A NeuGroup survey reveals trends among corporates embracing blockchain tech—and reasons others are holding back.

Members of NeuGroup for Digital Assets are among the groundbreakers for corporate use of digital currencies, blazing trails at companies including mega-cap corporates, by developing use cases for enterprise-wide projects involving a blockchain.

- NeuGroup’s newest survey, Digital Assets: Current and Future Use Cases, clearly shows rising interest in this area—as well as a growing urgency among treasuries to learn more. The survey revealed that nearly half of respondents have already executed a blockchain project. A quarter of those who are not yet in the crypto market have plans to do so in the next 12-18 months, indicating broader adoption over the coming year.

- “The best approach to coming up the learning curve is to find out how early adopters are deploying technology and using digital currencies to realize their objectives,” said NeuGroup’s Matt Thomas, who leads the group. “It ranges from supporting the business in expanding the customer base, to reducing friction in—and increasing the speed of—global liquidity management.”

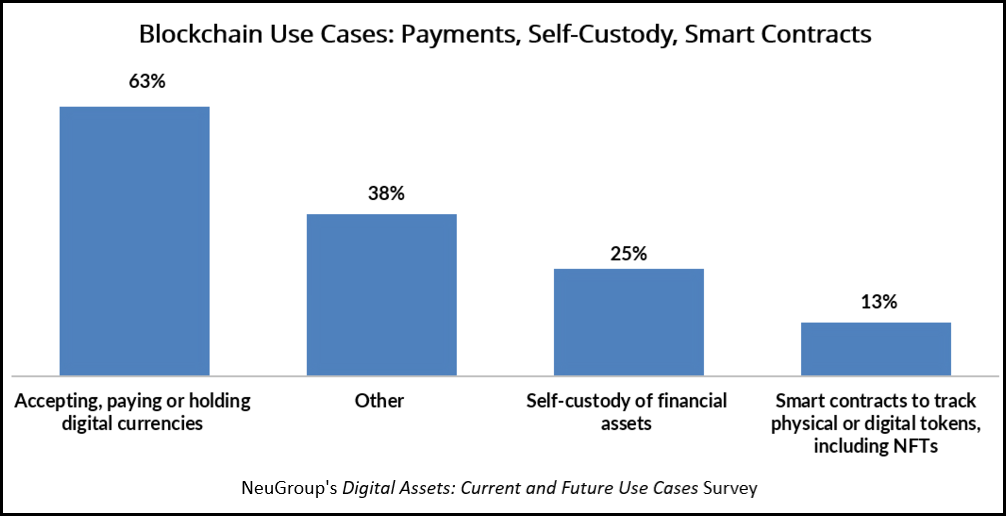

Taking the first steps. Among respondents that have launched a blockchain project, almost two thirds (63%) are accepting, paying or holding digital currencies.

- The survey shows that 37% of early adopters are holding cryptocurrencies such as ether, bitcoin and polygon for daily operational needs, with about half of those also taking direct balance sheet exposure.

- Other digital currencies in use include central banks’ digital currencies, also known as CBDCs, and fiat-based stablecoins, which can support liquidity management through cross-border payments.

Self-custody. The next most common use case, at 25%, is direct custody of digital assets, primarily because members are concerned about the steady deterioration in the creditworthiness of current counterparties. Because regulatory oversight of this new asset class is in the early stages of development, third parties have often been the providers of custodial depository accounts.

- One member at a so-called “crypto-native” company with a business model based exclusively on use of blockchain technologies said his company mostly uses self-custody, not external custodians. “Self-custody makes it a lot easier to do payments to vendors, and even invest to diversify our portfolio,” he said.

Smarter contracts. The third most common blockchain application among members is using distributed ledger technology to program an automated agreement called a smart contract. These are typically coded into the blockchain, requiring a decent amount of technological proficiency, and can be used to track NFTs or even physical goods.

- The member at the crypto-native company said he is exploring smart contracts that automatically convert a certain amount of the company’s profits to the USD-backed stablecoin USDC. Then, once a month, treasury could convert to dollars to save as cash reserves.

- One member said more established corporates may find smart contracts are nice to have, but aren’t quite ready for widespread adoption. “This is going to take a long time for old companies to embrace,” he said. “Until someone has a solution to make creating smart contracts easier, it won’t happen quickly, since you have to create your own.”

New opportunities. The “other” category in this survey question, chosen by 38% of respondents, featured a variety of other blockchain uses, including some of the applications below. Keep an eye on NeuGroup’s Peer Research page to read the full report, which dives deep into each blockchain use case, and will be released later this month.

- NFTs

- Data aggregation

- Permissioned blockchains

- Intercompany liquidity management

- On-demand funding

- Carbon credits