State Street experts recommend how to optimize an investment portfolio for both ESG and credit quality.

It’s a complicated world of ESG scores and standards, especially when managing an investment portfolio. At top of mind for NeuGroup members putting corporate cash to work: should they prioritize ESG performance or maximize returns? Hint: it’s not too much to ask for both.

- At a recent meeting of NeuGroup for Cash Investment 2, Will Goldthwait and Karyn Corridan, ESG investment experts from State Street Global Advisors, shared the advantages of tilting a portfolio toward companies with higher ESG scores, and why that may be more beneficial than an exclusionary approach.

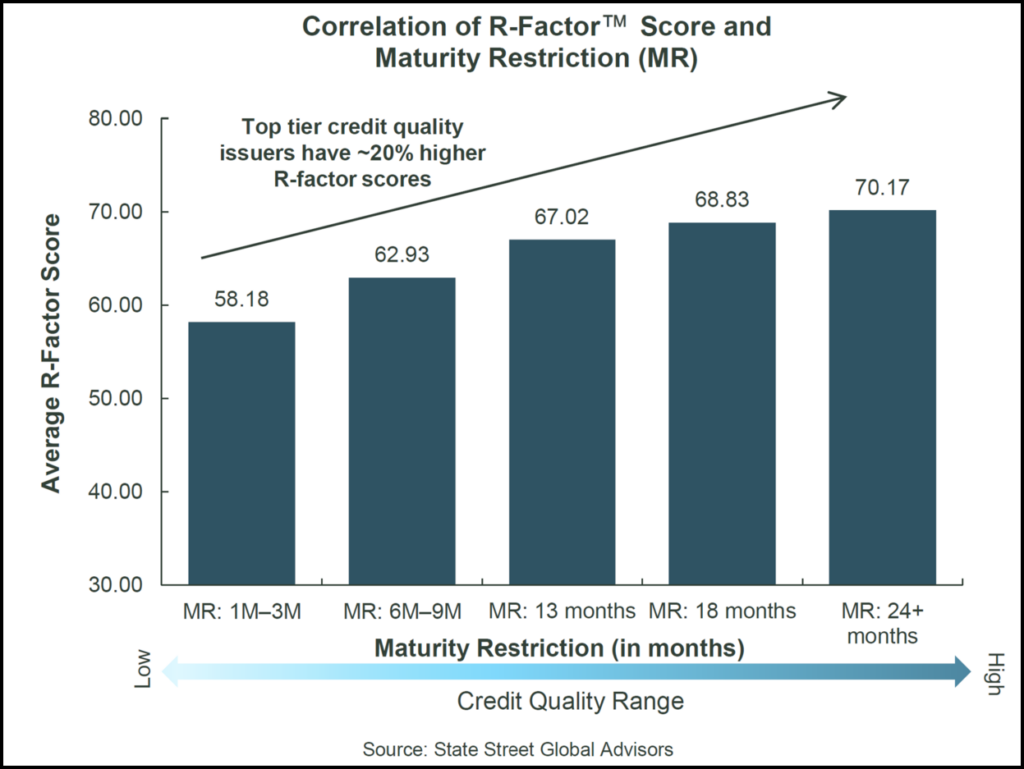

- According to State Street data, there is a strong correlation between a money fund’s ESG score and its overall credit value, a testament to the benefits of tilting—though it requires an investor trust the ESG scorer’s approach and methodology.

Understanding tilts and taking a stance. Historically, ESG investment mandates applied exclusionary screens to equities that contradicted the holders’ social or moral values (like tobacco companies). However, concern about missing upside and the larger global stance on environmentalism and human rights has shifted the way some investors think about ESG investing.

- “What’s changed in the last couple years is tilting a portfolio, and not being exclusionary,” Mr. Goldthwait said. “I think, ultimately, that is beneficial to ESG efforts here in the US.”

- By looking at what funds include, rather than what they exclude, asset managers (like State Street) can focus on financial materiality, credit worthiness and the wider sustainability strategies of fund composition.

- Looking at European companies, “we can see that over there, clients are like ‘I want carbon-free, right now, let’s do it,’” Mr. Goldthwait said. “I don’t think the US is quite there yet, we’re sort of in the process of trying to understand what that return construct looks like.”

Higher scores, stronger credits. Flipping to an inclusive approach and tilting asset allocation has allowed State Street to push performance while keeping within the perimeters of a client’s moral compass and to prioritize safety, liquidity and yield.

- State Steet’s ESG scoring system, named Responsibility Factor or R-Factor, uses Sustainability Accounting Standards Board (SASB) frameworks to evaluate the performance of a company’s ESG business operations and governance.

- “When we first looked at applying it to a money market fund, what we found, very interestingly, is there’s a strong correlation between companies that have a higher R-Factor score and our maturity restrictions set by our credit analyst,” Ms. Corridan said (see chart above).

- “By having a fund that integrates ESG considerations, it’s essentially giving you a portfolio with a higher credit quality.”

Transparency, trust and communication. But many corporates said they are still sitting on the ESG sidelines trying to make sense of scores and various benchmarks, repeating in various NeuGroup meetings that it’s a real challenge to weed through the noise and get an apples-to-apples comparison when evaluating investment options.

- Compounding this difficulty is that asset management firms are weighting ESG components differently, including measurements like R-Factor.

- Members agreed that it is important for them to be able to have frequent dialogues with their asset managers to appropriately understand their investment approach and how their funds are tilted (overweight) to equities or exclusionary (underweight) to ESG.

- In addition, asset managers should provide full transparency as to how their investment accounts tilt so that corporates may trust and believe in their process.

- “The future state: is if ESG is successful, it’s going to be successful by picking companies that ultimately help perform on your traditional metrics also delivering high-performing ESG scores,” Mr. Goldthwait said.