Dollar-linked investments are one way multinationals are preparing for a possible devaluation of the Argentine peso.

Multinational corporations closely watching Argentina’s primary elections on Aug. 13 for a preview of the general presidential election in October face significant uncertainty about the magnitude and timing of a possible devaluation of the Argentine peso. Many are seeking ways to hedge their exposure to the currency as they struggle to get trapped cash out of a country with capital controls, spiraling inflation, taxes on imports and a scarcity of US dollars.

- “The big question mark in the market these days is what is going to happen with the official FX rate after the election,” said Alejandro Haro, CEO of Comafi Bursatil, the brokerage arm of Banco Comafi, which sponsored a recent meeting of NeuGroup for Latin American Treasury held in Buenos Aires. “We think there is a 100% probability of having a sharp movement in the official FX rate in the next year.”

- At the official exchange rate, the peso recently traded at about 280 per US dollar; the unofficial “blue-chip swap” rate that is less favorable for corporates sitting on pesos was about 590. The more than 100% gap between the rates is just one sign of the fear of devaluation and further depreciation.

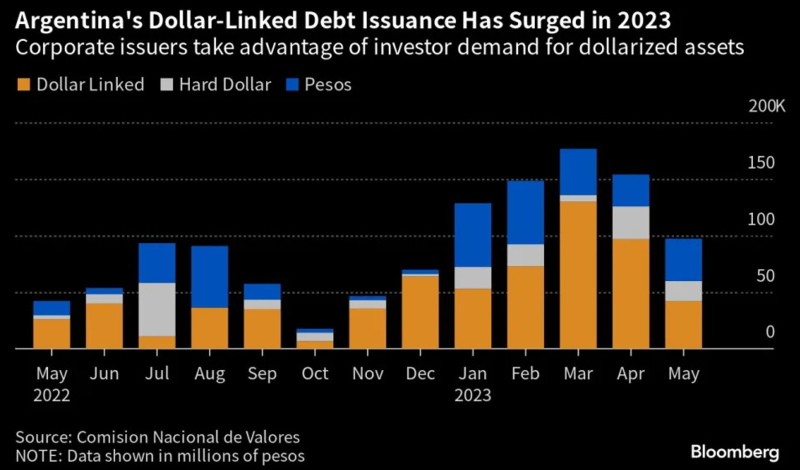

Dollar-linked investments. That outlook is driving more corporates to seek hedges through buying notes and bonds in Argentina’s relatively small debt capital markets. The yields earned on dollar-linked debt help offset the loss in value of a corporate’s cash amid local currency depreciation.

- “We are seeing huge demand these days from our corporate clients on dollar-linked instruments that are linked to the official FX rate, not the blue-chip swap rate,” Mr. Haro said. “It’s a small market but you can use it to invest some of your pesos.”

- Comafi Bursatil believes dollar-linked, intermediate investments are attractive, he added, noting that shorter-duration instruments have negative yields. Mr. Haro mentioned a 90-day promissory note recently issued by an Argentine company yielding about minus 12%. “We think that is a very good alterative if you want to be hedged through the elections.” He also cited a local issuer rated AA+ that sold two-year, dollar-linked notes with a yield of minus 9%.

- During the surge in demand for hedging in Argentina over the last two years, Mr. Haro said, issuers have continued to issue bonds at a 0% rate, but with some now “pushing tenors” to five years, a rarity in the country.

- As Bloomberg recently noted (see chart below), Argentine companies in industries including energy and telecom have taken advantage of demand by investors for dollar-linked assets, using the opportunity to issue low-rate debt to refinance or raise new capital.

Putting cash to work. One company that presented at the meeting that is committed to putting local cash to work listed several actions for doing that, including investing in dollar-linked securities issued by the government that are held to maturity.

- But the deteriorating economic situation in Argentina means “it’s been hard now to find alternatives to use all the cash,” the member said.

- The corporate is also analyzing making dollar-linked loans to third parties as another way to deploy cash that offers a hedge against depreciation.

The China factor. Adding complexity and perhaps opportunity to the calculus facing companies managing risk is the economic role China is playing in Argentina. In addition to investments in Argentina, China is strengthening economic ties through a currency swap line the South American country has tapped to avoid defaulting on IMF loans.

- Some corporates are discussing with advisors the possibility of converting pesos to Chinese RMB and then into dollars. “Now that there’s a deal with China, do we have to maybe go through China to get money out?” one member asked.

- The inquiring member had previously been converting pesos to dollars using the official rate. But those transactions have not been approved in many months, leading to the decision to try to access the blue-chip swap rate. To do that, a corporate must show it hasn’t accessed the official market in 180 days, and then won’t be able to access it for 180 days following use of the blue-chip swap rate.

- Doing what the member proposed would also require regulatory approval to invoice in Chinese currency. But all other things being equal, Mr. Haro said, “I think to get a payment abroad in Chinese currency will be of much higher probability than to get it in USD. So if that is something you can do, I think that is a good idea.”