Over half of NeuGroup members that have implemented NFTs manage some portion of the project in-house.

Corporate uses of nonfungible tokens (NFTs) have had a roller-coaster journey over the last two years, with a boom of adoptions in 2021 that plateaued rapidly. But the tokens are far from dead—nearly a third of respondents to NeuGroup’s newest survey, Digital Assets: Current and Future Use Cases, said they’ve already issued NFTs.

- NFTs are unique digital assets similar to cryptocurrencies that can be bought and sold, built on a digital ledger known as a blockchain. But these tokens do not store any value, instead serving as a proof of ownership of digital or physical items.

- Largely, NFT implementation has been limited to digital images or videos: for example, a collectible based on a recognizable representation of a company’s brand. More innovative NFT uses include tying the token to a proof of membership, tying it to a physical good as an authenticated receipt, and creating digital media that can be used in a video game or the metaverse.

NFT implementation. In the last two years, as markets and technologies for the tokens have matured, the number of options that corporates have to issue, or “mint” NFTs, has grown significantly.

- When NFTs were first popularized, a number of NeuGroup members didn’t trust the technology enough to mint them directly or to accept the cryptocurrencies required to sell them, instead hiring third parties that assumed all responsibilities, but for a high fee.

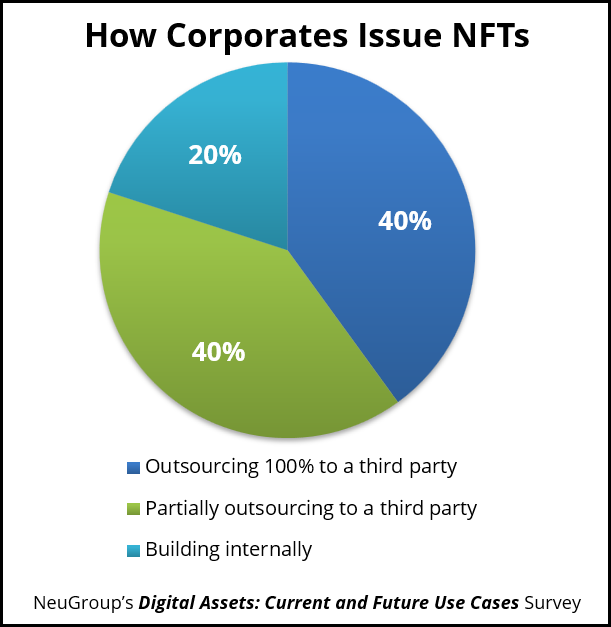

- Now, multiple members have begun minting NFTs on the Ethereum blockchain directly. Of those who are active in the NFT space, only 40% outsource their entire project to a third party (see below).

Understanding the options. When outsourcing, members pay a percentage of NFT sales or royalty payments to the third party, or they completely relinquish ownership and the sales process. The cost to outsource may be worth it if a company does a one-time mint; but for repeated mints, the costs can add up.

Building up. One member, who previously employed an advertising agency to accept cryptocurrency made from NFTs on her company’s behalf, has now set up a digital wallet through Coinbase that accepts ether directly, and converts to USD daily.

- The drawbacks to building a project internally, even partially, are the required expertise and operational know-how, which are expensive to develop or acquire. Even companies that choose to go the in-house route often rely on outside experts to outline their strategy and operational requirements.

- For some companies, another option to ramp up expertise is acquiring an NFT provider to expand product offerings and accelerate return on investment—a strategy one member has already implemented successfully.

NFT holdouts. Respondents who have so far shied away from the NFT universe listed several reasons; chief among them is the absence of relevant use cases. Other hurdles include the complexity of the required technology infrastructure, an immature marketplace, complex legal, tax and accounting issues as well as a lack of senior management backing.

- “There may be a use case for an NFT to be a store of membership to something that can be redeemed, but building that would be hard,” one member said. “You’d need the technology to support, track and monitor the NFTs, and users that will know what to do with it when they get it. There’s a bunch of barriers.”