Editor’s note: NeuGroup’s online communities provide members a forum to pose questions and give answers. Talking Shop shares valuable insights from these exchanges, anonymously. Send us your responses: [email protected].

Context: For some corporates, the transition from the London interbank offered rate (Libor) to risk-free reference rates—such as the Secured Overnight Financing Rate (SOFR)—included the decision to adopt so-called fallback language in existing derivative contracts covered by the International Swaps and Derivatives Association (ISDA).

- During the yearslong process, ISDA created the IBOR Fallbacks Supplement to define how legacy Libor derivative contracts would transition to SOFR.

- ISDA in 2019 announced the selection of Bloomberg Index Services Limited (BISL) to calculate and publish adjustments related to fallbacks. Bloomberg today provides the term and spread adjustments for the fallbacks.

- While publication of Libor ceased in June 2023, the move away from it remains relevant for many corporates, including the member who asked the question below.

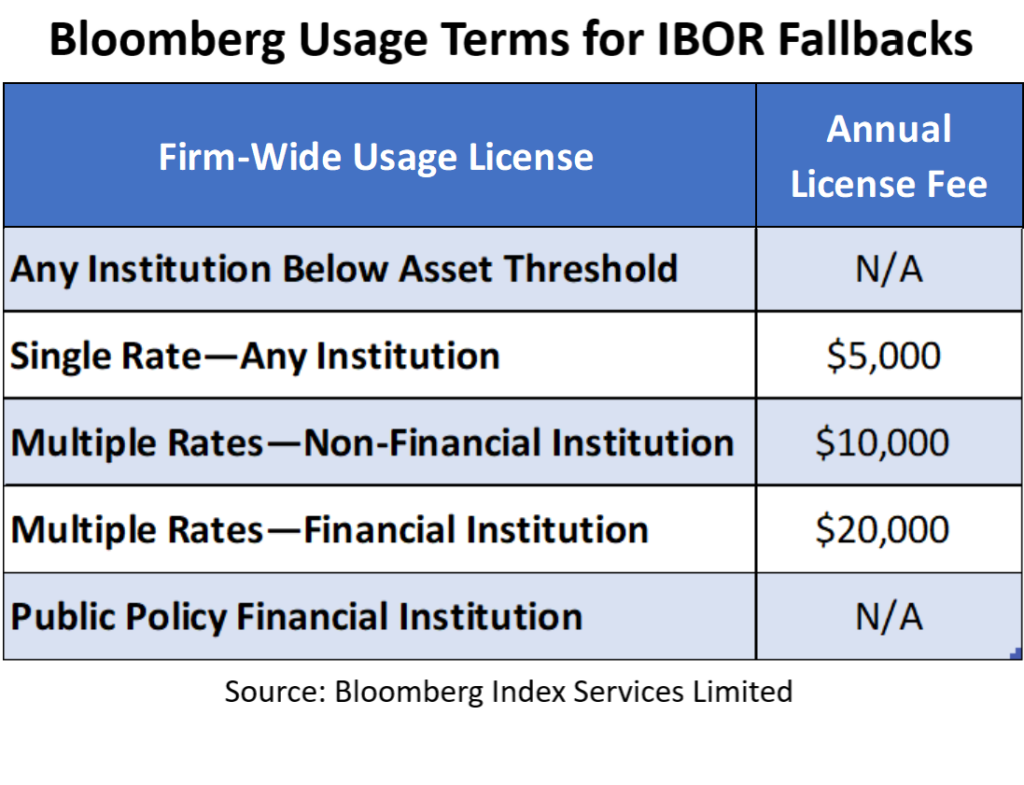

Member question: “Has anyone else been approached by Bloomberg about a $5,000 fee for using the Libor fallback rates? We let our interest rate swaps fall back using the ISDA IBOR Protocol and now Bloomberg says we owe $5,000 a year, even though we never signed an agreement with them. They say they have the right to charge us because they signed an exclusive agreement with ISDA to calculate the Libor fallback rates.”

Peer answer 1: “Yes. We begrudgingly went through this with Bloomberg. Painful, but no way around it if you want access to the fallback rate.”

Peer answer 2: “That is my understanding. When they carved up the post-Libor index revenue, Bloomberg got ISDA fallback, Refinitiv got the SOFR adjusted and ICE got the SOFR swap. We did sign an agreement to access/use the rate from Bloomberg and pricing is consistent with what you note.”

Peer answer 3: “No. We fell back to one-month term SOFR, which is published by CME Group.”

Sources tell NeuGroup Insights that some corporate clients have asked Bloomberg if they owe fees for the use of the fallback rates. In other cases, the sources say, Bloomberg has raised the issue during conversations with clients about other subjects.

- Asked to comment on the issue of fees, a Bloomberg spokesperson said, “Bloomberg serves as the fallback adjustment vendor for ISDA, which means we build, distribute and commercialize the IBOR fallback in conjunction with ISDA. The publicly available fee schedule is a standard way that the industry charges for the use of reference rates such as the ISDA IBOR fallback rates.”

Here are the fees listed on Bloomberg’s usage terms sheet for IBOR fallbacks. Users with financial assets of less than $5 billion are not subject to the fee.