An FX risk manager changed exposure ID systems and implemented the new solution in just three months.

Changing horses in midstream is never easy, but sometimes it’s the right move. One FX risk manager who did it explained to members of NeuGroup for Foreign Exchange the benefits of jumping off his existing exposure identification system and hopping onto AtlasFX—in an extremely compressed timeline of three months.

- The time and effort spent making the switch under pressure paid off big-time. “We now have our dream state,” he said at a March meeting sponsored by Standard Chartered.

- The new solution has boosted the company’s exposure accuracy, leaving the FX team more time for “value-add” activities, he said. Changing vendors also resulted in significant cost savings.

- The member started his presentation by thanking peers at two companies he called “early AtlasFX explorers.”

Quick pivot. One day last year, the member told AtlasFX that he needed to stick with his company’s existing exposure ID vendor for at least another year.

- The next day, for various reasons, he reversed course, set up a meeting with AtlasFX and explained exactly what he wanted, after the company asked him to describe his ideal state.

- About five days later, the member told AtlasFX that he was all in. Key to the decision was having confidence in the AtlasFX team’s ability to deliver the dream state and “confidence they could pull this off in three months,” the member said.

- He had to make a go-no-go decision immediately or would have to renew the contract with the existing vendor.

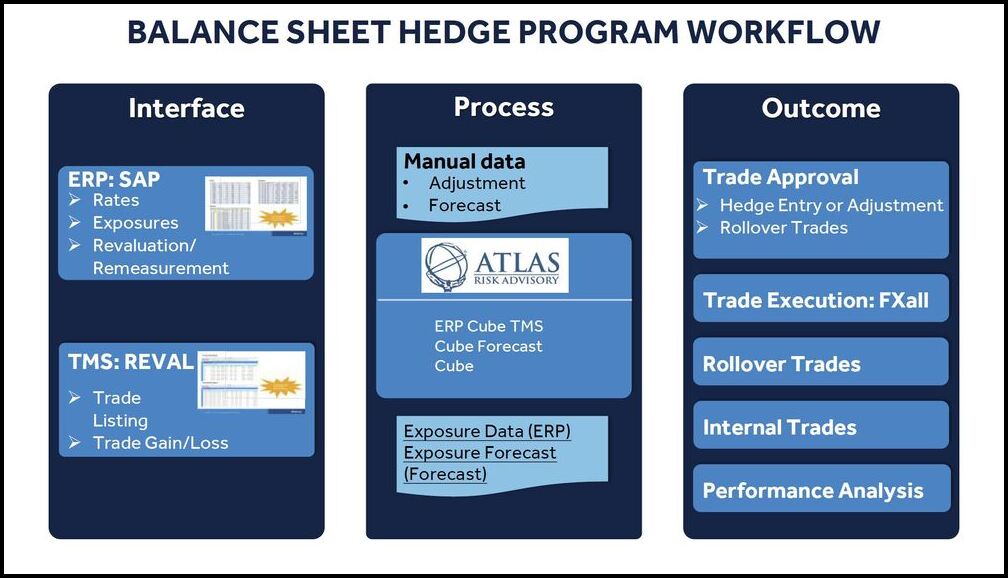

Making the dream real. His dream included opening up AtlasFX to see foreign exchange exposure data from his ERP, SAP, and current hedges from his TMS, Reval. And he wanted the ability to click a button to approve and move trade actions to his trading platform, FXall.

- Further, after trade execution, he wanted the info straight-through processed to both Reval (to book external trades) and AtlasFX, where intercompany trades would be automatically generated and sent to Reval.

- “To pull it off, there needed to be connectivity between all systems,” he said. “SAP, AtlasFX, Reval and FXall—and a new, novel connection between AtlasFX and Reval to automate back-to-back hedging at FXall trade rates.”

- AtlasFX made it all happen, giving the member the ability to execute the company’s balance sheet hedge program (see chart below) the way he envisioned.

- “I honestly thought that dream would be impossible to achieve,” he said.

- He said the extent of the exposure discovery and automation the FX team has with AtlasFX was not possible with the previous vendor.

- The solution AtlasFX devised to solve the member’s connectivity and automation issues can now be used by other corporates that use the same ERP, trading platform and TMS, he added.

Domain expertise. The member’s presentation listed several other reasons his company decided on AtlasFX, including “domain expertise provided routinely throughout implementation.” He noted that the fintech’s founders have experience as treasury practitioners, and said its representatives “are risk managers like us, they speak the language.”

- The reps, he added, “learn a company’s process when implementing the solution.” This paid off when the AtlasFX team suggested a simplification of the company’s settlement strategy for derivatives, helping the FX team better “distribute our workload,” he said.

Exposure determination technology. The member said AtlasFX has so-called query software that “adapts to changes immediately” in the company’s general ledger, saving hours of maintenance time each month compared to what was required before.

- He said delays in making this type of change can mean treasury misses exposures, potentially resulting in insufficient or incorrect hedges.

- While exposure determination is faster using AtlasFX, setting up the automation, interfaces and workflows making that speed possible “was definitely more complex,” the member said.

- “That took some deep thinking and partnership between fintech vendors, and we had to involve our IT team for the connection to SAP data.”

Performance analysis. Using its previous vendor’s solution, the company was not able to successfully configure end-of-month hedging analysis to determine how well its hedges performed relative to actual accounting losses and expectations. “With our prior vendor, we were only able to get 25% of the process working,” the member said.

- He said that with AtlasFX, 80% of the process was working within a month. His presentation read, “AtlasFX: In process of configuring and testing—we will get there!”