Attractive yields and safety are two reasons some corporates are investing directly in reverse repos.

Turmoil in the banking sector earlier this year sent shockwaves through corporate treasuries, triggering widespread reviews of credit risk policies and changes in how cash investment managers think about counterparty limits for unsecured exposure to banks. As these managers continue to seek both safety and healthy yields, reverse repurchase agreements, also known as reverse repos, are drawing increased attention globally. And no wonder: they offer corporates an additional layer of safety—securities held as collateral—with the current, added bonus of higher yields than some other low-risk investments due to recent favorable regulation in the US and Europe.

- Deutsche Bank data shows that yields in the range of SOFR flat (about 5.3%) to SOFR+40 basis points (or about 5.7%) can be achieved through reverse repo—with an overnight US Treasury tri-party repo (we’ll explain below) at the low end of the yield spectrum, and using equities as collateral out to three months on the high end.

- Brendan McCarthy, Deutsche Bank’s director of client management for agency securities lending in the US, said reverse repos are an ideal tool for treasuries at large, cash-rich corporates that manage cash conservatively, as well as those that are looking at additional asset classes.

- “As cash reserves have grown larger, a lot of investment managers are buying commercial paper, or doing different types of investments that have different tenors,” he said. That includes reverse repos, whose collateralization significantly reduces risk. In addition, accounting standards allow them to be treated as cash or cash equivalents, another reason “reverse repos are a natural fit: a very simple, highly liquid investment.”

Yield-boosting regulation. Those attractive yields are not only thanks to the jump in rates over the last 18 months as central banks waged war against inflation—it’s also bank regulators. Deutsche Bank VP of risk management solutions Leon Kurz said the European Banking Authority and the US Federal Reserve are incentivizing banks to trade with corporates in the repo market to boost liquidity as measured by their net stable funding ratios (NSFR).

- “There’s real value, quantifiable for the banks, to trade against corporate clients,” Mr. Kurz said. “With banks that know they are in competition against other banks, there’s value to be had. The competition will force them to pay out this value back to the corporate clients, which has increased this year.”

Investing in reverse repos. In a reverse repo, in this context, the corporate purchases securities from a broker-dealer that is borrowing cash for a specified term, usually ranging from overnight to 90 days. The agreement requires the bank to buy back the securities at a higher price—the premium that produces yield for the corporate investor. The yield is based on the length of the term and the quality of the securities used as collateral.

- While a broad array of assets may be financed in the repo market, the most commonly used instruments according to SIFMA are US Treasuries, federal agency securities, high quality mortgage-backed securities, corporate bonds and money market instruments.

- Global financial institutions like Deutsche Bank that have access to repo markets in all regions of the world are ideal partners for reverse repo investments. Their broad market reach enables execution with whatever counterparty has most demand and therefore pays the highest rate at any point in time.

- “For example, one of our dollar-based German clients does trades in Europe, but they also access USA domicile banks via our New York-based agency desk,” Mr. Kurz said.

Three-party system. There are two structures for reverse repurchase agreements: bilateral and tri-party. In a bilateral repo, investors and collateral providers directly exchange money and securities. Mr. McCarthy said the tri-party structure is more commonly used by corporates, with a custodial institution, or tri-party bank, acting as an intermediary.

- Banks including BNY Mellon, JP Morgan and Euroclear often play the role of tri-party bank, holding the securities on behalf of the corporate for the duration of the agreement. If, for any reason, the bank counterparty defaults, the collateral is returned to the corporate client.

- But a fourth party often comes into play, which is where Deutsche Bank fits into this picture. It can be contracted as an agent, providing clients access to trade with over 50 bank counterparties through one agreement, handling all trade execution, settlement, and other processes, including reporting.

- One valued service the bank provides when working as an agent is so-called margin shortfall indemnity—another layer of security that Mr. McCarthy said sets the bank apart from many of its competitors.

- That means if the bank counterparty in a reverse repo goes insolvent and Deutsche Bank is unable to liquidate the full value of the collateral, “DB steps in to make up the difference to the investor,” he said.

What about money market funds? Between the banking crisis and the debt ceiling showdown earlier this year, a wave of corporates sought security in money market funds that invested largely in reverse repos. And although corporates can access some benefits of the reverse repo market through money funds, Deutsche Bank says it’s not the same as investing in reverse repos directly.

- “If a corporate wanted to go out to a three-month tenor and bought money funds backed by repos, that will only buy overnight repos backed by very secure short-term treasuries,” said William Sauer, an associate on the US corporate investment solutions team at DB.

- “What money funds can invest in are only on the lowest end of the yield spectrum. Working with Deutsche Bank makes things much more customized—if you’re comfortable with a three-month tenor, you won’t miss out on yield.”

Repo in action. One of Deutsche Bank’s clients, a logistics company, was confronted with excess cash balances after business surged following Covid-induced lockdowns. It paid down debt but still had billions of deposits in accounts, exceeding the company’s target limits with its core banks. And where could it put the cash to work when banks across the globe were failing?

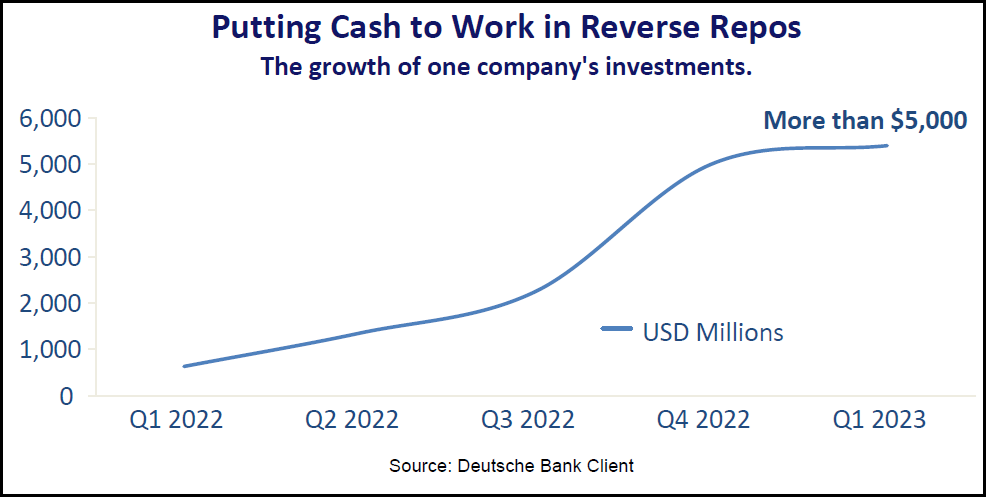

- For answers, the company turned to Deutsche Bank, which advised tapping the reverse repo market. The bank served as an agent to manage the transactions through its cash investment service (CIS). As the chart below shows, the company now has more than $5 billion in reverse repo assets.

- The treasury team said working with Deutsche Bank brought several benefits. Among them: no need to onboard each new counterparty, saving time on administrative and compliance efforts. It also got access to the bank’s broad spectrum of potential reverse repo counterparties and money market funds linked to the CIS platform.

High customization, low maintenance. The treasury team added that another key benefit of reverse repo is that the risk-return is fully tailored to the company’s needs, including the counterparty, collateral type, collateral quality and tenor.

- Once the program was set up, the corporate had to do very little active management, with Deutsche Bank’s CIS service deputized to manage all day-to-day activities.

- Mr. McCarthy said that most corporates using this service “might check in once a week just to touch base, but they have full access to all details daily.”

- The treasury team members said the project was a clear success, significantly reducing counterparty exposure through collateralization, but with attractive yields compared to standard time deposits.