Treasurers are adding new ways to measure the credit risk posed by their banks, new NeuGroup Peer Research shows.

The nearly overnight demise of Silicon Valley Bank jolted many corporate treasurers into taking a hard look at what metrics to include when assessing banks’ creditworthiness. New NeuGroup Peer Research shows many treasury teams are now going beyond the obvious to evaluate their counterparty credit risk.

Missing the signs. The urgency of this review and retooling is fueled in part by the realization, in hindsight, that there were red flags indicating SVB was in deep trouble. However, credit agencies and many others failed to recognize them, in part because they were not looking at the right indicators.

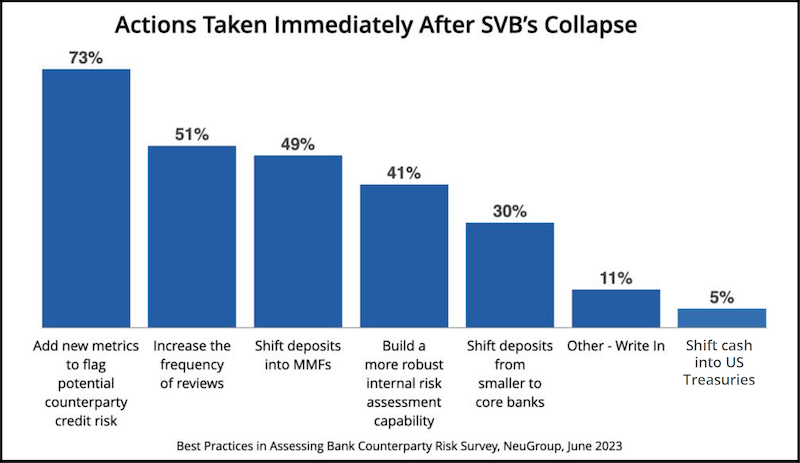

Expanding the menu of measures. NeuGroup’s Best Practices in Assessing Bank Counterparty Risk Survey shows that 73% of companies that took immediate action in the wake of the SVB debacle planned to add new metrics to their risk models (see chart below).

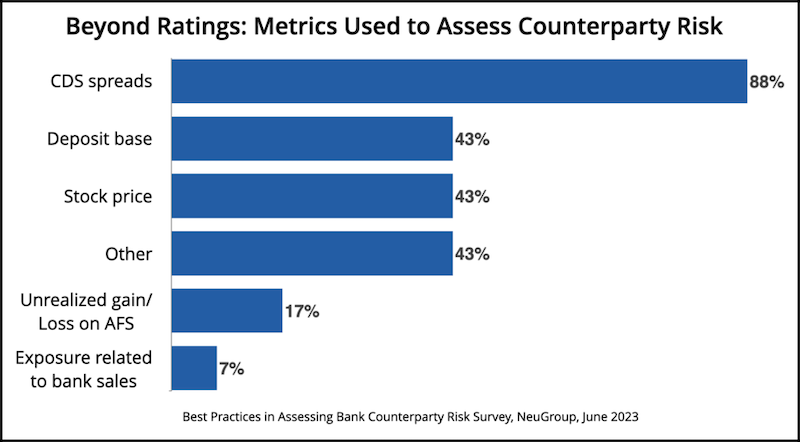

Going beyond the obvious. Many treasuries already go beyond credit ratings when evaluating their exposure to banking partners. As the chart below illustrates, the most common additional measure (88%) is tracking credit default swap (CDS) spreads, and 43% of respondents also review bank deposit bases and stock prices. Notably, an equal percentage use “other” individual metrics that are tracked by fewer respondents.

Leading indicators of counterparty risk. Those “other” measures treasury teams are already reviewing to get ahead of bank failures, as well as metrics they plan to start monitoring, are listed in the bullet points below. These fall into three categories: market, structural and balance sheet indicators. Treasuries looking to build up their risk assessment capabilities should consider tracking some of the following:

Market indicators

- 10-year bond spreads

- Changes in bond spreads

- Bloomberg default risk metrics

- Implied rating based on bond spreads, if available

- Market sentiment/news

- Stock price performance vs. bank index

- Countries of risk

- Option-adjusted spread (OAS)

- Credit valuation adjustment (CVA)

- Dollar duration (DV01)

Structural indicators

- Capital adequacy ratio

- Structural liquidity

- CAMELS rating (capital adequacy, asset quality, management, earnings, liquidity, sensitivity to market risk)

- Liquidity coverage

Balance sheet indicators

- Loan/deposit ratio

- Long term deposit coverage ratio

- HTM investments as a percentage of total asset size

- Unrealized losses/tangible equity

- Unrealized losses on HTM investments/shareholder equity

- Commercial real estate ratio

- Percentage of uninsured deposits

- Percentage change in deposits quarter-over-quarter

- Loss reserve/write-off assessment

- Unrealized losses on HTM securities

Getting ahead of rating agencies. Seventy percent of treasuries ranked the performance of rating agencies at three or below, on a scale of 1 (lowest) to 5. The biggest criticism was that they are backward looking and slow to react to changing market conditions and are thus ineffective in producing early alerts on pending liquidity crises or keeping up with evolving market conditions.

As companies build up internal capacity to assess bank risk, they also expect the agencies to do a better job going forward. Specifically, they recommend rating agencies:

- Improve the modeling of risk scenarios, particularly idiosyncratic exposures of specific institutions.

- Take a firmer stance on key measures of safety, specifically asset/liability management.

- Factor in robustness of bank risk management practices relative to industry standards.

- Be more responsive to materially changing conditions.

- Include risk on AFS/HTM in their analysis.

- Include level of uninsured deposits and deposit diversification.

- Run forward-looking scenario analysis based on insider information.

- Offer greater transparency of analysis, e.g., explaining why SVB was not downgraded.