Survey data shows treasury is moving to the cloud but still leaning away from the tech direction finance is heading.

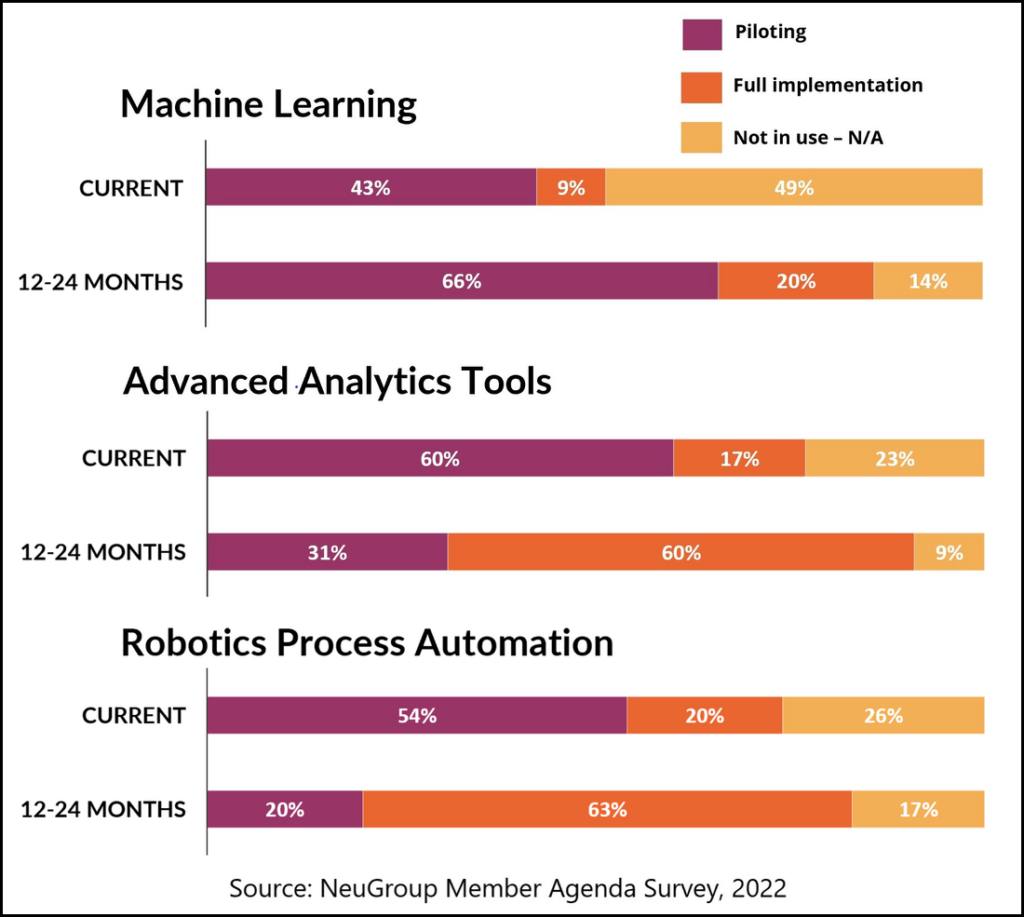

NeuGroup Peer Research data shows that while finance organizations are rapidly embracing advanced analytic tools, robotic process automation (RPA) and machine learning, treasury teams—which are moving rapidly into the cloud—appear convinced that treasury management systems (TMSs) will remain the centerpiece of treasury technology despite market disruption that suggests otherwise.

- That analysis provides context for a key takeaway of the 2022 NeuGroup Member Agenda Survey: Treasury is fully committed to the move of finance organizations to cloud-native applications.

- The majority of respondents (57%) currently have more than 40% of their applications in the cloud. And 40% of them expect to have more than 80% in the cloud in the next 12-24 months—double the 20% at that level now.

