An interview with Lucia Greenblatt, managing director of technology banking at MUFG, on a SAAS company’s financing journey.

The optimal capital structure for a high-growth technology company may change significantly as its business develops and its financing options increase—one reason corporates that issue convertible bonds early in their trajectory often replace them with alternatives more suited to mature businesses with investment-grade (IG) credit metrics or ratings

- That takeaway sprang from a session at a recent meeting of NeuGroup for Growth-Tech Treasurers featuring a case study of how one tech company in the SAAS sector is transforming its capital structure with the help of MUFG, sponsor of the meeting. The study included analysis of peers’ capital structures and issuance.

- “When we see a company displaying specific capital structure choices we make conclusions about their growth stage and maturity,” Lucia Greenblatt, a director of technology banking at MUFG, said.

EBITDA reality check. Earnings before interest, taxes and depreciation (EBITDA)—or the lack thereof—plays an important role in determining the financing mix available to companies. “As a proxy for operating cash flow, EBITDA is the foundation of any credit structure,” Ms. Greenblatt said.

- “A growth company, with limited EBITDA, will have to rely on instruments where EBITDA does not underpin the structure of the credit facility and availability of funds,” she added. “Converts suit this requirement.”

- The head of treasury at the member company said, “At the start, EBITDA was a limiting factor for going to different financing types like bank debt.”

Convert considerations. A few years ago, the member company, like many peers, issued convertible notes at what the head of treasury said were “attractive terms for the time.”

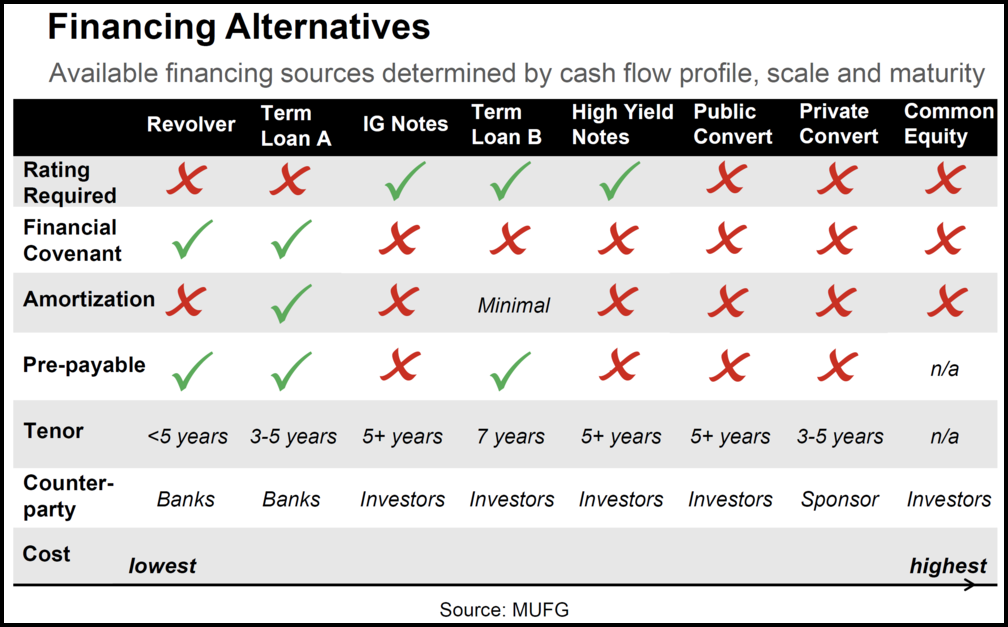

- As the MUFG table below shows, converts offer a financing alternative that does not require credit ratings or come with financial covenants, among other advantages.

- “Converts can enable a company to successfully accelerate growth via acquisitions by deferring the issuance of equity outright,” Ms. Greenblatt explained.

Peer pressure. Another reason many companies in this space go the route of convertibles: peer pressure. “Peers at similar growth and maturity stages in their life cycle exhibit similar financing choices and behavior,” Ms. Greenblatt said.

- “It’s pressure to make the same financing choice, like accessing the convertible market because it’s hot and other peers have successfully done so.”

- She added, “Conversations in the boardroom create momentum towards supporting the same financing choice that worked for the peer group.”

The dilution dilemma. Many mature IG companies avoid converts because of the dilution of the corporate’s common stock if the debt is converted to equity. That risk may not be of primary importance to younger, high-growth SAAS companies, but can take a toll later in their lives.

- “While we noted that the great majority of high-growth companies in the peer group had outstanding convertible notes in the cap structure, there was a general sentiment that management may overlook potential impact from dilution in the future,” Ms. Greenblatt said.

Looking ahead. That said, the member company stands out for its deliberate planning. “As part of our development strategy, we talked a lot about IG—which we consider ourselves close to being,” the head of treasury said.

- The company is gradually converting from converts to an IG-like financing mix comprised of a revolving credit facility to backstop liquidity, and a delayed draw term loan A to enable the company to opportunistically time repurchase or redemption windows.

- Last fall, MUFG and two other bookrunners arranged the revolver and the term loan. “The successful syndication displayed the IG market continues to have pockets of liquidity in a post-Covid-19 environment for 5-year tenors at relatively attractive pricing for well-structured facilities that are supported by sufficient ancillary business,” MUFG’s presentation stated.

- Since the transactions, “We have repurchased about half of the convertible debt,” the member said. “We’re a very different company, with more financing options available to us today.”