Matthews South, a leading advisor on buyback programs, has developed an enhanced open market repurchase solution that gives companies a compelling option to traditional methods.

Companies planning stock buybacks in 2024 and beyond may do themselves a real favor by considering a compelling alternative to standard open market repurchases (OMRs) and accelerated share repurchases (ASRs). It’s a buyback program offered by Matthews South, a capital markets advisory firm that has transformed enhanced open market repurchases (eOMRs)—which banks have offered for years—by significantly lowering transaction costs and increasing transparency.

A growing number of savvy treasury teams, including NeuGroup members, are exploring the advantages of Matthews South’s innovative approach to the eOMR product. “In the share repurchase and capital structure part of our dialogue, 80% is about eOMRs now,” said Vijay Culas, founder and CEO of Matthews South, which has advised on over $100 billion of share repurchases since 2015. “It has ramped up dramatically.”

eOMR Basics

An eOMR uses an algorithm to determine the amount of stock purchased each day. The algorithm is designed to maximize the discount to the average of the daily volume-weighted average price (VWAP) over the repurchase period. It does this by using the volatility in share prices to vary spending levels.

Generally, the algorithm will buy more shares as the stock price decreases and less when it increases. A broker executes purchases in an eOMR like in a traditional OMR. An eOMR is compliant with Securities and Exchange Commission Rule 10b-18 and Rule 10b5-1.

Structuring an eOMR is straightforward. The company makes a few decisions:

- How much money to spend?

- The company can set a fixed amount, use price limits or choose a variable size.

- How long the program can buy shares (e.g., end of the quarter).

- How soon the program can complete (e.g., two months into the quarter).

The algorithm uses these parameters to calculate the number of shares the broker executing trades will purchase.

Why Consider the eOMR?

The economics of an eOMR are very attractive, according to Matthews South. By varying the number of shares repurchased each day, the eOMR can provide large discounts to VWAP. Discount to VWAP is an important metric used to measure a program’s success.

The eOMR also achieves a better repurchase price than offered by other methods in many scenarios. According to Matthews South’s Monte Carlo analysis, if a stock is range bound (+/- 5%) during a three-month period, the eOMR outperforms dollar cost averaging 73% of the time. If the stock appreciates 5% to 10% in that period, the eOMR outperforms 95% of the time. (Matthews South’s analysis assumes a stock with 35% volatility and a 1.5 month minimum duration.)

eOMR vs. ASR

In an ASR, a company transfers cash to a bank and receives most of the shares upfront. This method also typically includes a minimum duration after which the bank can complete the program. In exchange for this timing flexibility, the bank guarantees a fixed discount to VWAP. The bank is willing to provide the discount because it expects to achieve an even better discount through its buying and hedging activity.

The eOMR uses the ASR hedging methodology to determine the amount of daily repurchases. The company puts itself in the banks’ position and generates a discount that is expected to be similar or better than the ASR.

A common objection to the ASR is that it is not flexible and cannot be “undone,” i.e., easily canceled early by the company. The eOMR provides the same flexibility as a traditional OMR in this regard and can be canceled at any time. Another criticism of ASRs is the upfront payment and related credit risk. The eOMR has daily cash and share settlements directly with the broker and does not raise these concerns, according to Matthews South.

KLA Corporation, a user of eOMRs, wanted flexibility, said Kevin Castellano, co-founder and client advisor at Matthews South. “They started moving down the OMR path and then they thought, ‘we like the economics of the ASR but we want flexibility, so let’s do the eOMR.’ In this way, the eOMR gives you the best of both worlds.”

Another benefit of the eOMR: The user retains interest income on its cash and has lower transaction costs because it avoids the embedded bank profit built into the ASR discount.

On the other hand, the ASR’s guaranteed discount can have real economic benefits. The discount generated in an eOMR is unknown at inception. The realized discount depends on the path of the stock and its volatility during the program.

The ASR also has the benefit of upfront share retirement and allows the company to send a strong message about its repurchase program via a press release or a Form 8-K filing.

However, signaling may not always be desirable; eOMR programs are not currently announced in advance. “They’re just like open market repurchase,” Mr. Culas said. “You don’t have to disclose it upfront and attract attention you may not be looking for.”

eOMR vs. OMR

The eOMR tends to generate larger discounts to VWAP than an OMR, according to Matthews South. This is because the eOMR has a dynamic grid that changes daily, unlike a static grid that is typical in an OMR. Jack Yue, treasurer of KLA, likes the eOMR’s ability to “react to market dynamics throughout the quarter, on a daily basis.”

However, one repurchase method cannot always outperform another: During periods where stock prices are falling, the eOMR tends to underperform the OMR. That’s partly because if the stock declines, the eOMR program may complete at the minimum duration the company chose. Many OMR programs, such as dollar cost averaging, remain in the market longer, which can be beneficial when prices keep declining.

A large number of companies using an eOMR proactively mitigate this “early completion” scenario by layering on a “springing” OMR that starts buying upon an early completion of the eOMR, according to Matthews South.

Matthews South’s eOMR

“The eOMR was attractive conceptually, but the original bank fee structure and its opaque, ‘black boxiness’ was too much for us to feel comfortable telling our clients to do it,” Mr. Culas said.

