The pandemic and rapid recovery underscore the benefits of more frequent forecasts by FP&A, but transitions can be messy.

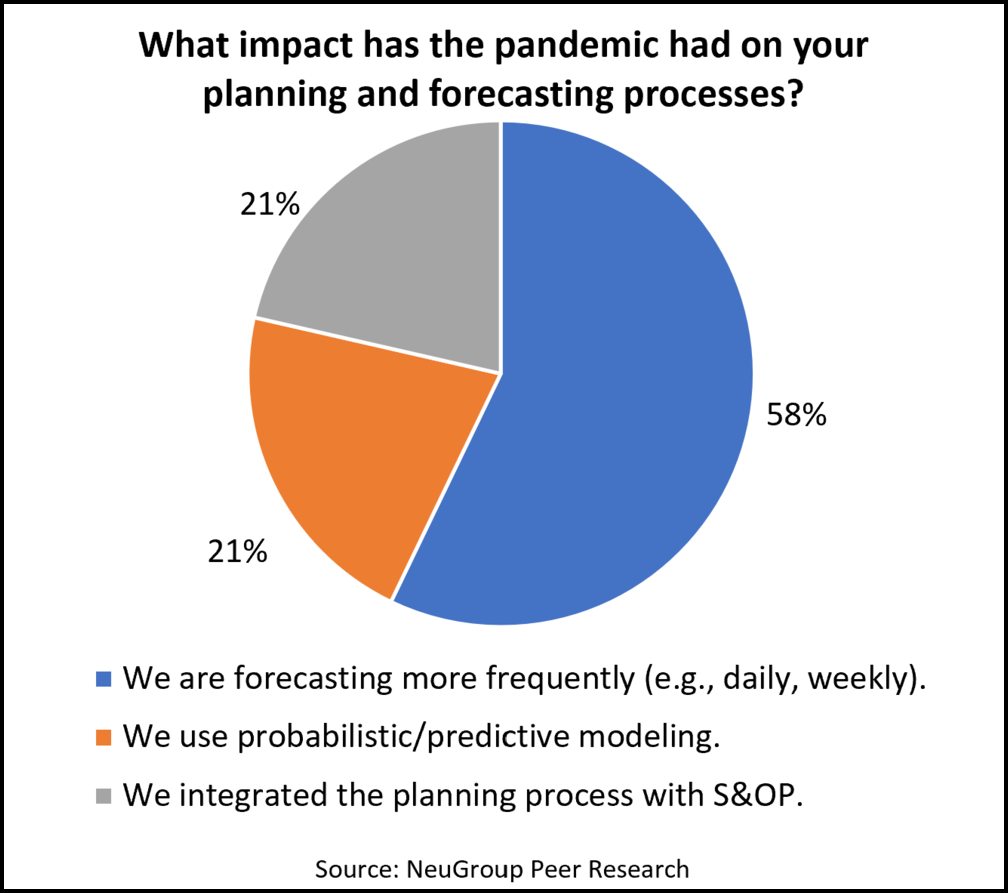

At a recent NeuGroup meeting for heads of FP&A teams co-sponsored by fintech OneStream Software, more than half of members surveyed said they are updating their forecasts more frequently—some using rolling forecasts—a practice prompted by the pandemic and continuing because of the rapid economic rebound.

- Instead of updating the standard 12-month forecast yearly, more teams now continuously update throughout the year. Most members said they update monthly, with some doing it every other month.

Velocity, agility and accuracy. “Increased frequency of forecasting helps with accuracy and also agility,” said John O’Rourke, VP of product marketing and communications at OneStream, whose performance management platform can streamline forecasting of cash flow, sales and earnings.

- “There’s positive results in the ability to make changes to the budget. You can respond quickly to new market opportunities or potential risks to your business,” he added.

- One member shared about the impact on forecasting of a supply chain issue related to shipping products on international flights, many of which were cancelled due to the pandemic. As a result, the company has made its forecasting more agile to be ready for future potential disruptions.

- Another member shared that post-pandemic business is far exceeding the company’s initial forecast, and they appreciate the added agility that comes with frequently updated rolling forecasts.

Baby steps. Although many members see advantages in more frequent forecasts, the switch isn’t always immediate, easy or clearly worth the extra resources. OneStream research shows that 66% of finance functions have the capability to update their forecasts within one week, but only 19% use rolling forecasts on a consistent basis.

- One member, whose experience many others said mirrors their own, said her company had to start by taking baby steps. “Previously, we only forecasted anything twice a year,” she said. “And this year, we do an assessment each month, but only through the end of the fiscal year.

- “Next year, I’m expanding that so that we’re doing a rolling 12 months. People’s heads are exploding when I say that, but I think we’ll be able to get there.”

- Another member raised the issue of potentially excessive workloads. “There are a few ways that a rolling forecast could help us,” he said. “But we are not going to transition to something like that if it creates excess work.”

- Other reasons companies stick with traditional forecast and budgeting processes include the cost of automation, additional training and work for accountants and Wall Street’s focus on quarterly earnings.

OneStream’s solution. OneStream’s platform unifies multiple finance processes, like forecasting, budgeting and reporting, and includes direct integration to ERP systems and other platforms. The system includes a number of built-in capabilities to assist in analyzing, reporting and forecasting.

- One member said the platform’s ability to streamline the forecasting process enabled her company to quickly implement rolling forecasts, calling it “a tremendous time-saver.”

- “Our planning system is two models, one is budgeting, one is a 12-month rolling forecast, which the company never used to do,” the member said.

- On the budgeting side, the member uses OneStream to simplify collaboration between multiple departments. Each team “can go and model their revenues and plan at the same time.”

- “The rolling forecast is then done at a high level of detail, using the same model we use for the budget but simplified,” she said. “[The model] is then overlaid on top of the information we have from the budget.”

- “It’s greatly simplified. It only takes about two weeks and is a very, very agile system.”