Meeting sponsor SocGen sees corporates growing comfortable with flexible, open market buybacks amid recovery.

During the global pandemic, many corporates have slammed the breaks on share repurchase programs to save cash and avoid criticism from politicians as Americans lost jobs and some companies sought government bailouts.

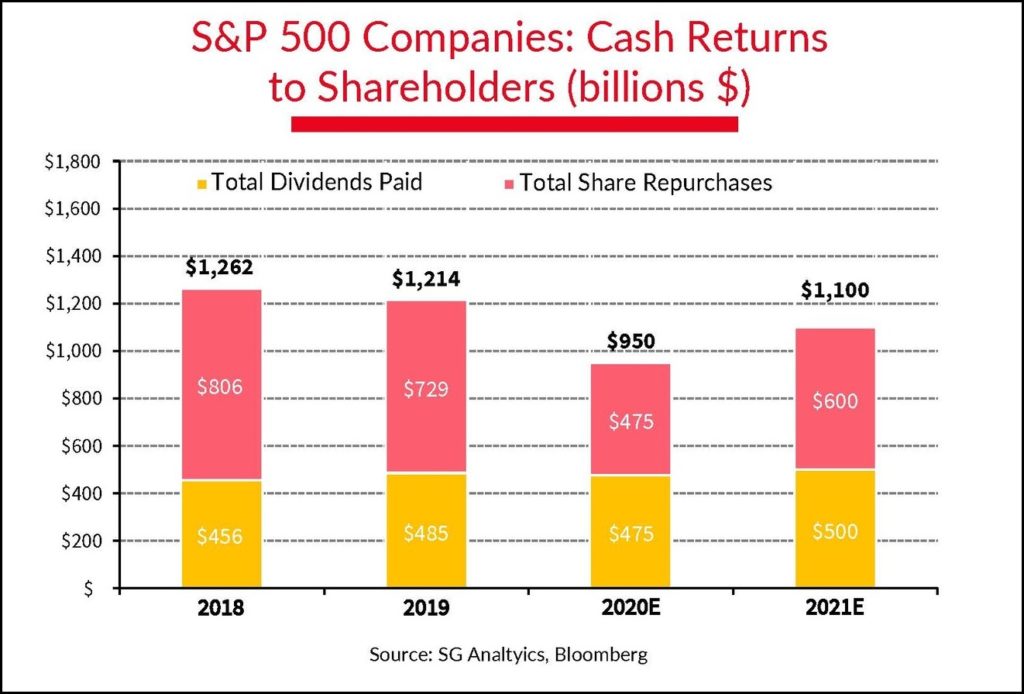

- At a recent NeuGroup meeting of treasurers at life sciences companies, Societe Generale’s David Getzler, head of equity capital markets for the Americas, forecast an increase in share buybacks in 2021 as the economy recovers and political scrutiny declines.

- “From our perspective, it looks like people are more comfortable,” Mr Getzler said. Below are his forecasts for dividends and buybacks.

Open market flexibility. Several members affirmed that their companies are buying back shares when the timing and price is right. “As long as you’re not taking government money,” said one treasurer. “We are looking at it opportunistically.”

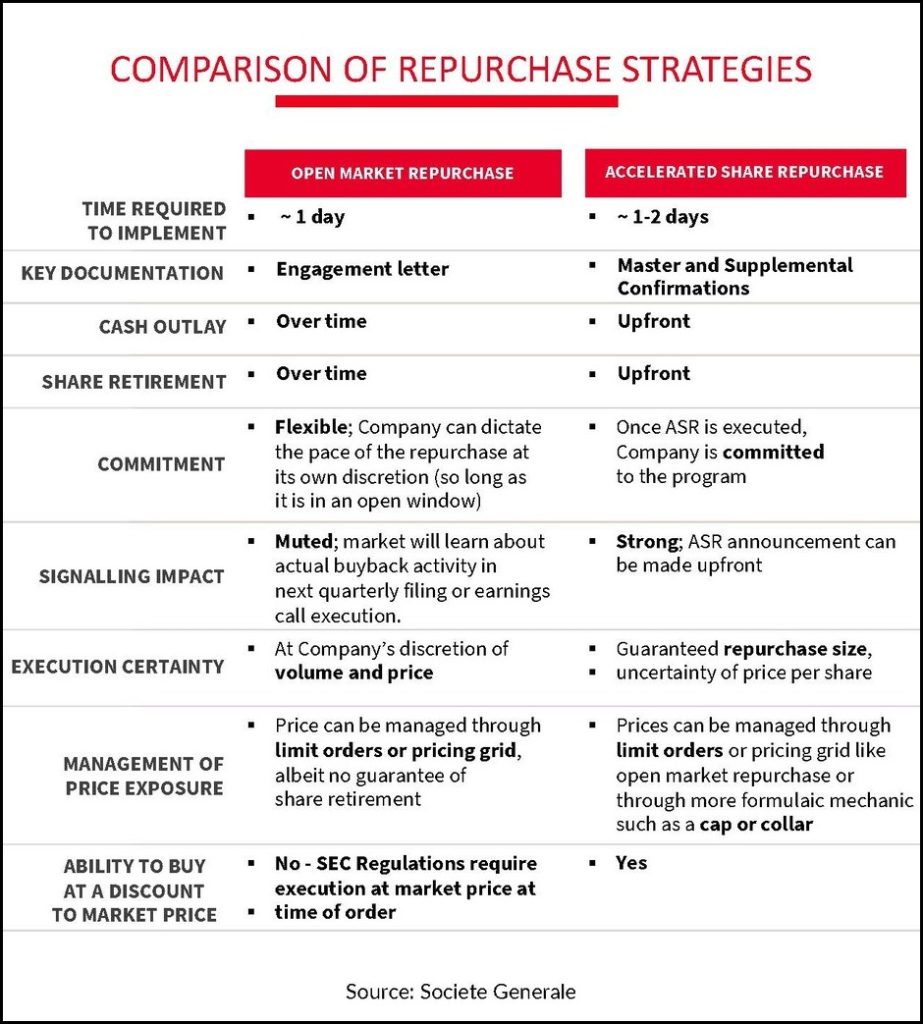

- SocGen’s Mr. Getzler expects more companies to use open market stock repurchases as opposed to accelerated share repurchase (ASR) programs.

- Volatility and continued uncertainty about the pandemic and the economy are factors explaining corporates’ preference for open market purchases, he added. “Companies want to maintain flexibility in case the economy retreats.”

Open market vs ASR. In an open market purchase, a company buys its shares at the going rate. With an ASR, a company can transfer the risk of buying back stock to an investment bank.

- “The banks give a guaranteed discount to VWAP over the period, typically two to three months, when they buy the shares in the market to cover their position,” Mr. Getzler explained. “The banks borrow the shares on day one and deliver to the company and then will cover the borrowed position by buying in the market over the period agreed.”

The debt factor. The level of share repurchases going forward depends in part on how companies manage their balance sheets. Many have issued debt in recent years to buy back stock, a trend that could resume as the economy improves, according to SocGen’s debt capital markets team. In addition:

- Companies that raised liquidity during Covid may decide they have excess cash and buy back shares if and when the economy returns to normal.

- Companies that added gross leverage may decide it’s more prudent to pay down debt than buy back shares.

- Leverage is up across the investment-grade space, so it could take a year for companies to get back down to pre-Covid levels before they look to re-engage in share buybacks.

- Companies may choose to live with higher leverage so they can return cash to shareholders.