Balancing act: FP&A must balance a faster budget cycle with business unit accountability and effective targets.

Agility is about keeping up with and adjusting to the rapid pace of change in market and business conditions. This flexibility often runs counter to FP&A’s deliberate, typically granular, budget-setting process. At a recent session on agility in annual planning, members of NeuGroup for Heads of FP&A discussed how to balance the need for speed with setting effective performance targets and ensuring business unit-level accountability.

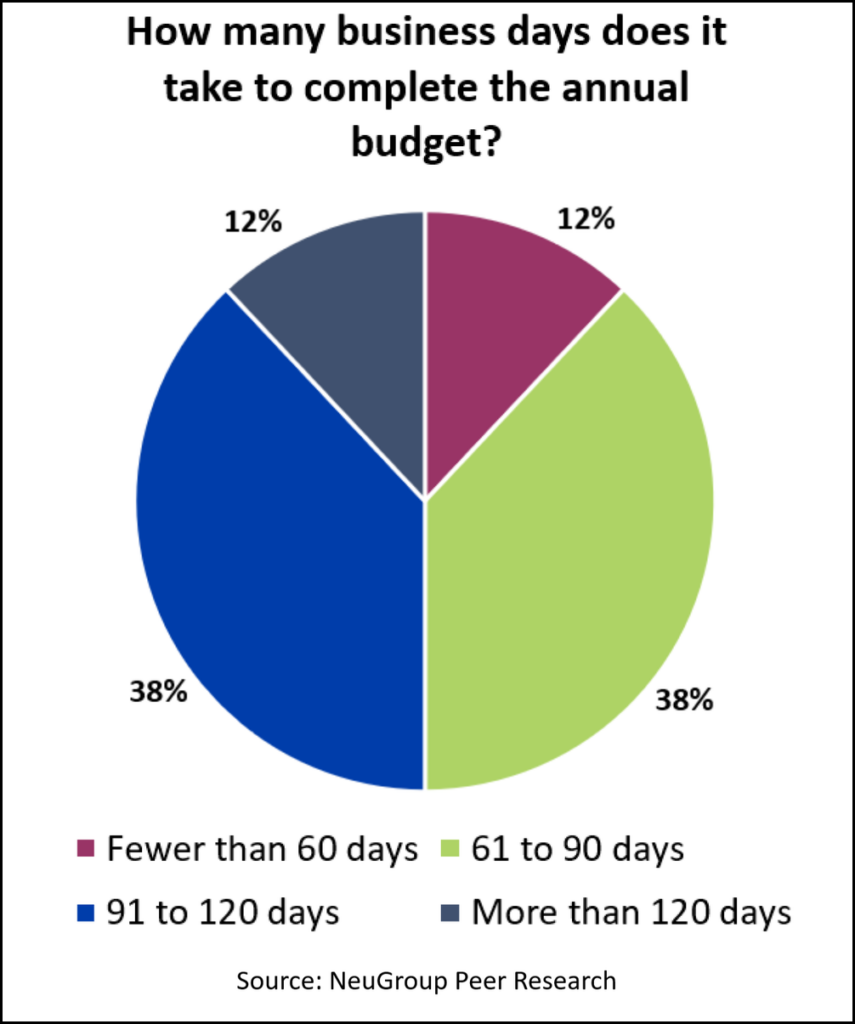

Keeping speed in perspective. A shorter budget cycle can enhance agility because it allows FP&A to better capture changes in business conditions and saves time on having to go back and recalibrate numbers before finalizing the plan. An in-session poll showed that 38% of participants complete the budget in 60 to 90 days; a similar percentage have a 90- to 120-day cycle (see chart below).

- However, a shorter cycle time is not always an indication of excellence in efficiency. “I think producing the budget in 60 days may be a false outlier because it is reflective of a less rigorous approach to a very complex issue,” said the member with the shortest cycle time. “In many cases, corporate does not understand the story.”

- FP&A is working on improving the budgeting approach. “There would be more data analytics involved and more strategic discussions,” the member said. “And yes, that will result in a longer cycle time but a more effective process.”

A broader alignment. A slower cycle can also reflect the breadth of the planning process. “For us, annual planning is highly integrated, which requires a lot of sequential steps,” another member shared. This introduces greater complexity to the process because it involves more stakeholders. “By the time you get to the end, there’s a likelihood of having to make some changes that may require a catch-up, but only in very rare cases,” he stressed.

- Said another member: “Our process is a trade-off between granularity and top-down.” That is especially challenging because of the company’s exposure to volatility in commodity prices. This FP&A leader appointed a staff member to focus on fixing the ongoing challenge of chasing commodity prices.

- Finding the right balance between business unit/bottom-up input and faster top-down approaches is hard, in large part because absent local involvement, business leaders do not embrace the plan as their own and may have less accountability.

- One member is aiming to run long-range planning and the financial and operational plans in tandem. “We want to do both from October to December,” he said. “The initial focus is on the LRP and then cascade it down to the annual plans to avoid redundancies.” The plan is “blessed” in December and locked in. “There is no broad refresh except for FX rates.”

Roll it forward. Another member is enhancing agility by relying on a rolling forecast to seed the budget for the next fiscal year.

- “We have a rolling 18-month forecast horizon that we update every quarter, which informs the trend for the year ahead,” the member said. “So next year’s plan is the next four rolling forecasts. Target-setting begins midyear when the next fiscal year forecasts are available. The result is a lot less time spent on a parallel budgeting process as well as avoiding the fire drill toward the end of the planning season.”

- At first, he admits, “the business leaders thought it was just another FP&A Excel exercise. But as it came closer to the end of the year, they started taking it a lot more seriously. This was the first year we did this, and it was quite successful.”

The metrics that matter. Seventy-five percent of the members polled reported they use driver-based planning to cut through the noise in the data, which saves time and produces a more meaningful outcome. The challenge is identifying the metrics that truly move the needle on business performance.

- “We used to boil the ocean for data; we loved to know the details,” one member said. However, this company has done extensive historical and statistical analysis to narrow down the list of factors that drive the business from over 100 to just two. “We now tell the story about the plan around those two. Ultimately, there were just a couple drivers per unit, which boiled down to volume and revenue.”

- Among members who use driver-based planning, the number of drivers varied from two to 12. However, the company with 12 drivers is working on narrowing the list.

- A fully top-down approach carries the risk of reducing business leaders’ accountability, so most are using a hybrid. However, with the right level of education, changes to performance evaluation metrics and senior-management messaging, members have managed to create a consistent message around a smaller set of key drivers.

- This was not an easy process at one company. “It took us five years of trying to be culturally ready for it,” said the FP&A leader. Several factors helped bring the business leaders on board. First, they needed help in figuring out how to prepare for upcoming levels of extreme volatility in market conditions. Second, the leaders had a voice in determining what the key drivers would be. Finally, “the CEO recognized that this is an important effort.”

Guiding the business. Ultimately, while the plan sets targets for compensation, “we really use the forecast to guide the business,” one member said. “We can make changes to specific business targets due to events outside their control, e.g., a fire shuts down a plant.”