Downgrades by Moody’s point up the ongoing, post-SVB review of bank risk by investors and corporate treasury.

Moody’s this week downgraded 10 regional banks and took other actions that underscore that a banking crisis ignited by the collapse of Silicon Valley Bank five months ago has changed how the world—including corporate risk managers—views the creditworthiness of banks. The failure of SVB and other institutions has triggered a widespread review of credit risk policies and led to changes within many finance organizations.

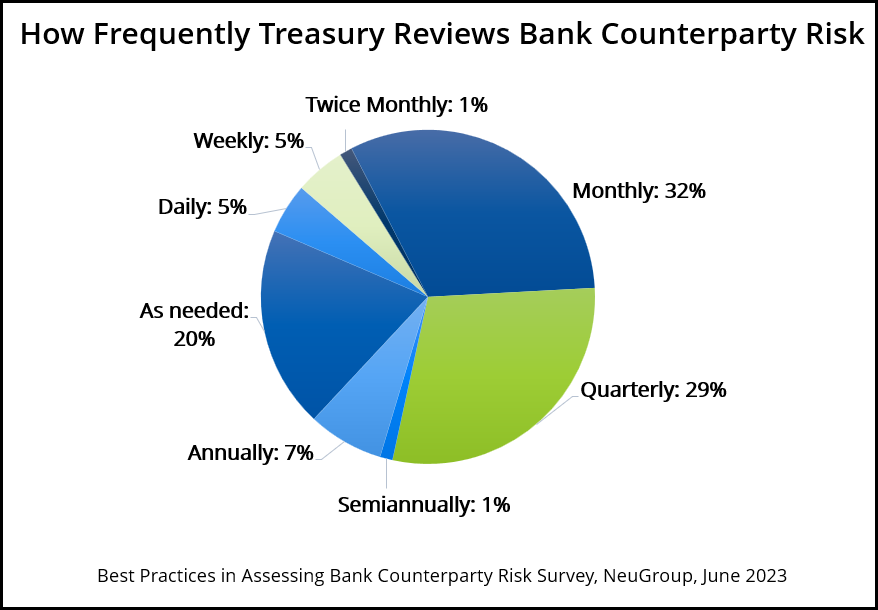

One indicator of their commitment to this critical cause is how often treasury teams review the counterparty credit risk of their banks. The latest survey by NeuGroup Peer Research, Best Practices in Assessing Bank Counterparty Credit Risk, shows 43% of them review their exposure monthly or more frequently.

- Many take a two-pronged approach: They scan high-level metrics like credit default swap spreads and bond spreads frequently and perform a more thorough analysis on a quarterly or semiannual basis.

The chart below captures respondents’ current review frequency. The cadence often reflects the size and volatility of the exposure. One treasury team with a significant cash balance pulls data into an Excel template on a daily basis. “I look at the report first thing every morning,” said the member. Any meaningful change triggers further review and potentially pulling money out and shifting it to another bank money market fund.

- While treasuries are already monitoring their exposures closely, the survey data shows that 13% of them are planning to increase the frequency of reviews, and 15% that currently look at exposures on an as-needed basis are formalizing their process by establishing a set cadence.

In a debriefing session this week covering the full set of survey results, one member said his company leverages third party research from banks, ratings agencies and the Fed. But he said that data isn’t updated frequently enough—regardless of how often his team reviews its metrics.

- “There is a lot of stuff, but it’s snapshots available quarterly or infrequently,” he said. “They really don’t scratch the itch because it’s so dynamic; you really need the in-between reporting.”

- “That’s a really good point: a lot of indicators are periodic, regardless of your own review,” said NeuGroup’s Nilly Essaides, who led the survey and the debrief session. “Trying to get regulators and credit rating agencies to be more transparent would be helpful, because they’re very opaque until you see the downgrades after the fact.”