Danone North America took an overly manual process, added artificial intelligence, and now gets close to 100% accuracy.

Cash collection during the pandemic has been a big issue for corporates, with many facing uncertainty and lower cash flows. That’s why cash forecasting, and one of its main components, receivables calculations, have become more important than ever. And it’s also why more companies are turning to automation and artificial intelligence (AI) to improve the accuracy of those forecasts.

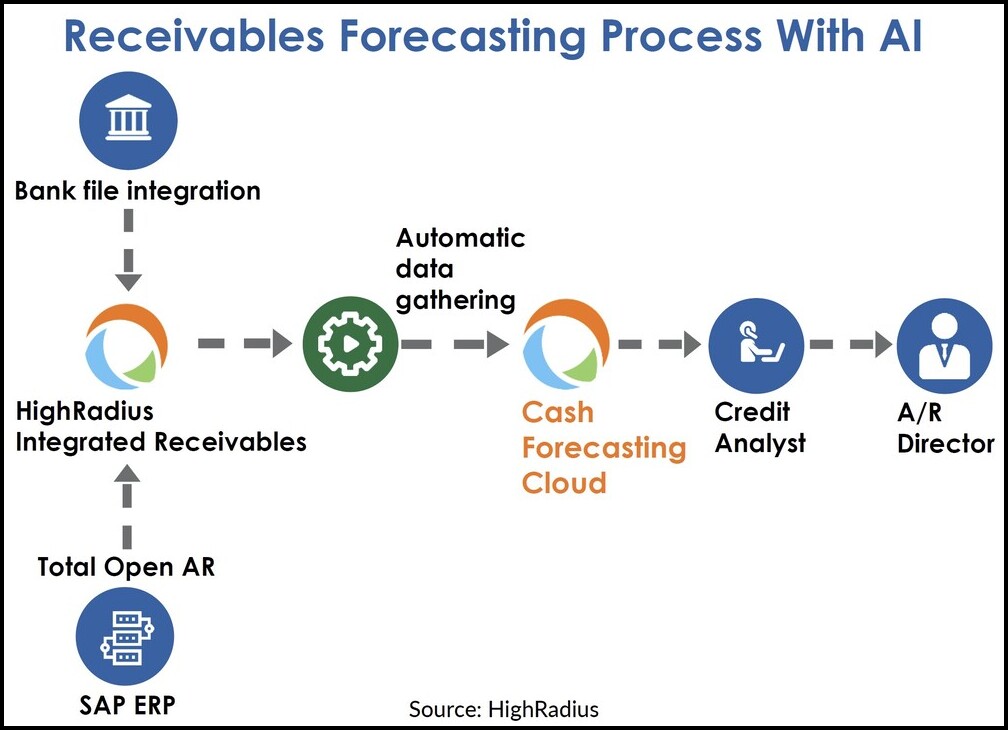

Fewer lumps and errors. At a recent NeuGroup meeting sponsored by cloud-based autonomous software company HighRadius, Jacob Whetstone, director of invoice to cash for Danone North America, described his company’s journey from a labor-intensive collection forecasting process to a more accurate, automated approach (see graphic).

- After years of tracking lumpy and error-prone payments from customers, it improved its accounts receivables forecasting to 96% accuracy.

- “It was a very manual process,” Mr. Whetstone said about the previous AR process. “Sometimes it looked like were accurate, but a lot of the time we were really off.”

- One issue that contributed to inaccuracy was that it was so time-consuming that the company only forecasted AR twice a year. “June and December,” Mr. Whetstone said, “and not much more than that.”

Putting the focus where it belongs. Savvy companies for years have realized there is cash to be had in some formerly untapped areas and processes and have been slowly incorporating them into their working capital management programs.

- Nonetheless, companies still are sitting on billions of cash, according to research by The Hackett Group, which calculated companies “were sitting on $1.3 trillion in unused working capital at the end of 2019, including nearly $4 billion” in AR.

- But instead of collecting that cash, companies are often bogged down collecting the data and doing calculations manually. Mr. Whetstone said this was true at his company. “We spent all this time pulling data together” instead of working with customers to get paid sooner. “We were spending too much time on non-value add activities.”

Too many variables. One of the issues of trying to accurately predict payments from customers is that there are too many variables to figure out.

- For instance, one transaction can have more than 60 invoice and customer-level variables to contend with, like invoice dates, customer-specific days payable, and invoice amounts among others. Accounting for all these in a spreadsheet would be nearly impossible or at least take a very long time.

Success through streamlining. After partnering with HighRadius and its AI-based automated cloud cash forecasting tool, the company was able to streamline the process.

- This meant it was able to take those 60-plus variables, correlate them to reduce that number to about 30, and create more than a dozen algorithms to come up with a predictable payment date. This can then be uploaded into the company’s automated cash forecasting tool.

- With the automation, Danone has more time to work on the algorithms and tweak them when necessary. And to work with the collections team in its dealings with customers. The automation also allows the company to do monthly forecasts instead of just twice a year.