A NeuGroup survey shows SOFR is the replacement rate for most banks, and many accounting systems aren’t yet ready.

The opportunity to give feedback on a plan announced in December to allow legacy USD Libor contracts to stretch to June 30, 2023—18 months beyond the initial deadline—ended Monday. Almost everyone expects Libor’s administrator to make it official and is planning accordingly.

- At a recent meeting of the Bank Treasurers’ Peer Group, NeuGroup members reviewed the results of a survey on their plans for the transition away from Libor.

- The survey showed that most members (62%) said their bank is most likely to use SOFR in place of Libor, while 28% expect to use a mix of rates.

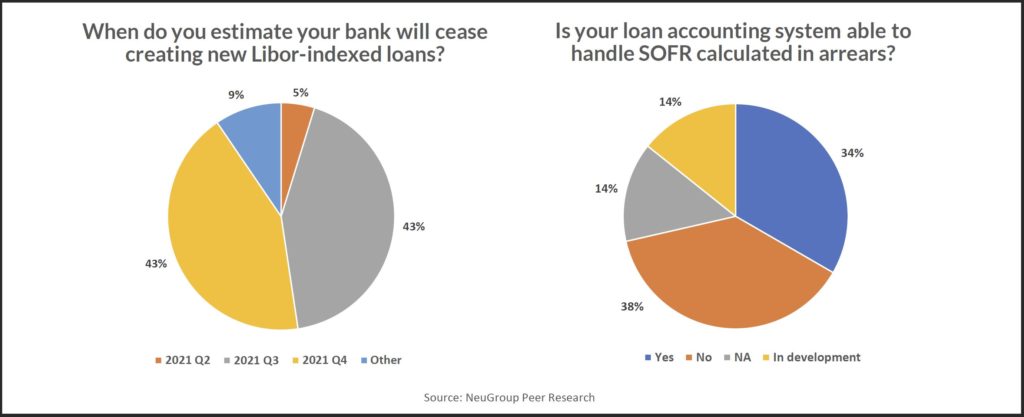

- On the key question of when the banks will stop originating loans priced off of Libor, none of the respondents said they’ll cease this quarter. As the first pie chart below shows, 86% of the banks will cut the cord in the second half of 2021, split evenly between the third and fourth quarters.

The calculation conundrum. The second pie chart reveals that only one-third (34%) of the banks responding said their loan accounting systems are currently able to handle SOFR calculated in arrears. System readiness for the transition is among the the most challenging issues facing both banks and corporates.

How to bill customers? The final question of the survey asked treasurers how their banks plan to bill customers for loans set in arrears. Here are excerpts from some of the written responses, edited for length and clarity.

- “The bank will send an interest bill about two weeks before the payment date, with an estimated amount due using the last daily reset variable rate, plus a credit spread for an estimated interest rate. Any difference between the interest actually accrued and paid (based on the estimate) will be adjusted in the next period.”

- “We plan to give them an estimated amount assuming flat rates mid-month, then bill them in arrears using actual rates. This will at least give them a ballpark estimate of what to expect.”

- “By using an outsourced solution until vendor readiness is reached.”

- “We are hoping that a forward SOFR rate develops and is widely accepted.”