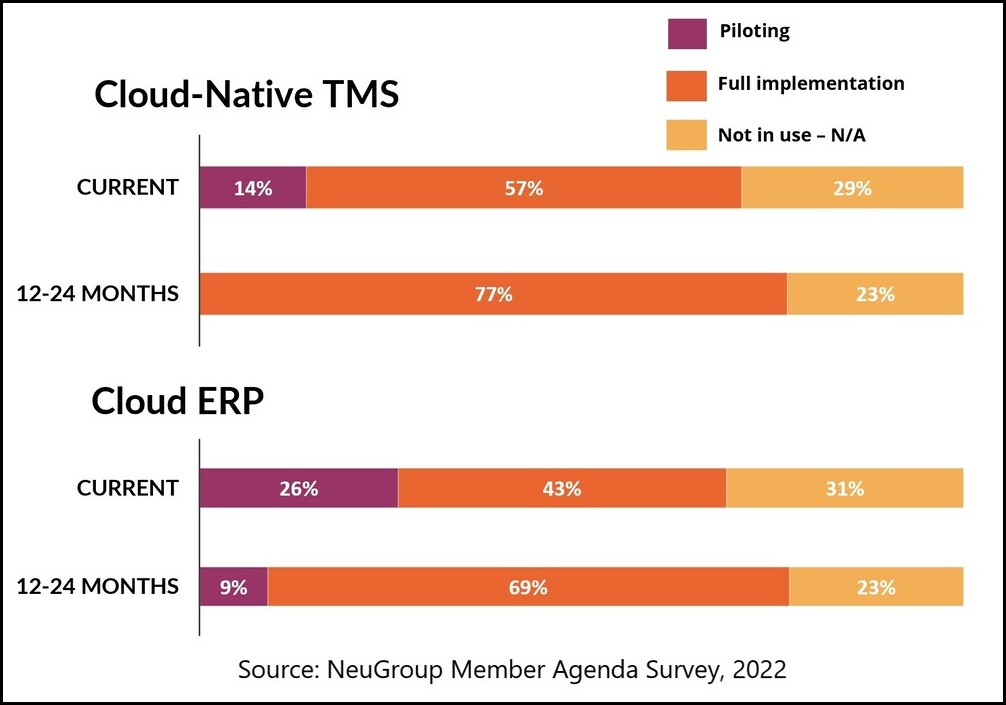

- And as the charts below show, 77% of respondents said they will have fully implemented a cloud-native TMS in the next year or two. Meanwhile, 78% of broader finance organizations expect to be implementing or piloting cloud-based ERPs in that time frame. Call that alignment.

Market disruption. However, that more than three-quarters of respondents see themselves implementing any sort of TMS in the next two years suggests to some observers, including Nilly Essaides, NeuGroup’s managing director of research and insight, that most treasury teams aren’t yet sold on so-called composable finance that will allow them to combine best-of-breed fintech automation tools that connect directly to an ERP through intelligent APIs.

- For example, “You can get a cash forecasting module that just does AI-enabled forecasting. It goes all around the ERP and picks pieces of data and then feeds them through an algorithm that produces a forecast,” Ms. Essaides said.

- “The 77% TMS figure shows treasury is going its own way while finance overall is moving in the direction of RPA, advanced analytics and this composable finance world,” she added. “It’s going to be very tough to justify why you have a TMS if there’s already an analytics tool you can just plug into your data. Why do you need your old system?”

- It’s important to note that TMS vendors are reconfiguring their solutions to align with this more modular approach. For example, the FIS family of treasury technologies now offers an analytics module. Other vendors are incorporating AI and ML and APIs into their architecture.

- “So perhaps the traditional TMS will evolve into more collaborative applications that rely on core, common functionalities to deliver treasury automation,” Ms. Essaides said.

A road to harmony. The charts above show the high percentage of finance organizations—including but not limited to treasury—that in one to two years plan to pilot or implement machine learning (86%), advanced analytic tools (91%) and RPA (83%). “What’s happening is that finance is adopting all these different technologies,” Ms. Essaides said. And one school of thought is that treasury can harmonize better with the broader finance org by borrowing its instruments.

- “What we need to do going forward is really take advantage of what the finance organization has already bought in terms of analytics and master data management and machine learning,” one survey respondent told NeuGroup Insights. “You pull that in and give it a treasury story, a use case. And if you end up pulling all these standalone functionalities embedded in an app into treasury, you don’t need a treasury management system.”

Of course, not everyone shares that view of the future—or wants to give up on TMSs. But the winds of change are blowing in the direction away from single systems and solutions and toward a future of automation, apps and APIs. And the forces of market disruption will only pick up speed from here.