A session sponsored by Insight Investment probes pros, cons and timing of transferring liabilities to insurers.

A key consideration for corporates with traditional defined benefit plans is whether to transfer pension liabilities to insurance companies as funding deficits narrow or plans go into surplus. The primary benefits of risk transfer are eliminating PBGC fees, which have escalated substantially in the last few years, and removing all risk from the company’s balance sheet—both interest rate and longevity risk.

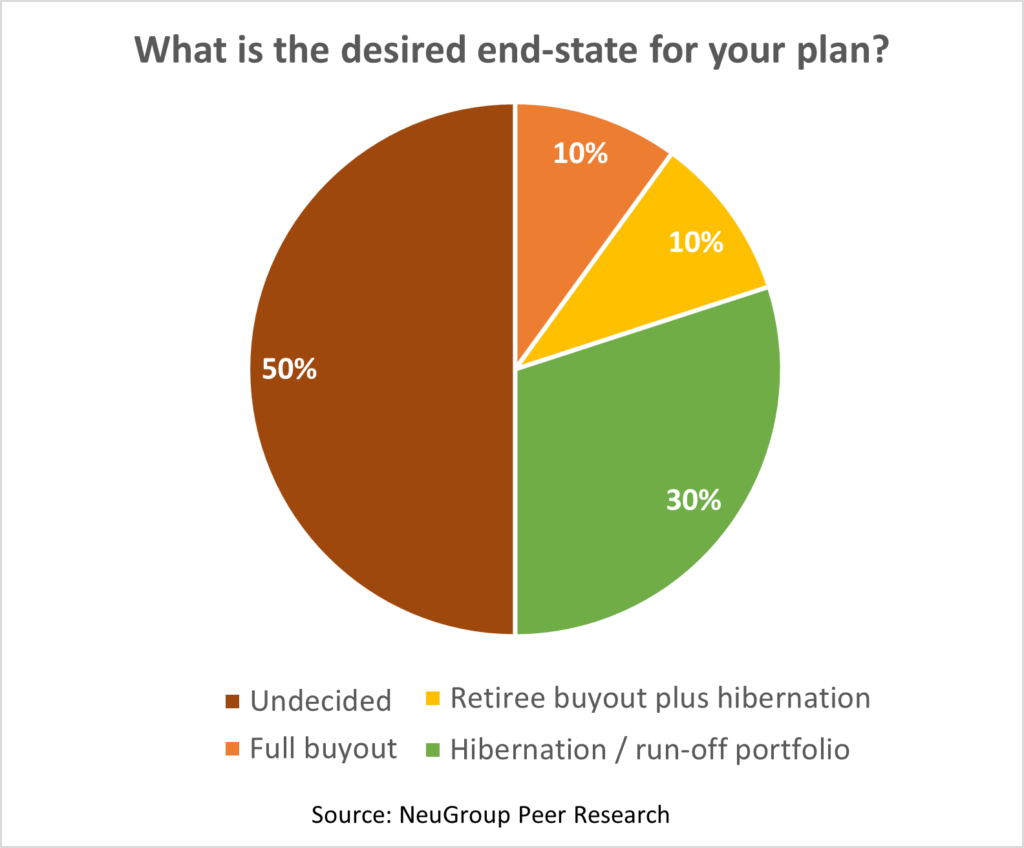

- Half of the members surveyed at a recent meeting of NeuGroup for Pension and Benefits sponsored by Insight Investment are undecided on the desired end-state of their plans (see chart below).

- NeuGroup senior executive advisor Roger Heine moderated a discussion of the advantages and drawbacks of liability transfers and provided the key takeaways and analysis that follow.

