Feeling pressure to cut costs, FX leaders are leveraging tools to determine which currency pairs to hedge and when.

Reducing the cost of FX hedging requires a multifaceted approach that integrates technology, data analytics and collaboration across various business functions. With the right strategy and tools, companies can mitigate risks effectively while reducing expenses in an increasingly volatile global marketplace.

- At last month’s summit meeting of NeuGroup for Foreign Exchange sponsored by Chatham Financial, FX managers emphasized the need for hedge optimization tools like ChathamDirect and AtlasFX to streamline hedging processes and improve decision-making.

- “Tech helps you get smarter and make better decisions, whether it’s reducing VaR (value at risk) or netting exposures,” Chatham Financial’s Greg Deveney said in the meeting. “Using models and having a really good grasp on data is super important.”

A new way to look at trades. One member presented how his team tackled a complicated balance sheet hedging program of nearly 80 currency pairs using the advanced analytics and dashboards available in ChathamDirect.

- Managing risk for legal entities with large amounts of activity and complicated tax structures presented significant challenges and costs. On a regular basis, the program required up to 800 separate cross-currency trades per hedging cycle.

- To streamline the approach, the member created a dollar-based view within ChathamDirect by “breaking apart” the cross-currency exposures into two sides, each one tied to the US dollar, then trading the net positions in back-to-back trades. This significantly reduced the number of street-facing trades necessary to hedge the same amount of risk; and it took more obscure (and expensive) trades like Russian ruble/Danish krone or Turkish lira/Hungarian forint out of the equation.

- After trades are completed, the system “folds” them back into their respective cross-currency pairs and pushes the internal back-to-back trade details down to the business unit for settlement and accounting. This has evolved into an automatic process that pushes hundreds of trades efficiently to the appropriate entities.

- Implementation of this streamlined strategy has led to a 40% reduction in trade volume for the corporate, cutting approximately $400 million in notional trading amounts each month and yielding significant savings in time, resources and execution costs.

Finding the point of diminishing returns. In the same session, one member whose company has 200 legal entities and hedges 30 currencies shared insight into his FX strategy, aided by internally built dashboards that connect to AtlasFX and Goldman Sachs’ Capital Markets Atlas tool.

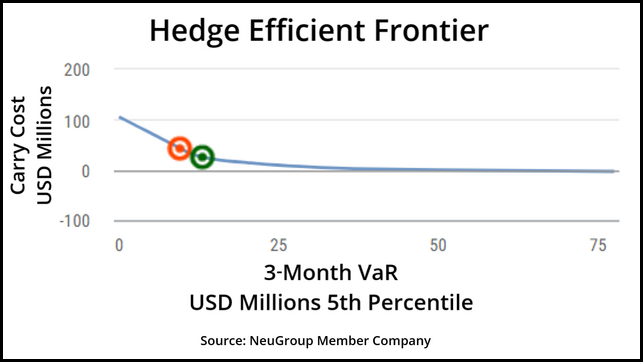

- These dashboards allow the team to experiment with different hypothetical hedging instruments or ratios for multiple currencies, and plot those on an efficient frontier that compares the cost of carry to VaR.

- Cost of carry reflects a hedging cost for the corporate, and is derived from the difference of the forward and spot rates, represented as a percentage of the spot rate. The cost of carry can be either positive or negative and is a function of two factors: interest rate differential between the currencies, and cross-currency basis (the difference in the cost of borrowing one currency versus another).

- For example, in the chart below, the two dots represent different strategies for hedging the company’s currency exposures: the strategy represented by the orange dot features higher hedging ratios, including a hedge of a small percentage of the company’s Argentine peso exposure. The green dot represents a strategy with slightly lower hedging ratios, but hedges none of the company’s ARS exposure.

While there is less unhedged VaR with the orange strategy, it is also noticeably higher on the cost side as well. This scenario analysis allows the FX team in treasury to choose the most cost-effective manner of hedging various exposures, and decide which currencies—like ARS—the company prefers to leave unhedged.

- “What’s really proving to be the cutting edge is knowing how much risk reduction is actually added for adding a currency pair,” Mr. Deveney said in response to the member’s presentation. “How can you reduce that risk, and how can you minimize cost in light of your risk profile? You have to have the tech that makes decision-making seamless.”

Following the session, NeuGroup peer group leader Julie Zawacki-Lucci said both members are blazing trails for FX best practices. “If you have large exposures to emerging markets and high cost of carry currencies, it’s well worth the cost in tools to help determine hedge execution optimization,” she said. “You can’t reduce the cost of hedging without the proper analytical tools.”