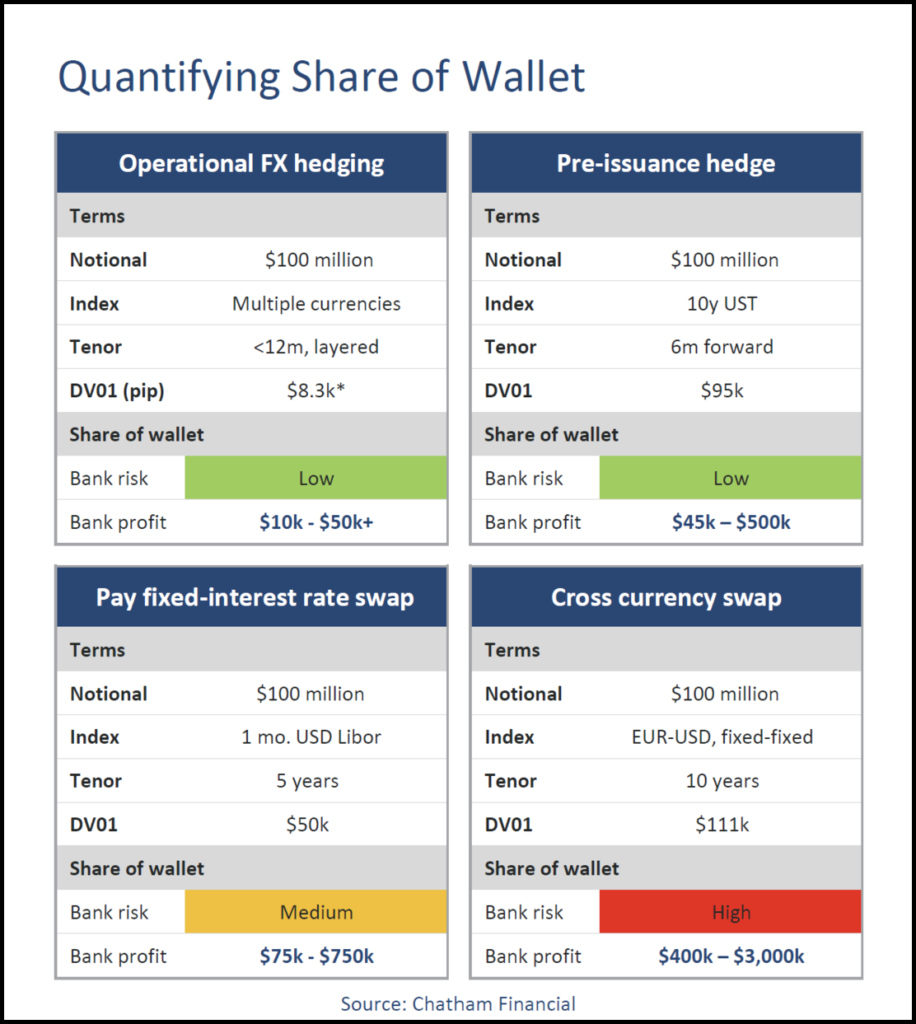

- Amol Dhargalkar, a managing partner from meeting sponsor Chatham Financial, expanded on this point and shared the chart below. It illustrates how the profits banks earn on different types of interest rate swaps such as pre-issuance rate locks, fixed/floating swaps and cross currency swaps grow along with the risk for the bank.

Mapping products. NeuGroup’s Scott Flieger shared a matrix of products and how they are viewed by many banks, noting that the most coveted products use little to no balance sheet, have good profit margins and are predictable and recurring (see chart below; RWA stands for risk-weighted assets, used to determine minimum capital requirements).

- So being in the top right quadrant (i.e., an IG bond issue) is where banks want to be, as opposed to the bottom left (i.e., a 5-year revolving credit facility).

- “A dollar in one product is worth a lot more than a dollar in another,” Mr. Flieger said.