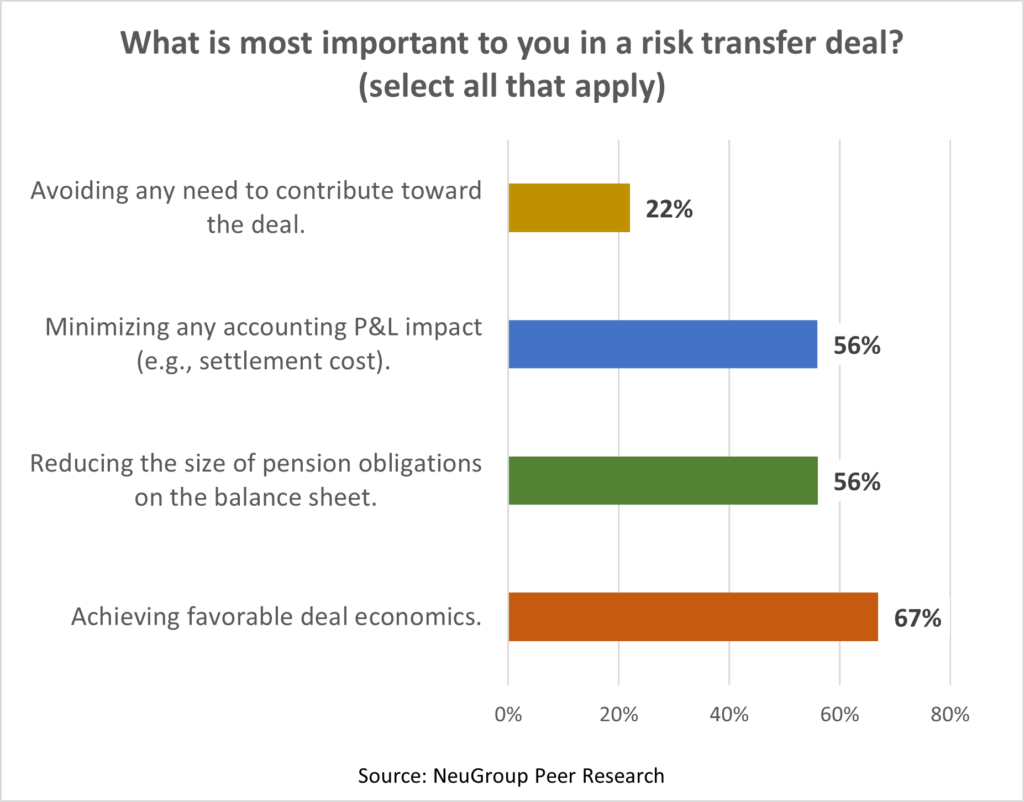

Cost is the key concern. How much insurance companies charge corporates to take liabilities off their hands is the primary consideration for pension fund managers.

- The amount charged reflects the insurer’s expected return on equity (ROE), and that typically leads to pricing that exceeds the accounting valuation of the pension liability used by the corporate.

- Insight Investment says the “spread premium” insurers are currently charging to generate adequate ROE ranges from about 60 basis points for older, retired participants to up to 100 basis points for active employees.

- So non-retiree pools can look prohibitively expensive to transfer relative to holding a matching fixed income portfolio.

- Members are aware that risk transfers in many cases are more expensive than managing a plan in-house, which is also called taking a hibernation or self-sufficiency approach.

Be ready for opportunities to lower costs. Companies may have the potential to transfer risk at a lower cost when corporate bond spreads widen, as they did briefly in early 2020 following the spread of Covid-19. That makes bonds cheaper for insurers to buy and increases the discount rates they apply to the pension liability.

- Heightened competition makes insurers hungry to win risk transfer deals, which can also reduce pricing.

- So it may make sense for corporates to complete all the work necessary before a risk transfer so the company is ready to move forward quickly if and when pricing becomes more favorable.

Lessons learned. The session benefited from one member who has recently executed a significant risk transfer and another who is seriously considering one and has many questions. This brought out several interesting observations:

- The entire exercise is complex and can take six to seven months to complete after board approval.

- There are experienced third party advisors and experts that can do the heavy lifting, know the other players and will execute well, avoiding the need for additional company staffing for the project.

- Cleaning up the participant database is key, but records are generally already in good shape where participants are already receiving benefits.

- Hiring a bank to hedge the execution cost makes the transaction feasible despite market volatility.

- Surprisingly, the only retirees who complained at the company that did a partial transfer were those who did not make the transfer pool; they would have preferred exposure to an insurance company with a household name.

- The company took a charge on writing off unamortized losses but the market and equity analysts disregarded it.

- The liabilities typically get transferred into a separate account within the insurance company where the plan assets directly protect the participants should the insurance company get into trouble.

Intermediate steps towards risk transfer. Risk transfer of participants with small balances—roughly a benefit of less than $500 a month—has been popular because of tangible positive NPVs from saving per-participant PBC fees (now $86 annually).

- Voluntary lump sum offers to retirees or terminated-vested participants can be more economical than insurance company risk transfer because participants don’t get additional premium for a required return on equity.

- A lump sum offer can also provide an alternative to participants who may not want to be transferred to an insurance company. But companies need to be careful not to offer lump sums too frequently, or they may be deemed a component part of the plan requiring regular offers.