For treasurers at acquisitive mid-cap companies with limited cash, short maturities and liquidity are critical.

The size of a company and how much cash it has on hand play key roles in shaping corporate investment policies, with the breadth of investment options in a policy closely correlated with the amount of cash—i.e., the more cash, the more options.

- That takeaway emerged at a late fall meeting of NeuGroup for Mid-cap Treasurers during a session on investment policies featuring a presentation by a treasurer who had previously worked at cash-rich Fortune 500 company and recently moved to a smaller firm in a different industry.

Conservative investments. Answers to three poll questions asked during the session indicated that mid-cap companies generally follow a conservative investment path:

- Only 18% said their companies invest in riskier corporate bonds.

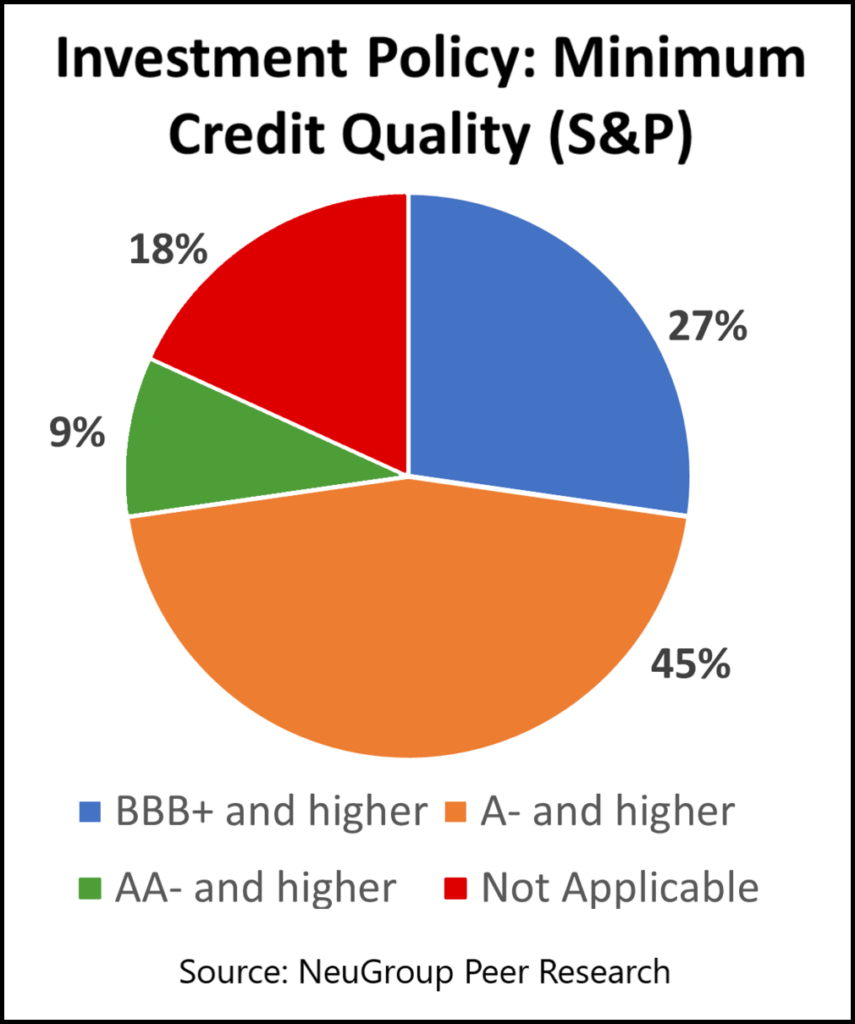

- A 54% majority invest in bonds rated A- or higher (see chart), with 27% investing in paper rated BBB+ or higher, and none in BBB or below.

- Most respondents, 55%, invest in debt with maturities of two years or less, 27% between two and five years, and none over five years.

Dry powder. The members’ conservative investment approach likely reflects mid-cap companies having less cash to invest and needing to keep that cash very liquid.

- One member had previously worked at a technology giant, putting its tens of billions of dollars in cash to work in investments around the world, with maturities up to five years, while hedging those exposures. It’s different at the mid-cap employer he works for now.

- “In my current role, my goal is to keep the cash liquid as a dry powder, so we do not go out more than 90 days” in the event M&A opportunities emerge, he said. Targets may be private companies “and those transactions can close quite quickly.”

Arm’s length. The session leader noted her company’s “authorization matrix” which outlines when the treasurer and CFO must approach the board for approval on investment decisions, and the need to update it because now, “We have to run to the board for many things that weren’t necessary in my old company.”

- As a company grows, those authorizations need to be expanded, she said, so treasurers have more decision-making power.

- A peer said his company’s investment policy is approved annually by the audit committee, eliminating the need to inform the board unless investments fall outside the policy’s parameters.

- Another member whose committee meets quarterly and sends the report and minutes to the board or audit committee for review, suggested that when the session leader adds headcount, she may want to form an internal investment committee.

- Another member uses an asset manager to choose individual bonds that meet the criteria of the company’s policy, which also details concentration limits, minimum qualifications and other factors. “We use Clearwater Analytics to give a top-down review on whether the manager is in compliance or not,” he said.

Portfolio monitoring and construction. The session leader said she reviews the portfolio monthly with the CFO and recommends opportunities to liquidate certain positions, especially corporate bonds. Tactical asset allocation is a quarterly exercise, and treasury annually considers the portfolio’s long-term asset allocation on an annual basis as a part of budget decisions. The firm’s cash portfolio is divided into three parts:

- Overnight bank deposits are designated primarily to cover payroll and day-to-day expenses.

- A “reserve” layer comprises bank-brokered corporate and municipal bonds that are held to maturity. This reserve bolsters returns somewhat and is aligned to one- and two-year corporate projects in the pipeline.

- A third stage is less liquid corporate bonds that provide higher returns over the next three to four years. “You’ve got a well laid out process,” commented a peer.