MUFG helps one mega-cap use structured preferred shares to monetize a “difficult” asset.

In a session at the recent NeuGroup Tech20 annual meeting—the 20th annual no less—a guest speaker from a mega-cap communications company shared how his treasury found a great deal of success using structured preferred shares to monetize previously untapped assets on its balance sheet. All while managing its net debt within a target leverage ratio, with the assistance of meeting sponsor MUFG.

- Structured preferred shares are a type of hybrid instrument that can be used to achieve multiple corporate objectives, in this case deleveraging and asset monetization.

- With MUFG’s assistance, the presenter, the treasurer of a company with one of the largest debt portfolios of any non-financial institution, said the deal was “a real success story” for the company.

Asset monetization. When the company entered a 30+ year deal to lease out some of its assets for a one-time fee, it faced a dilemma: what could it do with an essentially dead asset on the balance sheet?

- “We couldn’t really securitize these things, and it would’ve taken us years to see any cash,” the presenter said. “So we looked around at different solutions and came to the idea of working with MUFG to (issue) structured preferred (shares). We liked it, it allowed us to monetize what was otherwise a difficult asset.”

A shared structure. The presenter worked with MUFG to reassign the assets into a separate legal entity and issued preferred shares, in which eight banks were buyers of a multibillion dollar facility.

- “Ordinarily, when you think about preferred, you think about it being issued at a parent company,” said Terry McKay, head of Global Financial Solutions at MUFG. “But in the case of structured preferred shares, the issuer is a subsidiary.”

- “The legal form of this subsidiary can be a corporation, a partnership or a trust, so there is a lot of flexibility,” he said. “And in terms of the assets, there is also a lot of flexibility, and it’s critical to select the right assets; investors are focused on the critical assets.”

- Thanks to this flexibility, the asset types can vary from core assets to inventory to even intellectual property.

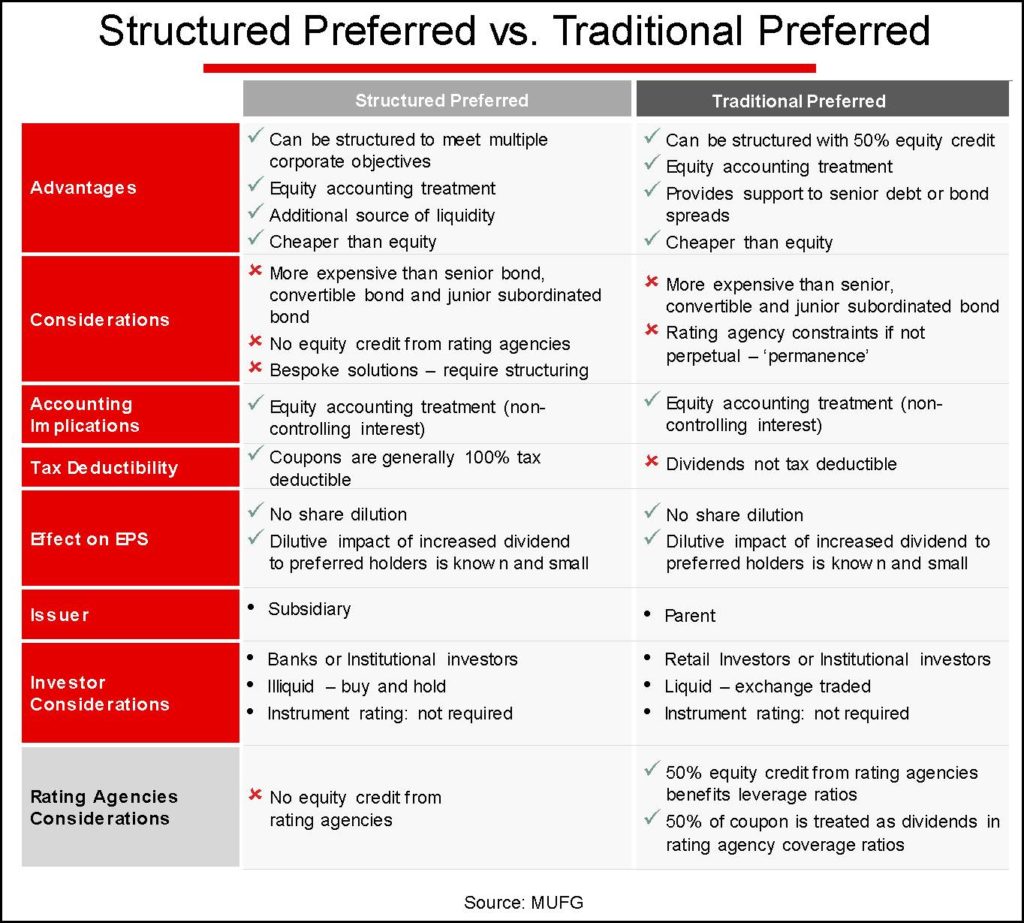

- Mr. McKay continued that structured preferred stock, though it is more expensive than a senior bond and does not include the ratings agency credit of traditional preferred stock, can be useful because of its tax deductible coupons, added liquidity and the ability to be strategic in financing and adapt to meet specific objectives.

Story of success. “It had a lot of benefits to it,” the presenter said. “It helped us really meet our objectives and gave us a chance to reward banks we’ve done significant business with.”

- In its work with MUFG to issue structured preferred shares, the company was able to meet these three core objectives:

- Managing its debt tolerance, reducing its net debt by about 17% in the span of a year and a half.

- Achieving a target leverage metric which was contingent upon asset sales to be met.

- Acquiring an incremental source of liquidity and reducing the pressure on refinancing its bonds.