Automating trade operations lets treasury focus on strategy and understanding economic drivers of FX exposures.

“Automate the operations, unlock the strategy.” That concise phrase encapsulates the transformational and holistic approach to consolidating and managing data, including exposures, at high velocity within the FX trade life cycle adopted by one NeuGroup member company. And the phrase served as a subheading for a presentation made by a manager in the company’s global treasury FX risk management group at the fall meeting of NeuGroup for Foreign Exchange 1.

- “It has been a tremendous help to automate it,” the member said of the FX trading process. “Because most of our operations are automated, we can focus on strategy, understanding the current macroeconomic environment, and managing the P&L.”

Exposure forecast model (EFM). The risk management team has an exposure forecast model designed by two full-time software developers that makes use of IBM’s Planning Analytics system (TM1/PA) to transform its “global supply chain data and business planning infrastructure into a foreign currency perspective so that the global treasury team can manage the consolidated FX risk” for the corporation, according to the member’s presentation.

- The EFM consists of three parts shown in the presentation: input, analysis and output. The output phase consists of:

- Sourcing exposures

- Trading company exposures

- Inventory exposures

- The data is then migrated into the company’s hedge position model (HPM) in the IBM system.

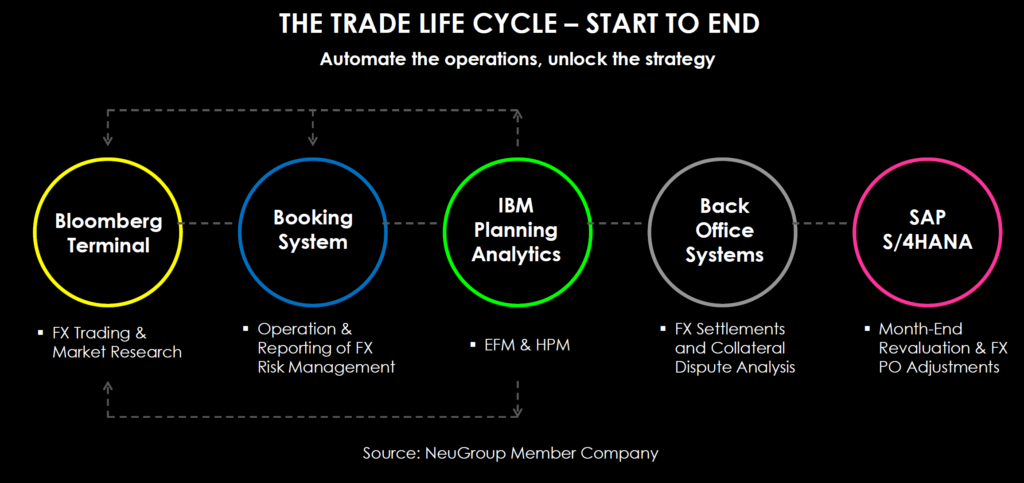

The trade life cycle. As the infographic below shows, there is a purposeful, circular relationship between the EFM, HPM, booking system, and live market data. For this example, the company executes new trades using the Bloomberg Terminal and those trades are automatically processed and confirmed by the trade booking software system. The company’s back office manages FX settlements and collateral issues before the trades are entered into SAP S/4HANA.

- During the session, the member demonstrated end-to-end, real, live FX trades, using the company’s connected systems.

Less time, more value. In a follow-up interview, the member outlined the benefits of the system. “We have drastically minimized non-value-added work across the global FX team. Things such as (1) exposure consolidation; (2) designating a trade against an exposure; (3) auto-NDF fixing with counterparties; (4) confirming, matching, and settling of FX trades (~80% automated by total outstanding notional volume in USD equivalent); (5) tax reporting on financial derivatives; (6) and lastly, minimizing the amount of manual errors,” he said.

- “Don’t get me wrong—these steps are critically important, but it has been a tremendous help to automate it, allowing us to focus more on managing the P&L.”

- He said the biggest benefit is that the “automated systems enable us to ‘compete’ an order filled with multiple counterparties. So instead of negotiating an unfavorable price with a single bank, we deploy the order (privately) to various banks, ‘competing’ the second, more profitable component of the FX deal, the forward points.

- “The best part is that while the banks are competing against each other, it gives us time to analyze their bids or offers relative to the indicative price. That way, we know exactly how much they are profiting off the deal and, more importantly, how much we saved by competitively dealing away the second part of the order. This could have taken hours of negotiation in the past, but now it takes only a few minutes.”

Deeper dive. The member’s team trades the FX forward components separately: spot rate first, then the forward points. “Some corporates leave orders with a bank to take advantage of market spot volatility (we do this). When a bank fulfills a spot order, we can roll the done spot deal into forwards with that specific bank or compete it with multiple banks,” he said.

- “Essentially, the bank has won the spot component of the deal, but they must be competitive to win the rest (the forward points). Automation has helped make these conversations/negotiations easier because we can bid forward points to any bank in our credit facility,” he added.

- “Spot risk has been neutralized via the order fill. The mechanics before automation were messy, but now it’s simplified, expedited and straightforward.”

Words to the wise. “When implementing this across our global FX team, we were careful to automate specific processes in our operations with intentional human intervention,” the member said. “For example, the hedge designation process can only be kicked off when each trade is confirmed and matched. After our back-office reviews this step, our system will retrieve that input and automatically run the hedge designation process.

- “Not only does this allow our automated operational flows to comply with the requirements of our audit and controlling groups, it also ensures that each trade fulfills the intended risk management strategy,” he added.

- “As financial risk managers, we aim to minimize FX volatility and protect the P&L,” he said. “Still, we must also identify efficient processes and streamline our systems to support our key objective. Additionally, we must ensure our software developers understand what needs to be done for a successful program. Without their help and continued support, none of this would be possible.”