Willis Towers Watson offers insights on how companies should assess the financial and economic risks of rising temperatures.

At a recent NeuGroup virtual interactive session, Willis Towers Watson’s Climate and Resilience Hub experts, led by Irem Yerdelen, detailed the long-term risks of ignoring the causes of climate change and other environmental threats, and members discussed what steps, if any, treasurers can take to incorporate this risk into their ESG and risk management strategies.

- “There is an extraordinary depth and breadth to this issue,” Ms. Yerdelen said. “It’s one of the few issues that permeates every element of every business—it hits every stakeholder in every element of every organization in every industry.”

Understand the types of risk. Willis Towers Watson divides climate-related risks into three categories:

- Physical risks, the acute risks arising from extreme weather-related events and chronic, slow onset climatic changes. While these risks may not impact all corporates in the near future, Ms. Yerdelen said, “without an established climate resilience, we expect the global economy to shrink by 2050.”

- “The trends here are interesting,” one member responded. “But currently a lot of what our ESG function is identifying as a risk isn’t yet a material enterprise-level risk for the company.”

- Transition risks arise from changes in policy, technology, societal pressure and consumer preference. Some sectors face significant shifts in asset values or higher costs.

- Liability risks, or the risk of actions initiated by claimants who have suffered loss and damage arising from climate change.

Time to act? “Every risk is different,” one member said. “Identifying what is voluntary and what is mandatory is something that is taking a lot of our time and resource allocation. It is definitely a priority on our agenda, as well as all of the reporting with which we have to comply.”

- She added that her company is still looking into how to evaluate the impact of climate change on cost of capital. “If the money we’re making demands an action that’s responding to climate change, what is going to happen with that impact?”

- “Sustainability has never been a topic that is promoted and discussed in this way before,” she continued. “It is a top priority for us, and we want to figure out how to leverage the knowledge within our corporation, how we can organize to deal with this holistically.”

- Willis Towers Watson recommends starting slow and assigning an end goal, like reducing your total carbon emissions to a set target by 2030 or later but understanding that the journey may fluctuate along the way.

- “If you do nothing, governments and regulators and other corporates will do some of it for you,” one presenter said. “At the very least, ensure you’ve got the right leadership that think about these risks and appropriately weigh climate risks when they make decisions.”

Burden of proof. One member said that while climate change at the current pace could have a long-term impact, he could not get sign-off on any action to mitigate risks without supporting data. “It needs to be properly quantified, otherwise it’s just a headline,” he said.

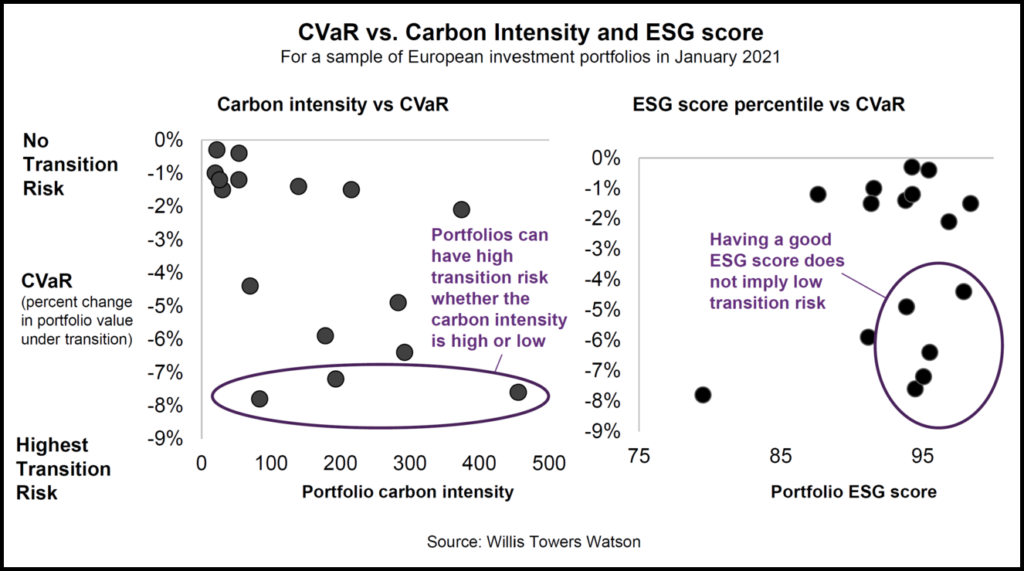

- Though there are a number of third parties that rate a company’s ESG performance, Willis Towers Watson has an in-house valuation tool it calls CVaR (climate value at risk), which evaluates long-term transition risk, as well as a physical climate risk modelling tool that reviews climate change impacts for selected scenarios and strategic time horizons.

- As the charts below show, transition risk does not necessarily correlate with ESG scores or carbon intensity metrics.

- “Evaluating climate risk is about looking at different assets, and that requires a whole set of analytics based upon commodities like the oil crisis and carbon prices changing in the future,” one presenter said.

- “There is a bit of a debate about if ESG is an emerging risk or an existing risk,” he continued. “It’s not emerging, it is very prevalent now, but we still need to reconcile materiality when it comes to ERM. Ultimately, things need to be quantified in order to be impactful.”