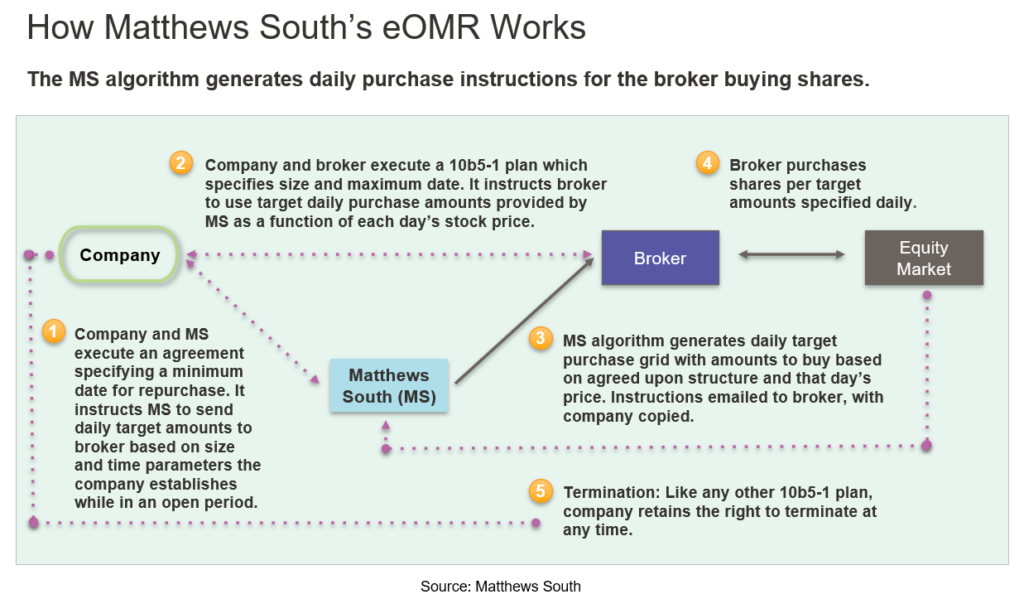

In response to this concern, Matthews South created its own version of the eOMR. Matthews South uses its algorithm to generate daily, dynamic price-volume grids. Grids are sent to the executing broker and the company each morning. The broker buys shares based on the grid’s parameters. Purchases are settled on a regular settlement cycle and in the same manner as a traditional OMR.

This construct has fundamentally changed the eOMR’s value proposition in the view of Matthews South. The fee a bank charges a company to execute an eOMR is typically 20% to 25% of the discount to VWAP achieved by the bank algorithm. Using Matthews South’s eOMR, the company pays its typical commission to the broker and a fixed fee to Matthews South. The company therefore retains all of the program’s upside.

Matthews South also provides more transparency by sending the company the daily repurchase instructions. “In a bank eOMR, you sign the agreement and it’s a complete black box as to what happens. That should be discomforting to a client. They have no idea today if they’re going to buy a lot of shares or nothing. With our version, the client sees the exact instructions every day; you don’t see that with a bank eOMR,” Mr. Culas said.

Companies also like the ability to use their broker of choice instead of a limited group of banks that can execute an eOMR. This includes many traditional lenders and diverse-owned firms. “We work with more than 10 banks; some are more traditional lending banks that partner with D&I firms. A lot of those banks don’t have the capability to offer structured repurchase, but with this approach, I can share business and wallet,” Mr. Yue said.

Many companies are curious about the difference in algorithms, which is often described as a differentiating factor between eOMRS. Mr. Yue said banks pitch eOMRs to him and some claim their algorithm is better, an assertion he hasn’t seen proven. According to Matthews South, all eOMR algorithms are comparable given similar underlying methodologies.

Of course, some companies may stick with bank eOMRs instead of a less costly version because of longstanding relationships and wallet share issues. “Others just don’t know about this better mousetrap yet. There can be twenty bucks lying on the ground and you just don’t realize it until someone tells you, ‘look over your shoulder, there’s a bill you just dropped on the floor,’” Mr. Culas said.

For now, Mr. Yue is sticking with Matthews South’s less costly eOMR. “Our experience has been solid and transparent. They work with us upfront to do all the modeling and tailor the programming to match up to our objectives.”

Looking Ahead

Looking at the big picture, S&P 500 firms are expected to spend at least $890 billion on buybacks in 2024, according to S&P Dow Jones Indices. That would be a gain from $795.2 billion in 2023 but still below 2022’s level of $923 billion. Additionally, there are potential changes to buyback disclosure rules and some risk that Congress raises the 1% buyback tax.

But on a more micro level, companies with solid cash flow and vocal investors will undoubtedly continue to return cash through buybacks. One CFO recently told NeuGroup, “Companies like ours with strong, stable cash flows that have seen a pullback in valuation believe it is a good time for buybacks. We aren’t levering up to repurchase shares, but we are being opportunistic with cash and free cash flow.”

That, of course, is good news for Matthews South. “The eOMR is a good product for companies in capital return mode,” Mr. Culas said. “It is a very good method of buyback in the current market where volatility is high and clients want to retain flexibility.”

Sponsored by: