Higher interest rates and economic uncertainty have treasuries taking a long look at FX risk management programs.

Recent signs of economic strength and enduring inflation have raised the specter of more interest rate hikes. This does not come as a surprise to NeuGroup members: In the Treasurers’ 2023 Agenda Survey, they ranked political and financial volatility as second and third on their list of risks for this year. That’s up from fourth and fifth place in 2022.

Increased scrutiny. While economic and financial market volatility influence every part of treasury, they have the most direct impact on FX risk management. Fluctuations in the value of the US dollar against other currencies are threatening to deliver a double blow to companies’ financial performance, i.e., injecting volatility into the P&L, just as earnings are diminishing.

- “Treasury is under a microscope,” said a participant in a recent agenda survey debriefing session for members of NeuGroup for Foreign Exchange.

- 60% of participants reported they are working more closely with the CFO and the board, and one-third are revving up their collaboration with investor relations.

- “If your hedging program is effective, you shouldn’t have a ton of noise, you should be talking to investors about everything else besides FX,” one member said.

Building a partnership with the business. The adverse effects of changes in currencies’ value are also highlighting the important role FX managers can have in supporting business decisions, from providing more accurate forecasts to build business plans to acting as a bridge between treasury and operational functions like procurement.

- The focus is on “helping our commercial finance teams or CFO to explain how the financial impact has changed,” one session participant said. “We’re not trying to predict the market, but we’re looking at things that can happen, what to expect internally, and what’s driving financials.”

- “We have been working with FP&A and providing them information on expectations of forward effects and gains/losses based on our findings,” another member added. “We communicate much more often with them to try and compare and get a more accurate forecast to help drive business decisions.”

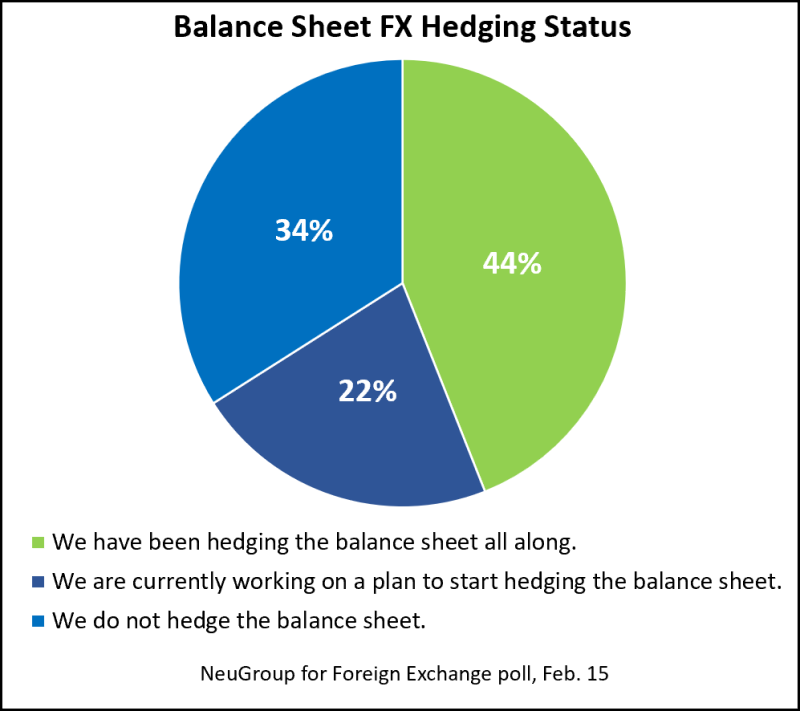

Focus on the balance sheet. C-Suite concerns about FX impact on the P&L are prompting members to review risk management strategies, for example balance sheet hedging.

- While 44% of participants have been hedging balance sheet risk all along, 22% reported they are working on launching a new program to reduce fluctuation in the FX gain/loss line. (See chart above)

- “We are being asked to validate our hedging programs, and how we’re hedging,” one member shared. “We are looking at how to improve the balance sheet side of hedging, since misses are magnified due to FX volatility.”

- “Even a small variance in hedge volume can provide positive or negative P&L impact,” agreed another, “and we’ve been tasked to fine-tune the balance sheet and cash flow hedge programs, and rethink if we’re hedging the proper volumes.”

- As part of fine-tuning balance sheet hedging, one member conducted in-depth analysis comparing the plain-vanilla rolling forwards strategy to determine if they would do better by using collars, long forwards and participating forwards. After intense analysis of hedging cost and risk reduction benefits, “we decided to stay with our original approach,” the member said.

Bookending volatility. As the primary purpose of hedging is to insulate earnings per share (EPS) from FX volatility, members are taking steps to measure how their programs perform against this objective.

- To determine performance, “we perform a [value-at-risk] analysis per currency pair looking back over the past year,” said one member who had completed the analysis in Q4 of 2022.

- However, others suggested a more frequent review is necessary, given the wide movements in the market.

- “We review what percentage we’re hedging and the overall performance result,” one member said. “VaR analysis used to be annual, but we started doing it twice a year in 2022.”

- Another member questioned whether analyzing the exposures by currency is producing a holistic picture of the company’s currency risks. “Why not do the analysis on a portfolio basis?” he asked.

- The first member noted that correlations “change all the time.” Plus, he is concerned that reporting on the portfolio level would be too confusing for his stakeholders. “You have got to know your audience,” he said.

Action items. “FX is in the limelight,” one session participant concluded. It therefore behooves risk managers to:

- Consider whether they should also hedge the balance sheet, given the amplified effects of frequent currency moves in order to bookend EPS volatility.

- Work directly with the CFO and investor relations to develop a qualitative narrative to explain the FX data to investors.

- Work closely with FP&A to create a more accurate forecast to support business decisions.