NeuGroup’s survey results on the frequency of borrowing authority renewals, use of carve-outs for M&A and more.

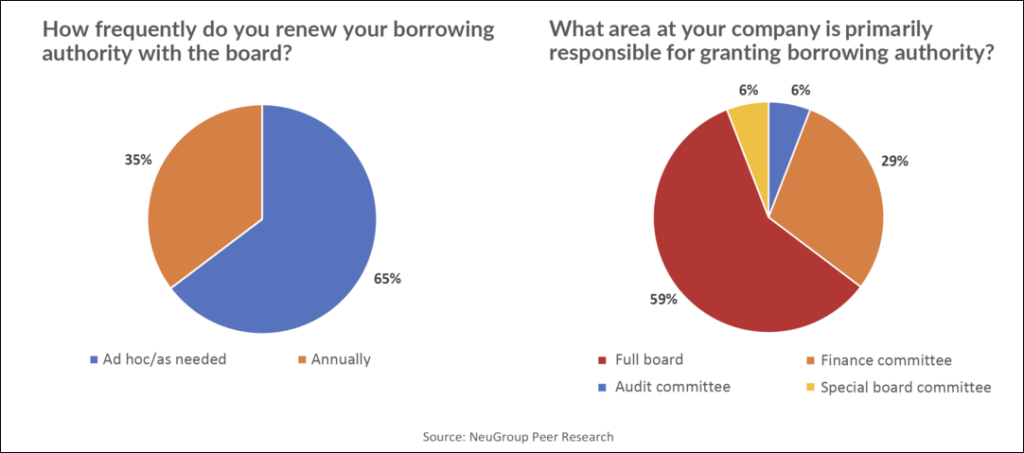

Nearly two-thirds of the treasurers responding to a recent NeuGroup survey renew their borrowing authority with the board on an ad hoc or as-needed basis, while about one-third do it every year. That’s shown in the pie chart on the left, below.

- But at a follow-up meeting to discuss the results, the general consensus seemed to be that an annual review made the most sense, as it can be part of the overall conversation with the board regarding capital structure.

- The second chart shows that for the majority (59%) of companies that responded, the full board grants borrowing authority, with the finance committee of the board playing that role at 29% of the companies.

Context. The importance of borrowing authority flexibility was underscored at another NeuGroup meeting in 2019. The takeaways then included:

- Winning authority from the board to go to capital markets opportunistically is a best practice. Treasury needs to have authority from the finance committee to refinance or issue debt when market stars are in alignment. This provides the flexibility to act fast, and members agreed it’s ideal for everyone as long as there’s full transparency between treasury and the board of directors.

Other observations from the more recent meeting:

- Some companies with a specified dollar amount ceiling for borrowing have carve-outs which do not require additional approval for purposes such as M&A financing, where borrowing needs are discussed during the normal evaluation and approval process.

- Members do not share details of their borrowing authority with the rating agencies, but rather provide a range of borrowing which might occur in the upcoming year.