MUFG presents a working capital road map for technology companies at NeuGroup’s AsiaTech20 pilot meeting.

At the inaugural meeting of NeuGroup’s AsiaTech20 Treasurers’ Peer Group, sponsor MUFG led a session titled “Optimizing Working Capital (in Uncertain Times)” and participants discussed challenges including how to get vendors to extend payment terms, the need for efficient collections processes and developing KPIs around working capital.

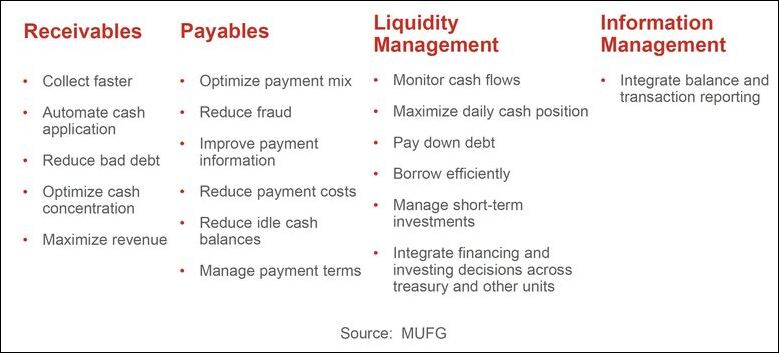

Working capital cycle. MUFG’s presentation identified four areas, and goals for each, in the working capital cycle.

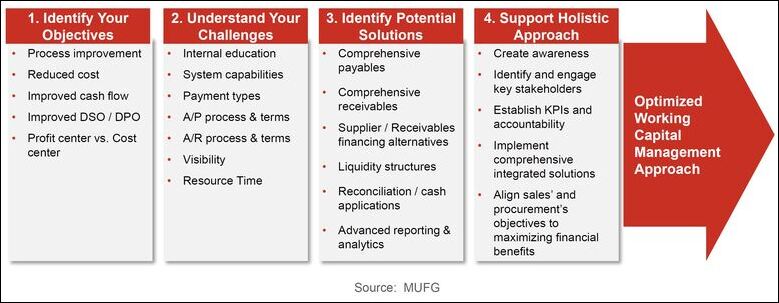

Big Picture. The presentation also set down a path for companies starting on the path to optimizing their working capital management programs. It requires:

Senior attention.

- Working capital improvement is an ongoing process led by the most senior stakeholders within the company.

- Holistic organizational transformation requires close cross-functional coordination.

- Change in culture and organizational buy-in by all stakeholders is necessary.

Organizational change management.

- Buy-in is needed across various departments, including treasury, sales and procurement teams.

- Working capital solutions require a deep understanding of systems and processes supporting the company, legal contracts and payment terms affecting working capital, and financial tools used to improve and gain efficiency.

Steps. Here are four steps to take on the path to an optimized working capital management approach, according to MUFG:

Observations from North America. MUFG’s presentation said that over the course of 2020, “companies have seen substantially higher amounts tied up in working capital. Furthermore, several key working capital metrics deteriorated during the year.” In addition:

Pricing pressure.

- With liquidity scarce and credit concerns, we have seen significant repricing movement across the broader market.

- Pricing levels have varied from program to program with new pricing around 25 to 50 basis points higher.

- The industry segments hit hardest by Covid-19 faced the most pressure with significant premiums needed to maintain funding.

Term or tenor extension.

- Buyers are delaying payments and/or forcing extension of terms to preserve cash.

- Terms continue to get extended with 90- to 120-day terms becoming more common and customers absorbing higher product costs from suppliers in exchange. In some cases, terms have approached 360 days

Usage and volume.

- Seller-led programs have had growth in usage over LTM due to longer tenors while volume has decreased.

- Buyer-led (payable) programs have had an increase in usage as volumes have increased as suppliers are looking for more liquidity.