In a late March poll, Capital Markets members expected one, two or no cuts—a view increasingly held by the market.

On the same day in late March that the Federal Reserve signaled it still expected to cut interest rates three times this year, almost none of the members of NeuGroup for Capital Markets polled at their spring meeting sponsored by HSBC believed that would happen. Call them prescient, perhaps: the poll came weeks before March jobs data and Wednesday’s hot inflation report pushed more investors and economists to revise expectations for the number and timing of cuts.

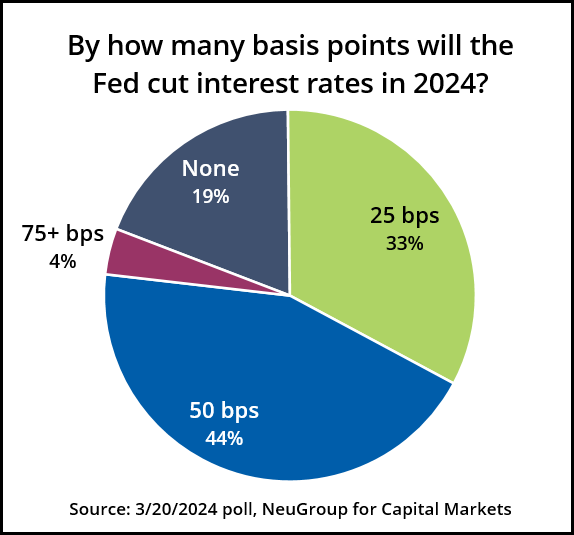

One cut or two? Or none? As the graphic below shows, 96% of members on March 20 said they do not expect the Fed to reduce interest rates by more than 50 basis points this year. Assuming each cut is 25 basis points, one-third said they expect one cut, 44% expect two and just 4% expect three cuts.

- The federal funds rate today is in a range of 5.25% to 5.5%, so three cuts would bring it down to 4.5% to 4.75%.

- Perhaps most striking is that 19% of those polled that day said they expected no cuts at all in 2024. That possibility generated headlines last week when Minneapolis Federal Reserve Bank President Neel Kashkari said if inflation data continues to move “sideways,” the Fed may not need to cut rates.

Why it matters. When and how much the Fed cuts matters to corporates for a variety of reasons, including decisions on debt issuance, liability management, cash investment and how much of their debt is fixed- or floating-rate. Indeed, during the meeting’s projects and priorities session, many members listed debt composition as a key focal point.

- One company is reducing what was a 35% exposure to floating-rate debt that inflicted financial pain through rising interest expense when rates jumped. Many more members want to reduce exposures to fixed rates at or near 100%, including one that now has board approval to swap to floating.

Cuts and inflation. In terms of timing, more than two-thirds (70%) of members polled said they don’t expect the Fed to start cutting rates until the consumer-price index falls between 2.5% and 3% year-over-year. About a quarter of members (26%) said the Fed won’t move until CPI is below 2.5%.

- We learned this week that CPI rose 3.5% in March from a year earlier, more than expected. The Fed’s target for inflation is 2% as measured by the personal-consumption expenditures price index.

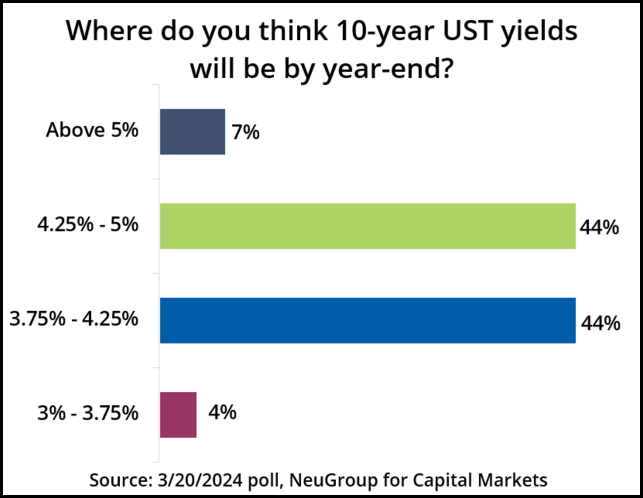

Bond yields. Wednesday’s inflation data sent the yield on the 10-year Treasury to its highest level since November, topping 4.5%. As the graphic above shows, 88% of members polled in March said the 10-year yield will be between 3.75% and 5% by the end of 2024. That includes more than 50% of members who said they expect rates to be at 4.25% or higher.

Perspective: don’t play the market. A treasurer at the meeting made the important point that treasury teams should not let their views on the direction of rates delay decisions or actions necessary for the company’s financial health. The jump in interest rates starting in 2022 showed that “you don’t want to get caught betting against the market knowing you have risk you need to fund,” he said.

- “Take risk off the table as soon as you have it; don’t play the market. Keep the company safe and secure.”