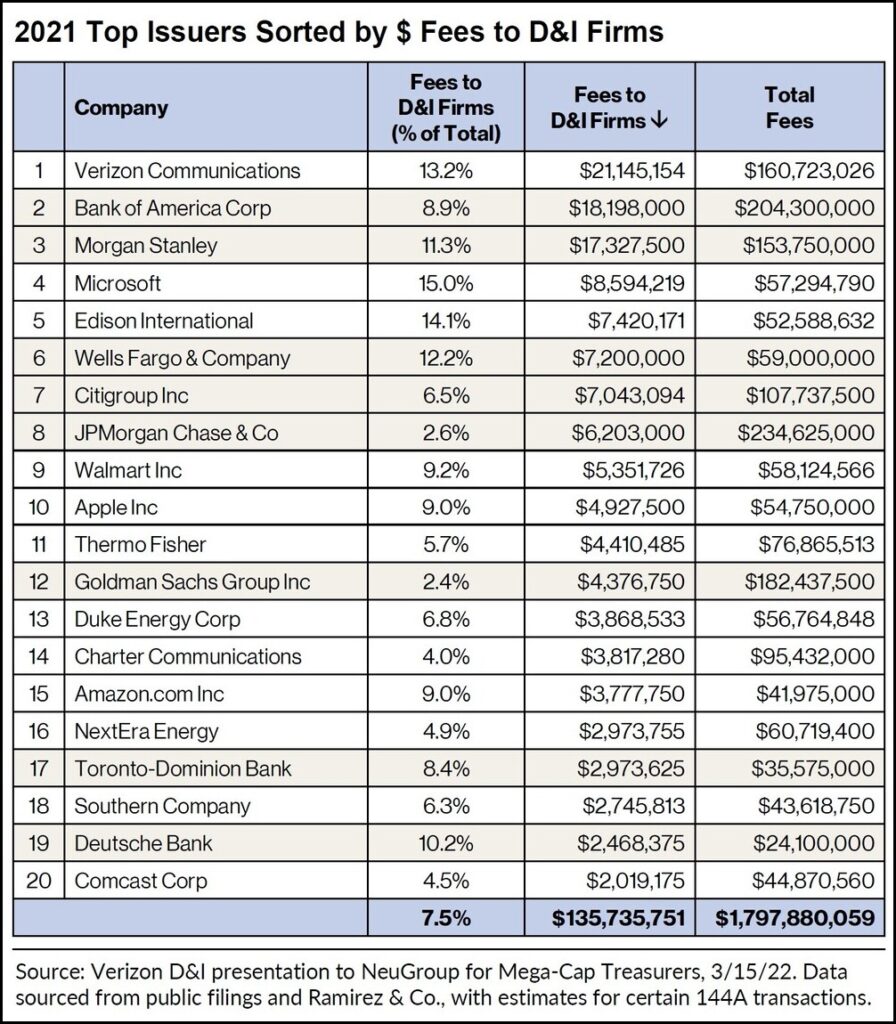

Aggregated data shows which IG bond issuers paid diversity firms the most in dollars and as a percentage of total fees.

Verizon treasurer Scott Krohn this week presented data to his peers in NeuGroup for Mega-Cap Treasurers showing the top 20 issuers of investment grade (IG) debt ranked by the fees they paid in 2021 to banks and brokerage firms owned by women, Blacks, Latinos and veterans—so-called diversity and inclusion or D&I firms. Verizon is a recognized leader among corporates that have committed to giving more business to D&I firms in the past several years. More importantly, Verizon and some other companies are giving the firms more meaningful roles, including in green bond deals where Verizon has elevated some D&I banks from being co-managers to serving as active joint book runners.

- The fee data was part of a larger presentation by Mr. Krohn that offered Verizon’s perspective on corporate issuers and D&I engagement and the company’s strategy of “investing for growth” as well as “differentiated economics” when selecting, engaging and paying D&I firms. Other data presented showed racial diversity at Wall Street firms; the representation of new corporate board directors who are women and ethnic minorities; Verizon’s green bond syndicate structures; D&I dealer equity capitalization and head count levels and trends.

Reading the rankings. The companies in the table below are ranked by the amount they paid D&I firms; the first column of numbers shows the figure as a percentage of the total fees the companies paid for IG debt deals. In terms of leaning into meaningful economics, “all we really control from year to year in terms of policy and approach is the percentage, given varying issuance amounts and needs,” Mr. Krohn said. Verizon ranked No. 1 in dollar amount ($21.1 billion); by percentage of total fees (13.2%), it ranked third, behind Microsoft (15%) and Edison International (14.1%).

- The shaded fields show banks—which took five of the top 10 spots. “The banks have started to walk the talk in certain cases,” Mr. Krohn said. He noted that Verizon pays close attention to where banks rank in percentage of fees paid to D&I firms when selecting lead managers for its green bond deals, as the company has added underwriter selection criteria focused on sustainability and diversity commitments to its green financing framework.

Context. Mr. Krohn noted that while the supply of investment grade debt in the primary market fell by about 18% in 2021 from 2020, the D&I fees paid by the top 20 issuers in 2021 exceeded 2020 fees by nearly 20%. “That highlights the overall market’s higher prioritization of engaging with D&I firms as part of broader social responsibility goals,” he said.

- “Not shown in the table are the tremendous strides D&I firms are making to distribute bonds,” Mr. Krohn added. “It goes beyond cutting a check for D&I firms to grow. While increasing their capital base is important, so is the ability to enhance their distribution franchise to place bonds with investors. And there’s a call to action, with a role to play in providing a meaningful opportunity for D&I firms whether you’re an issuer, large bank or fixed income investor.”

The art of the possible. In discussing the value of showing data comparing the allocation of fees corporates pay to D&I firms, Mr. Krohn said, “One of the things we wanted to accomplish in this presentation and with this data is to help people understand what the art of the possible is. And for those that haven’t yet made a change but may be interested in making a change, we hope this data is helpful.”

- With regard to bulge bracket banks, he added, “Part of my hope is that there are more of us that draw conclusions on who’s walking the talk, and that we demand more from our partners in the capital markets.”