At a time when agile enterprises are in favor, OneStream suggests finance functions live more in the moment.

Accounting functions tend to look backward, with reporting that’s subject to close processes and consolidation. Planning and forecasting, on the other hand, is looking forward, seeking to support business partnerships by helping managers predict what’s coming.

- Covid—especially the early period of the pandemic, which was arguably the most forecasted and re-forecasted period in modern history—has helped emphasize the importance of focusing more on the here and now.

- The goal is to find signals of opportunity or risk that will help proactively drive performance with higher velocity, even in circumstances that are uncertain or subject to rapid change.

- This also fits with the digitalization of business, where it pays to be agile and pivot quickly in response to new circumstances and what the most recent data signals about what’s coming.

Rise to the occasion. With that backdrop, John O’Rourke, OneStream vice president of communications and brand marketing, said the finance journey for financial planning and analysis (FP&A) is reaching an inflection point.

- “This is a moment for right-time finance, where FP&A should be proactively reading performance signals and helping the businesses be agile and respond to change on a more frequent basis, such as daily or weekly,” he said.

- This shift to right-time finance for FP&A was one of the key takeaways from day one of the NeuGroup for Financial Planning and Analysis pilot meeting sponsored by OneStream, which provides an intelligent finance platform for the modern enterprise.

- According to Mr. O’Rourke, “Decision-makers can no longer wait until month-end or quarter-end to get access to financial and operating results. They need access to key performance data and metrics about customers, suppliers and working capital on a more frequent basis so they can make decisions that impact future results.”

- What separates right-time data from its cousin real-time data is that data needs to be transformed to information by putting it in context and adding financial intelligence so business leaders have access to the right info at the right time in the right format and don’t just make knee-jerk decisions in response to each new data point that comes in.

- In other words, FP&A still needs to help identify the trends and signals in the noise to help business leaders make the right decision at the right time.

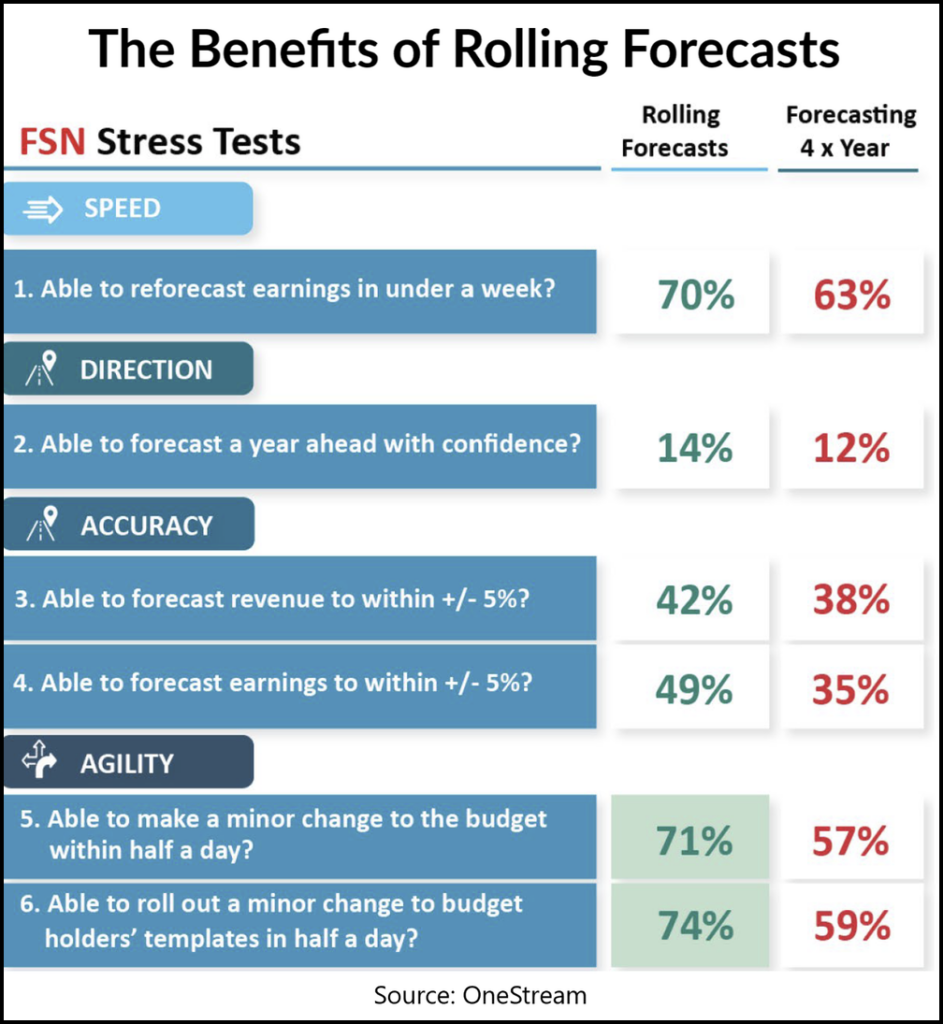

Stress testing agility. Drawing on results from the FSN 2021 Survey on Agility in Planning, Budgeting and Forecasting, Mr. O’Rourke encouraged members to stress test the agility of their organizations against three benchmarks. Implicit in each of these benchmarks is enhancing FP&A’s ability to accelerate insights.

- Velocity. The time needed to reforecast earnings and revenue should be less than a week, and that forecast should provide a look at the year ahead that can be relied upon with confidence.

- Accuracy. Companies should be able to forecast earnings and revenues to within +/-5%, even with a speedy reforecast. However, members noted that this percentage may be too low for some businesses.

- Change management. Companies should be able to make a minor change to their budget and roll out that change to budget holders’ templates within half a day. They also should be able to make a simple change to their hierarchy in that same timeframe.

How to improve. Clearly it helps to have capable people and software, but adopting a rolling forecast and zero-based budgeting is shown to significantly improve FP&A agility.

- Rolling forecasts (see chart above): Per the FSN survey, 70% of respondents deploying rolling forecasts (and just 19% did) were able to reforecast in under a week (vs. 63% for those who only reforecast quarterly).

- Almost half of rolling forecasters had +/-5% or better accuracy (vs. 35% of quarterly updaters) and 71% could make a minor change to budget/forecast model within a half day (vs. 57% of the quarterly updaters).

- Zero-based budgeters also outperform: 84% of them can reforecast in under a week (vs. 51%) with 58% having +/-5% or better accuracy on earnings forecasts (vs 28%; and 60% vs. 35% for revenue forecasts). Also, 62% of ZBBers could make a change within a half day (vs. 27%).

Final thought. Mr. O’Rourke says it’s still important to have an accurate and timely period-end financial close process, so that book-of-record financial and operating results can be delivered as rapidly as possible to internal and external stakeholders.

- And it’s becoming increasingly important, he said, “to have agile planning and forecasting processes that help managers adjust resource allocations based on changes in your company or industry”.

- But many organizations are now also providing more frequent snapshots of operating metrics to managers, some daily or weekly, to help identify key trends and signals in the business that can support midstream decision-making.