Treasury leaders at the two companies urge peers to aim high in providing meaningful opportunities to diversity firms.

In the last several years, treasury team leaders at NeuGroup member companies Verizon and Amazon have stood out for their determination to provide meaningful opportunities and fee income in capital markets transactions to banks and brokerage firms with women, Black, Latino and veteran owners. These members have also been outspoken about how their actions in this sphere of influence align with wider corporate goals.

- A recent session at the first half peer group meeting of NeuGroup for Mega-Cap Treasurers made clear that these leaders remain committed to promoting diversity as they encourage other companies to follow their example in giving smaller, diverse-owned firms significant roles in transactions—along with rising shares of the fee “wallets” managed by treasury.

- Amazon treasurer Tony Masone said treasury’s support of diverse-owned firms “is an extension of what our values are at Amazon today,” adding, “my mission is to help create finance opportunities for someone that might not be able to get those opportunities.”

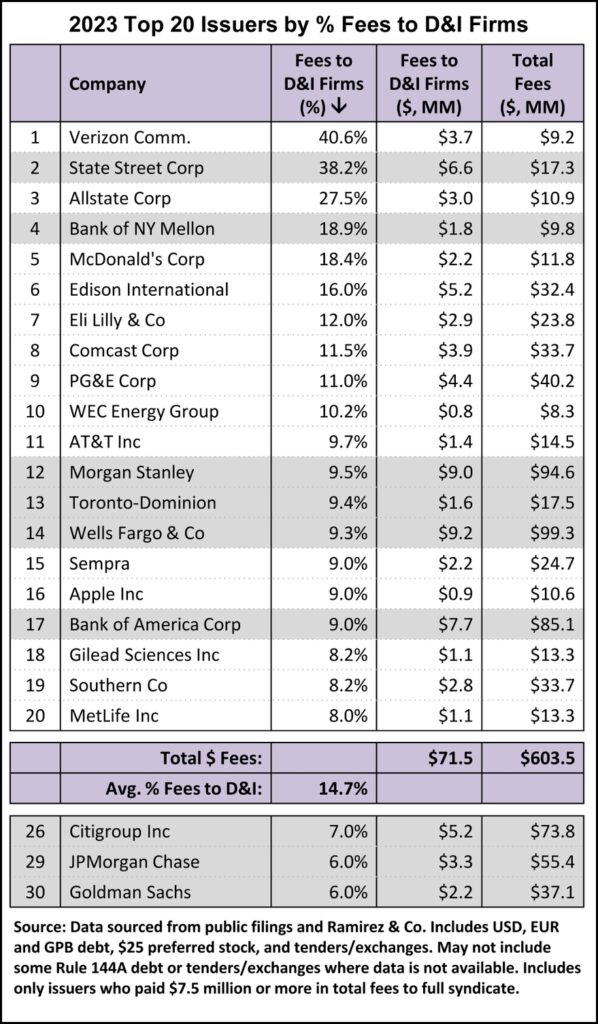

Fees and beyond. At the group’s meeting in New York, Mr. Masone and Verizon assistant treasurer Ron Simon discussed their views as well as data that included the top 20 debt issuers ranked by the percentage of fees paid to diverse-owned firms in 2023 (see table below). The shaded fields show banks.

- The fee table is an update of one, also provided by Ramirez & Co., shown to peers by Verizon treasurer Scott Krohn two years ago and featured in NeuGroup Insights. As Mr. Krohn emphasized in 2022, Verizon’s goal of helping diverse-owned firms grow goes well beyond cutting checks and includes allocating them bonds in deals that will help build their distribution franchises.

- “There’s a call to action, with a role to play in providing a meaningful opportunity for D&I firms whether you’re an issuer, large bank or fixed income investor,” he said.

Progressive assignments. Mr. Simon explained that Verizon initially included diverse-owned firms in bond deals as co-managers that receive fees and in some cases are allocated bonds. That gives a corporate a chance to evaluate the firm and its distribution capability. Flash-forward several years and Verizon today is using some firms as joint book runners that earn fees equal to big Wall Street firms in some deals, including two recent green bond issuances by Verizon.

- “Those that have a chance to be joint leads in a deal get a chance to expand their network and show that they’re able to more than competently handle these deals,” he said. And the firms help the corporate broaden its investor base by bringing in small or medium-sized fund managers. “Helping the DEI firms expand becomes the gift that keeps on giving.”

Beyond bonds. Amazon today uses 12-diverse-owned firms for a variety of transactions, including bond underwriting, commercial paper issuance, share buybacks and investment management. (The company did not issue debt in 2023; in 2022, it ranked No. 8 on the debt issuance fee list, with 15.4% of total fees paid to diverse-owned firms.)

- Other ways corporates use diverse-owned firms include liability management, asset-backed securitization programs and investments for pension plans.

- One member whose company doesn’t often issue debt also mentioned supply chain finance programs that provide funding allowing corporates to make early payments to suppliers, including businesses owned by minorities. “There are other avenues,” he said.