New NeuGroup Peer Research shows DEI firms enjoy support among corporates but face headwinds in the current ESG climate.

A new NeuGroup survey reveals that 66% of corporate treasuries include diverse-owned firms in their capital markets deals, including bond underwriting, commercial paper (CP) and open market repurchase (OMR) programs. The survey, conducted in collaboration with Sustainable Fitch and the National Association of Securities Professionals (NASP) in December 2023, explored the level of engagement between treasury and diverse-owned firms.

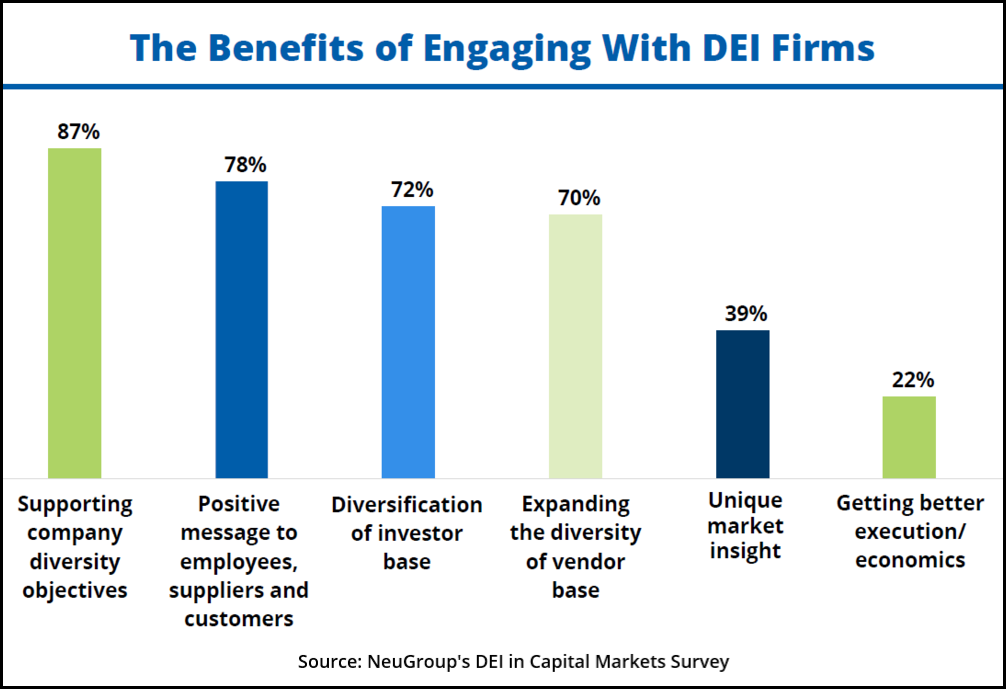

Shifting winds. NeuGroup members who responded to the survey cited two top reasons for awarding minority-owned firms a share of treasury’s capital markets business. Chief among them is supporting the company’s diversity objectives, listed as a benefit by 87% of respondents (see chart), followed by sending a positive message to employees, suppliers and customers (78%).

- These benefits illustrate both a weakness and a strength in supporting continued or expanded corporate engagement with diverse-owned banks and broker-dealers. Because they are related to companies’ overall commitment to DEI, they leave these firms vulnerable to shifts in the social, political and economic environment.

- “The environment in 2024 is not what it was in 2021-22,” noted one respondent in a follow-up conversation. Indeed, several companies have made headlines by backing away from earlier ESG commitments and reducing the size of their DEI teams—one aspect of the social component of ESG.

- “We have used diverse firms for a number of years, purely because it’s an effective way to demonstrate these are organizations we believe in,” one respondent said. “The danger is that if the company’s commitment to the issue wanes, it is no longer a big motivator.”

Investors and capital. The third most common benefit (72%)—access to a diverse investor base—indicates that minority-owned firms have an important and continuing role to play in executing corporate capital markets transactions, one with economic value. One member also highlighted the firms’ analytical skills related to investors. “The diverse-owned firms conducted much better analysis ahead of a bond deal,” one respondent said. “They looked at our overall debt investor base and dug deeper to find out, for example, what percentage of bonds is held by different types of investors, like insurance firms.”

- But corporates allocating fees (share of wallet) typically award the most lucrative roles to banks that commit capital to their revolvers; most diverse-owned financial institutions lack the capital needed to support those credit commitments. As a result, over three-quarters of respondents that work with diverse-owned firms on bond deals use them as co-managers as opposed to being active book runners that earn higher fees.

- “Our current pricing approach requires a bank to take trading risk,” explained one respondent. “The problem is that they lack the capital to support the types of transactions we undertake.”

- Another member said, “At a certain point, we will be cannibalizing the fee pool for banks that are providing us capital. Continuing to grow our business with all but the largest diverse-owned firms may be a challenge in this environment.”

A different type of capital. The key for maintaining and growing diverse-owned firms’ share of corporate capital markets deals is to not compete with big banks, but to offer more reasons for treasuries to award them higher fees. “The firms need to find the one thing or value they can deliver and do it consistently,” one member said. “They need to offer something that differentiates them from other firms.”

- Minority-owned firms often play active roles in CP and OMR programs because those do not require capital commitment. In fact, some treasurers said they use diverse-owned firms exclusively in their CP and OMR programs.

- “We get better execution than we do with bulge-bracket banks because the smaller institutions pay more attention to our business,” explained one respondent. “We found that they actually outperform the bulge-bracket banks.”

- As noted above, another area where some diverse-owned firms already shine is offering a unique point of view on the market and providing deeper and more insightful analysis. “They have to compete on intellectual capital,” said a respondent. “We partner with DEI firms that offer something unique and value added.”

- He added: “If I get 100 emails from banks with their market insight every day, the only one I read is from a diverse-owned firm. They bring a different geopolitical and economic perspective that I don’t get anywhere else.”