US Bank on where credit markets have been, are now, and what (we hope) lies ahead: recovery and relaxation.

NeuGroup held a virtual meeting last week where members who work in treasury at major retailers heard a presentation on bond and loan markets from US Bank and discussed other topics of interest during this period of uncertainty, volatility and disruption. Here are some key takeaways as distilled by Joseph Neu, beginning with insights from US Bank.

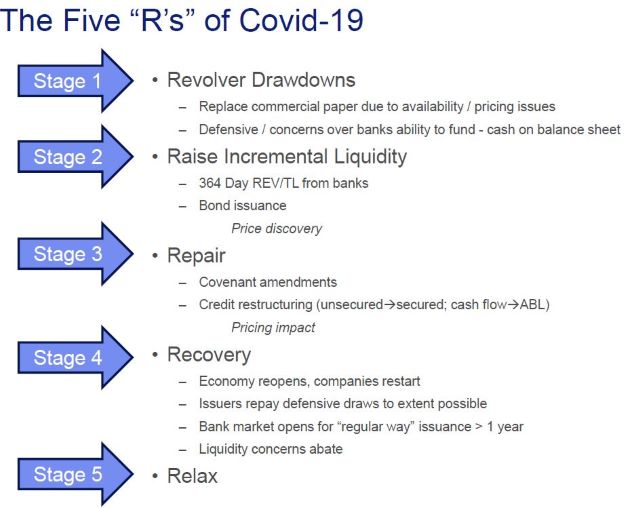

- The five R’s of COVID-19. US Bank described five stages of the debt and loan market’s progression in the wake of the coronavirus pandemic (see graphic). The funding market has moved through stage 1—revolver drawdowns—and stage 2—raise incremental liquidity—and is now in stage 3, repair, with covenant amendments and credit restructuring (to secured and asset-backed lending) with repricing along with that. Stage 4 brings recovery with the economy reopening, repayment of drawn lines and the bank market reopening for “regular-way” issuance extending beyond 364-days. Stage 5 is when we can all relax again.

- Confirmation that accordions and incremental borrowing past a year are out. There was also confirmation that until the economy reopens (stage 4), banks will not offer anything but incremental short-term facilities priced above current revolver pricing (e.g., Libor + 225 basis points). The economics are best when done in conjunction with a bond deal and where revolvers remain undrawn. Lesser credits and smaller corporates may see Libor floors between .5% and 1%.

- Debt issuance continues down the credit spectrum. Ongoing Federal Reserve efforts to bolster the credit markets—namely the primary and secondary corporate credit facilities—are helping to narrow credit spreads in the bond market. The expansion to include high-yield debt is helping the lower end of the investment grade market, too. The issuance trend will likely continue into fallen angels and convertibles as a result.

- Essentials vs. non-essentials. Credit risk perception in both the bond and bank loan market is bifurcated by ratings as well as essential vs. non-essential businesses, with companies in the latter group also seeing their ratings downgraded on higher perceived credit risk. This expectation also helps explains why most of the draws were in the BBB space.

- Some banks not participating in new lending. While the appetite for incremental lending varies based on the bank’s position in a company’s bank group, and there is more client selection going on than usual (with downsizing), some banks are not offering any more balance sheet at all. And foreign banks that cannot take US deposits are also reluctant to lend.

Member Insight

- Prime funds same risk as government funds? One member asked where to put cash drawn from the revolving credit facility (or raised in the CP market). Peers said they are doing the regular counterparty risk checks on banks (CDS prices are rising, but still below 2008 levels). One member said he would share analysis his team is doing to test the hypothesis that, with all the Fed backstops, government-MMF risk and prime-fund risk may actually be pretty close, so why not take the extra yield offered by prime funds?

- Credit card processor best practice. One member in a different group had been hit by a significant reserve request by BAMS; no one in the retail group has experienced that. This prompted an insight on processor best practice: Use multiple processors (three to five of the top ones) so you can shift volume when one does something to upset you; plus you can allocate based on stores (subsets of stores) and e-commerce.

- China store update. One member shared that they are reopening stores in China by following the SARS 2003 playbook, which then saw getting back to normal taking five to six months. On a positive note, the current experience is tracking slightly ahead of that.