As June 1 draws close, treasury teams need to consider how a default might affect liquidity and what to do now.

Treasury Secretary Janet Yellen repeated on Monday that if the debt limit isn’t increased or paused, the US will probably be unable to pay all its bills as early as June 1. And while the worst case scenario of a default seems unlikely, few observers see a quick fix to the problem, despite Tuesday’s meeting between President Biden and House Speaker Kevin McCarthy.

What, then, should treasury and finance teams be doing to prepare for the extreme volatility and market dislocation that would almost certainly be sparked by a default following a failure to raise the debt ceiling?

- Although answers to that question can be debated, it is incumbent upon treasury leaders—some still coping with liquidity concerns raised by the banking crisis—to consider, discuss and address the issue now if they haven’t already. That means digging into the potential implications for corporate funding sources such as commercial paper (CP), as well as cash investments like money market funds (MMFs).

- One member at a recent meeting of NeuGroup for Tech Treasurers sponsored by Standard Chartered Bank has been preparing for volatility and default risks. “We are having conversations about how to diversify our liquidity,” the treasurer said. His team is also discussing holding higher cash balances as a liquidity hedge and keeping more cash in foreign currencies vs. converting it into USD.

Diversifying with prime funds. The banking crisis has driven many corporates out of deposits into government MMFs, which may hold Treasury bills. The member discussing liquidity diversification is considering the resulting concentration of risk. “This may be the time to shift some cash into prime funds,” he said at the meeting, referring to funds that invest in corporate debt securities, including CP. “We are looking at the potential accounting implications.”

- He elaborated in a follow-up email: “We are already overconcentrated in government MMFs. If there’s a run, the funds will look to the reverse repo market to fund redemptions. If that operationally seizes, I want to have alternatives, rather than assume that it can’t happen. That’s why I’m putting some short-term liquidity in prime funds and banks.”

Prime counterpoint. A member of NeuGroup for Cash Investments agreed about diversification, but not about using prime funds: “Most of the government money market funds can access the Fed’s reverse repo [facility]; most of their liquidity is there. If there is a default, there will be volatility across all sectors, including a prime fund. The prime fund putting up gates and fees is more likely than a government MMF breaking the buck.”

- He added, “We have a variety of funding sources—deposits, repo and MMFs—and that is the best way to prepare” for a possible default. Another member of the cash group said, “There is really no place to hide if the US defaults on its debt. I think any change to what has been the universally considered ‘risk-free asset’ will raise the risk of other assets equally or even more, except perhaps non-US sovereign debt.”

- Asked to respond, the member putting some cash in prime funds said, “I’m not trying to protect the fair value of the assets so much as making sure I don’t need to be a fire sale seller if we need cash. I’m assuming during a distress period, my customers may not be able to pay me.

- “I want to be able to pay our bills even if collections dry up. Yes, the risk of other assets will increase. I just want to be sure I can get to a few weeks of cash through multiple channels, in case one channel seizes up.”

The CP calculus. At a session held Monday on the debt ceiling for members of NeuGroup for Mega-Cap Assistant Treasurers, one AT told peers his company is “positioning ourselves so we don’t need the CP market around the end of the month. We’ve been essentially raising additional cash in advance of that.”

- His company doesn’t typically use overnight CP, preferring longer tenors. “So we’re just issuing a couple months out and making sure that in prefunding any maturities, we have very little between now and the end of June.” In response to a question, he and other members said only a prolonged disruption in the CP market would raise the possibility of drawing from revolving credit facilities.

- The AT’s company will likely leave some cash that would otherwise go into MMFs with its main bank to cover the “max days’ outflows, to the extent we see weirdness impacting government money market fund liquidity—which we don’t expect,” he said. “We just think it’s prudent to forgo a little bit of interest to make sure we have money in the system.”

- That said, the member observed that government MMFs are reducing risk by shortening duration and avoiding Treasury bills. “We have no more concerns about government money market funds than we do about the banking sector these days,” he said, noting his high degree of faith in his main bank, a GSIB.

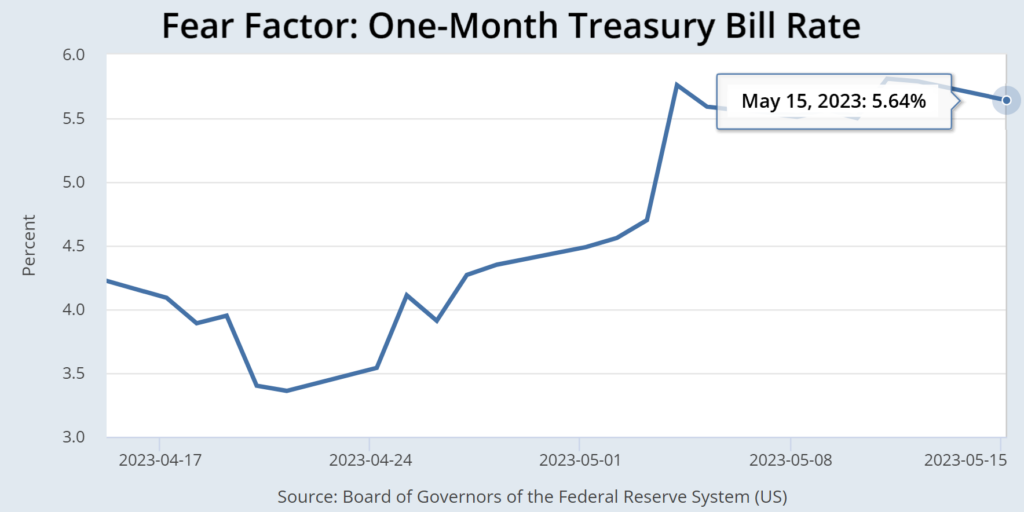

T-bill opportunity? The avoidance of Treasury bills by some investors may create opportunities for others. One member of the cash investment group raised the possibility of buying one-month T-bills, recently yielding more than 5.5%. “If you know your liquidity, honestly, buying the one-month bill is a relatively interesting trade,” the member said. “If it hits a high enough yield for a few days of technical default that can be compelling,” he added.

- Other members raised doubts about taking advantage of any market disruptions. “Given the high degree of risk, there are no real opportunities on the corporate side from my perspective,” one said.

- Someone else said it’s a matter of deciding “whether you think there will actually be a payments delay in any of those T-bills.” Another question: will T-bills pay accrued interest if not redeemed on their maturity date? Most members doubt they will, as T-bills do not pay interest, but rather are purchased at a discount to par.

- One AT said his company took advantage of similar market conditions during the debt ceiling crisis in 2011. He has a little less confidence in a resolution this time but added, “It will be interesting to watch and there may be some very attractive yields available.”