SVB’s failure has pushed the conversation about backup cash management banks to the forefront for more companies.

Shifting business to a new cash management bank is a huge ordeal for corporate treasury teams, but concern about bank creditworthiness, triggered by the collapse of Silicon Valley Bank (SVB), is leading more treasuries to explore what’s required and how to set up a backup solution.

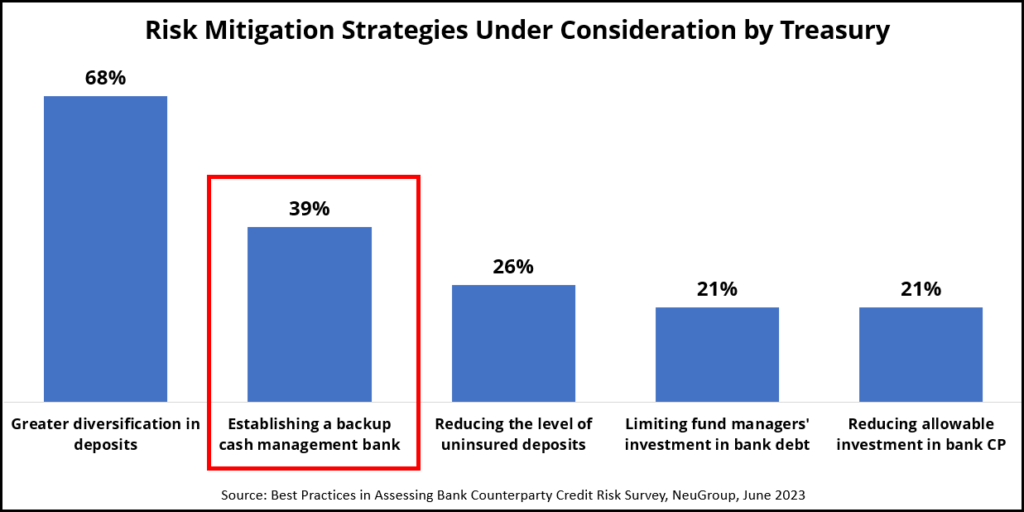

Thirty-nine percent of respondents to NeuGroup’s Best Practices in Assessing Bank Counterparty Credit Risk Survey reported they are considering establishing a backup cash management bank to mitigate operational risk in case of a bank failure or a meaningful decline in credit quality (see chart).

That’s a significant percentage because a corporate’s relationship with its cash management bank is very sticky. Switching banks is complicated and extremely time-consuming, involving the creation of a new account structure as well as transitioning pooling and sweeping arrangements.

Taking action. Despite the challenges, several NeuGroup members have already taken steps to establish this alternative solution. One member had the benefit of getting a head start: Towards the end of 2022, discussions began about how to mitigate the risk of a major relationship bank failing. “Even before SVB, we were exploring cyber and geopolitical concerns, and what we would do if our main cash management bank went down,” the member said.

- While this large multinational did not have a meaningful exposure to SVB, its collapse triggered a more urgent conversation about its preparation for a major event. “Once SVB happened, it really did gain a lot more traction in the company, and moved to the forefront for us to really evaluate the banks we transact with,” the member said. “It also generated stronger sponsorship because the CFO got personally involved.”

- The company deals with multiple major banks, so the focus was broader than just cash management. “We had conversations with each of them about how they would recover if they experienced a cyberattack.” Those initial conversations helped accelerate the process of setting up a backup provider.

A risk-based approach. The timing and extent of another SVB-like event is, of course, uncertain. So preparation requires flexibility. “We don’t know what the next crisis might be—an outage for a day or a more extended period. We focused on a setup that allowed for optionality,” the assistant treasurer at this organization said.

- The process included an evaluation of the type and volume of transactions the company has with each bank. “Then we asked: “What would it take to pivot if one went down?’” The initial focus was domestic. “All funds come into a single concentration account so we can invest more of those funds. We wanted to be able to pivot if we need this backup account,” he said.

- “We took a risk-based approach,” he added. That meant opening one account for now that does not offer full capabilities but can be quickly expanded. ”We didn’t set up everything that we do today, but to ensure we have liquidity in our structure.”

- The corporate ran tests with the single account to ensure it can make the switch quickly and that the backup can handle critical treasury transactions smoothly. “We tested our capabilities with that account by running small transactions; we tested the machine,” he said.

Communication is key. Internal and external dialogue is critical when establishing backups. “We had several calls with the bank we chose to make sure we were aligned in what our expectations were and what they wanted from us,” the member said. In addition, treasury kept in close contact with big functional areas with extensive accounts like AP and payroll that would require services right away in the event of a major problem.

- “We worked with our business partners to make sure we’re protected against disruption at every account where we do big transactions,” the member said. “We had to ensure all lines of communication are open, so we can pivot from bank to bank in times of crisis.”

Cost concerns. Some treasuries may be concerned about the additional fees associated with opening a redundant account. “We looked at the pricing and what could happen—we had to make sure it all made sense on that end,” the member said. The good news: the cost is not necessarily prohibitive.

- “Fee wise, the cost of having this additional account is very small. You only really get charged when you start moving funds into it and transacting out of it. If we decided to switch it, depending on the volume, we can further negotiate fees.”

An essential part of the playbook. While many treasuries may remain reluctant to go through the process of selecting another bank, opening new accounts and doing extensive testing, the exercise should be part of every company’s business continuity plan.

- “I think it’s a really smart move. I’d like to advocate that more corporates do it. Having that backup is a super important hedge,” the member said.

- “It is a lot of work up front, but if you think about it, we do a lot of disaster planning. This is going to go into a business continuity plan like everything else.”

- And bear in mind that this exercise should not be a one and done. “We will plan to test the arrangement annually and incorporate it into our business continuity playbook.”